January 14th, 2026

Trust accounting in Australian property management: a practical guide for agencies

Property Management

PropertyMe

Payments in PropertyMe are stepping up in 2026!

With the launch of DirectPay and ClassicPay, MePay now offers more flexible, automated ways for money to move across your rent roll.

The result is faster payments, less admin for agencies and a better experience for tenants and owners alike.

DirectPay is a fast payments option that flows money direct to owners and suppliers. It’s a modern alternative to trust-based payments, meaning agencies don’t need to run their own trust account to collect rent, pay bills or disburse funds.

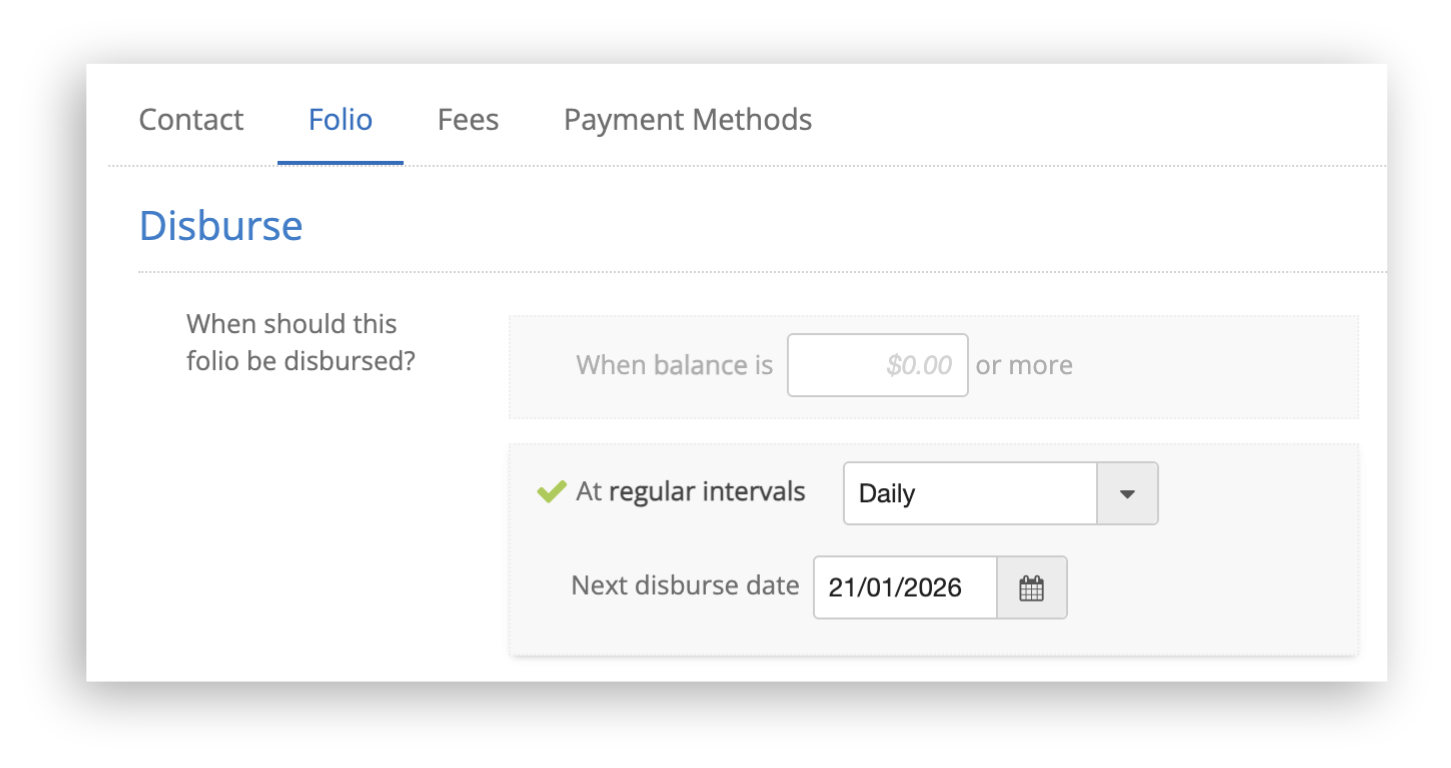

Built into PropertyMe, payments are handled automatically from start to finish. With DirectPay, agencies can choose how often owners are paid, including daily disbursements, and manage this per owner. Rent doesn’t sit around waiting. It can be paid through without adding extra work for your team.

