August 8th, 2019

41 property managers tell us their favourite PropertyMe feature

PropertyMe

Property Management

An analysis of Australian Taxation Office (ATO) data revealed that real estate agents claim an annual average of $8,634 in real estate tax deductions. This is triple the national average of $3,413 and ten times that of shop assistants.

As a real estate agent, there are obvious deductions for work-related travel, advertising, mobile phone, licencing and home office expenses. However, there are many more deductions that are commonly overlooked. To help maximise your tax return, we’ve compiled a list of the top 12 forgotten ATO real estate tax deductions:

If you’re an agent or property manager who is entitled to earn a commission, you can claim a deduction for gifts and greeting cards that you’ve purchased for work purposes i.e. for your tenants, owners and suppliers.

These gifts may include hampers, bottles of wine and whisky, gift vouchers, perfume, flowers and pen sets. You cannot claim entertainment gifts such as tickets to the theatre, movies, plays, sporting events, amusement centres or holiday vouchers.

If you’ve spent money getting a property ready for an open home and haven’t been reimbursed by your employer, you can claim a deduction on property presentation costs. This includes costs associated with cleaning the property and the purchase of decorative elements such as flowers and plants.

Similarly, you can claim a real estate tax deduction for your advertising costs, but only if you’re an agent or property manager who is entitled to earn a commission and you haven’t already been reimbursed by your employer. This includes costs associated with advertising through newspapers, letterbox drops, signage and bunting.

As a real estate agent, you can claim a deduction on the work-related portion of any marketing equipment which was used or purchased in the last financial year. This includes drones, professional cameras and virtual reality goggles that are used for work as well as any repair costs associated with those items.

If you spent $300 or less on a piece of marketing equipment and you used it for work only, you can claim the full cost of the item. However, if the item was more than $300, you can claim a depreciation deduction.

Did you use a registered tax agent or online service such as Etax.com.au to prepare and lodge your tax return last year?

If so, you can claim on the fees that you paid in section D10 (cost of managing tax affairs) of your tax return. Additionally, if you met with a recognised tax advisor, you can claim on the fees charged and the associated travel expenses.

You can claim a deduction on your handbag, satchel or briefcase if you use it to carry work-related items such as laptops, iPads, documents and stationery to and from work. However, it must be used primarily for work and should be a reasonable amount of your business revenue.

If you use your handbag, satchel or briefcase outside of work, the ATO recommends you keep a log of when you use it privately versus when you use it professionally. Come tax time, this will help you calculate the portion which is tax deductible.

Self-education is often overlooked when it comes to real estate tax deductions. If you’re studying a work-related course that leads to formal qualification, you can deduct a portion of the course fees.

The ATO states that the course must “maintain or improve specific skills or knowledge you require in your current employment”. This means you can take a course on marketing to learn how to grow your rent roll or enrol in a real estate photography class. As long as you can prove that the training will help you expand your real estate business or career, it’s likely you can claim it.

One of the most commonly forgotten real estate tax deductions is subscriptions to industry publications and newspapers. As a rule of thumb, the content of the subscriptions must be connected to the duties carried out by you as a real estate agent. For example, you can claim on real estate publications like Elite Agent, Your Investment Property, AFR Weekend or newspapers that have property sections.

However, if the property section of the newspaper only appears in the Monday, Wednesday and Friday issues, you can only claim a tax deduction for those issues rather than for the entire subscription.

If you’re required to wear clothing that is unique and distinctive to your real estate office, you can claim on the purchase and upkeep of those items of clothing. This might include blouses, pants, shirts, jumpers, dresses and skirts that have your office’s logo on them or even distinctive shoes, socks and stockings that are specified in your office’s uniform policy.

To claim a deduction, you must provide written evidence of your clothing purchases and laundry and dry cleaning expenses. It’s also likely that you’re able to claim mending and alteration costs for those items of clothing.

If you’ve donated $2 or more to an approved organisation or registered political party in the last financial year, you may be able to claim it as a tax deduction. Your donation receipt should indicate whether or not it’s tax deductible. Additionally, you can claim a deduction if you’ve made a net contribution of more than $150 to an approved organisation for a fundraising event.

Note that you cannot claim a deduction for a donation if you’ve received something in return. For example, if you received raffle tickets or novelty items in exchange for a donation.

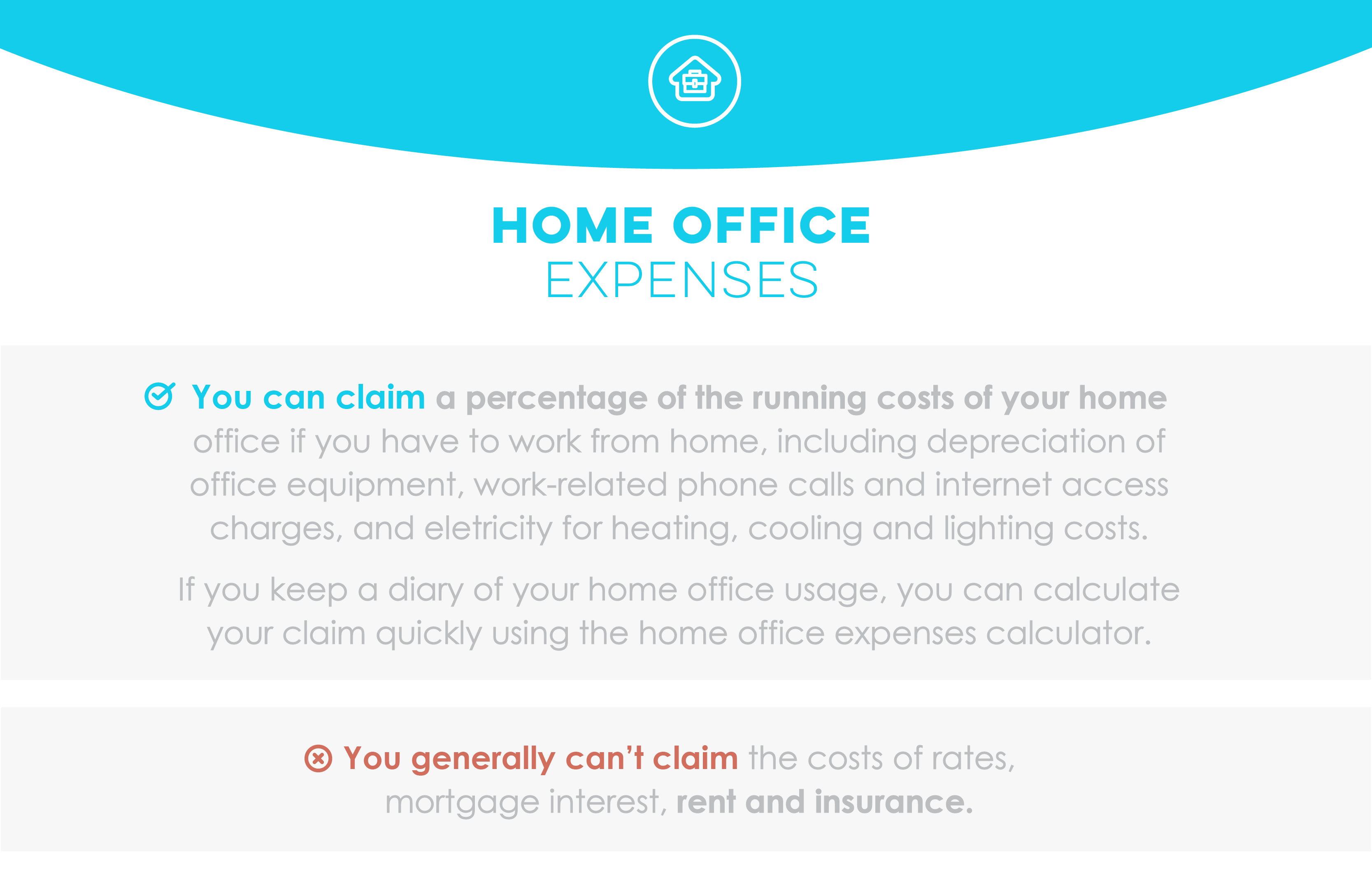

If you work from home (WFH), you may be able to claim a percentage of the running costs of your home office. This includes things such as:

Similar to purchasing marketing equipment, if you purchased any home office equipment or furniture for work purposes, you can claim a deduction. If your equipment costs more than $300, you can claim a depreciation deduction.

Many companies around the world rolled out work from home policies at the beginning of March in response to the COVID-19 pandemic. If this applies to you, you can claim a deduction for your work from home expenses during tax time.

To help you out, the Australian Government issued an expenses calculator to make this process easier. The temporary shortcut method allows Australians who worked from home during the period of 1 March 2020 to 30 June 2020 to claim a deduction of 80 cents for each hour worked from home, with minimal record keep requirements. Note that those who use this method cannot claim any other expenses for working from home.