1. Rent comes in more reliably

Using PayTo or PayID, tenants have fast, fee-free ways to pay that make on-time payments easier and help reduce arrears.

2. Faster owner payments

Rent flows through as it’s received with daily disbursements, so owners see their money sooner. Faster payouts improve cash flow for owners and remove pressure from your team.

3. Payments run themselves

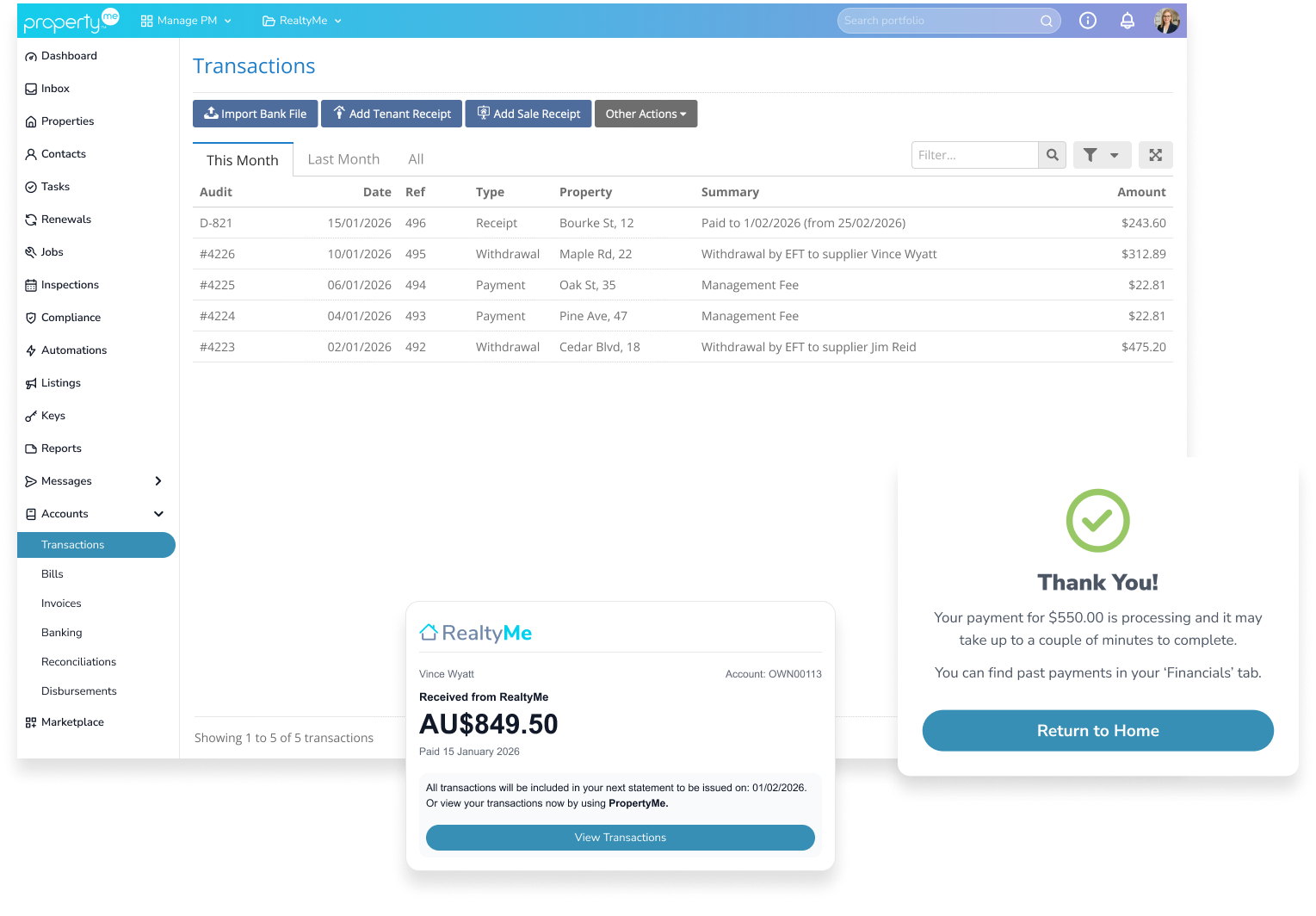

DirectPay takes care of the entire payment flow in the background. Once rent is paid, bills are processed and money is distributed automatically. There’s no importing bank files, no manual disbursement runs and no reconciliation clean-up.

4. Clear visibility at every step

Every step is visible as money moves from tenant payment through to owner payout. Remittance emails are sent when funds are disbursed and monthly owner statements are generated automatically, including $0.00 statements.

ClassicPay is a faster way to take tenant payments while keeping your trust account in how you work. It’s built for agencies that want rent to clear sooner, without changing their existing trust processes.

Payments are transferred straight into your trust account as they’re received. From there, everything works the way it always has. The difference is that the money comes through sooner and there’s a lot less work to get it receipted.

1. Rent shows up sooner

Payments clear faster than traditional direct debit, which can still take a few business days.

2. Your trust process doesn’t change

Funds go straight into your trust account, so you’re still in control of when and how money is paid out. You don’t have to rethink your setup to get the speed benefit.

3. Receipting done in a click

Once the money’s in, receipting is simple and takes just one click. There’s no importing files or extra steps just to keep things tidy.

4. You can still see everything clearly

You keep the visibility and record-keeping that comes with trust accounting, with transactions that are easy to follow and check.

Both DirectPay and ClassicPay deliver fast payments through Australia’s New Payments Platform. The difference is what happens after rent is paid.

Choose DirectPay if you want:

Choose ClassicPay if you want:

In short, DirectPay is built for agencies ready to move to a direct-to-owner model with minimal manual work. ClassicPay is for agencies that want faster payments while keeping trust accounting at the centre of their process.

Whether you choose DirectPay or ClassicPay, tenants get access to faster, simpler ways to pay rent and invoices. They can self-service everything in one place, right inside the PropertyMe app or Client Access.

Recurring rent payments – Tenants can set up recurring payments using PayTo with their bank account or PayID and choose a schedule that suits them.

In-app manual payments – Tenants can make one-off payments directly in the app, without logging into their banking platform.

Pay via MePay PayID – Tenants can pay manually from their bank app using the MePay PayID. Simple and familiar.

Faster payments, less admin and a better experience for everyone. That’s what DirectPay and ClassicPay deliver.

To see how our latest payment features work, you can book a feature training session.

Not yet using PropertyMe? Book a demo today to see why one in two Property Managers across Australia and New Zealand trust us to do their jobs every day.

——————

Please note: MePay is only available to Australian real estate agents.

Disclaimer:

This content relates to the MePay payment product and has been prepared by MePay Holdings Pty Ltd (ABN 55 638 819 575 / AFSL no 528836) (MePay Holdings). Any financial services provided in relation to MePay (including the issue of MePay) are provided by MePay Holdings. To the extent any information provided to you in this content constitutes financial product advice, such advice is general advice only and has been prepared without taking into consideration your objectives, financial situation or needs. You should consider your needs prior to acting on any advice or making any financial decisions and seek independent financial advice regarding your own personal circumstances. Cooling-off rights do not apply to MePay. A product disclosure statement (PDS) has been issued by MePay Holdings for MePay and is available at https://www.propertyme.com.au/mepay/documents. The PDS explains the features, risks and benefits of the service and you should consider it in deciding whether to use the product.