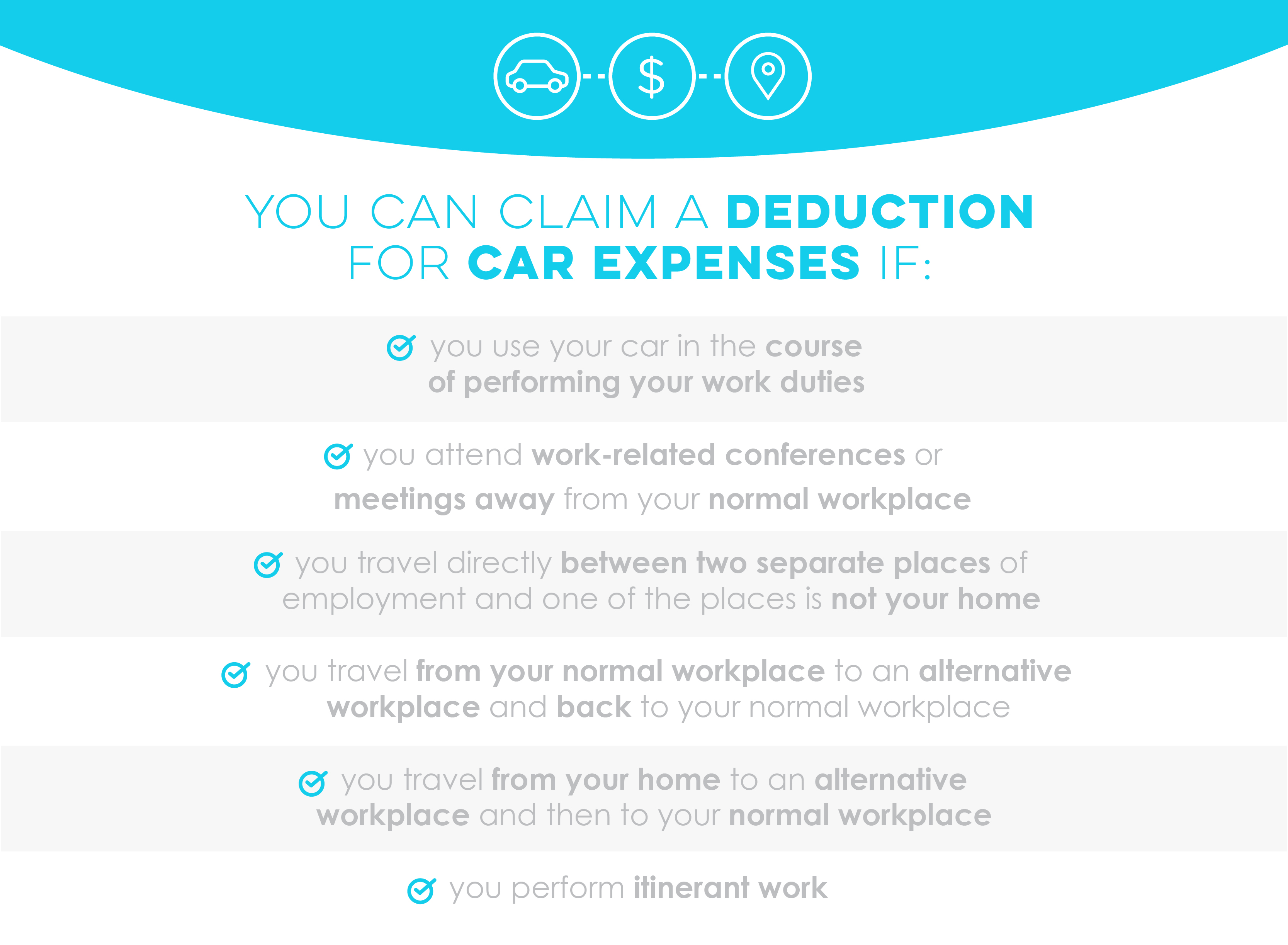

If you use your own car for work purposes, there are a few expenses that you can possibly claim for:

You can choose between a logbook method (example below) or a cents per kilometre method to calculate your deductions. You can also use the myDeductions app to keep track of pending deductions.

The cents per kilometre method uses a single rate, being 68 cents per kilometre and you can claim a maximum of 5,000 kilometres per car. Whereas the logbook method is based on the business-use percentage of the expenses for the car. Meaning that you would need to keep written evidence of the business use of your car.

The top 12 forgotten ATO real estate tax deductions are:

Be sure to check the ATO for a complete list of general tax deductions and more specifically, real estate tax deductions.

Hopefully this blog post on forgotten ATO real estate tax deductions has helped you maximise your tax return. You might also be interested in:

PropertyMe is Australia’s largest and most complete cloud property management software. Book a free demo to see why thousands of property managers have switched or learn more about how PropertyMe is different.

Please note that this blog post has been prepared for informational purposes only. PropertyMe does not provide tax advice; be sure to consult your tax advisor before engaging in any transaction.

Let us know your thoughts on the top 12 commonly forgotten ATO real estate tax deductions by emailing [email protected].