MePay solutions

| Feature | DirectPay | ClassicPay | Direct debit |

|---|---|---|---|

| Platform speed | Next day* | Next day* | Standard bank clearing |

| Platform | New Payments Platform (NPP) | New Payments Platform (NPP) | Direct Debit network via Macquarie Bank |

| Trust account processing | No agency trust account required | Yes | Yes |

| Owner disbursements | Automatic daily disbursements | Scheduled trust payments eg. EOM | Scheduled trust payments eg. EOM |

| Receipting & reconciliation | Fully automated | One-click receipting | One-click receipting |

| Instant visibility in PropertyMe | Yes | Yes | Yes (noted as pending) |

| Cost to agencies | An extra $1 plus GST per property (in blocks of 100) | An extra $1 plus GST per property (in blocks of 100) | Free |

| Cost to tenants & landlords | Free | Free | Free |

*Depending on the time of day transferred.

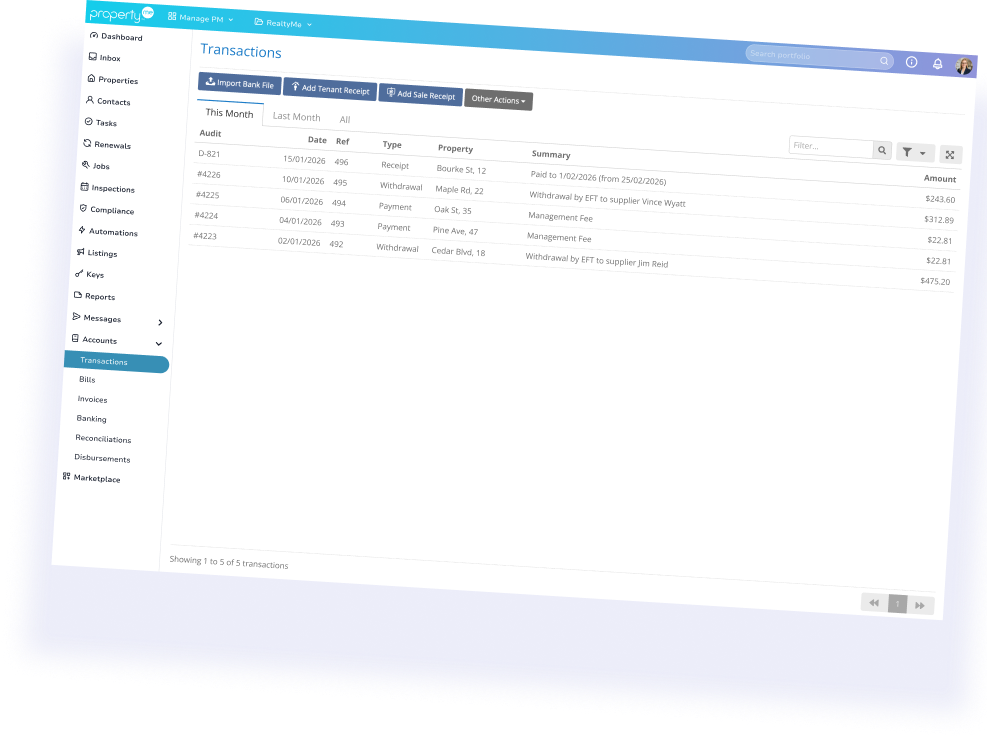

Built into PropertyMe.

Backed by bank-grade security.

MePay isn’t a third-party add-on or external payment tool. It’s native to the PropertyMe platform, meaning payment data flows directly into the right ledgers, reports and owner statements without duplication or manual handling.

Tenants self-administer their details via the PropertyMe app and can select regular or once-off payments.

A flexible rental payment platform that grows with your agency

MePay gives Property Managers choice, speed and confidence… without adding complexity.

Whether you’re focused on fast rental payments or traditional trust accounting or a mix of both, MePay lets you deliver a smoother payment experience for tenants and faster outcomes for landlords.

Accessible for you and your tenants

Our new feature is included in your PropertyMe subscription, regardless of which plan you are on. Additionally, MePay Direct Debit is free to use for your tenants! Currently, all third-party payment platforms charge a fee at some point, even direct deposits have fees for excess transitions. With MePay, everyone wins.

Stay ahead with real-time updates

MePay records payments in real-time with no importing of transaction files or next-day receipt matching to be done. This gives you full visibility on what has been paid in real-time — never chase arrears that have been paid again.

Fully integrated and easy to use

MePay is fully integrated throughout the PropertyMe platform, streamlining the experience for you, your team and your tenants.

Agents + Co find MePay

to be a game changer

Driven to be at the forefront of her industry, Eleni Romanous understands the impact of using technology to enhance her customers’ experiences. Find out how the team from Agents + Co use MePay to improve their property management processes.

Read Case StudyFrequently asked

questions about MePay

What is MePay?

MePay is PropertyMe’s integrated rental payment system, allowing agencies to collect rent and process payments directly inside the platform using DirectPay, ClassicPay or Direct Debit.

Is MePay free to use?

MePay Direct Debit is free for agencies, landlords and tenants.

Can agencies choose which payment options to offer?

Yes. Agencies can tailor MePay to suit their business model, choosing payment options depending on landlord and tenant needs.

How fast are rental payments with MePay?

Payment speed depends on the method used. DirectPay gets money moving next day, ClassicPay accelerates trust account payments and Direct Debit clears through normal banking timeframes while still giving you immediate visibility.

Are MePay payments secure?

Yes. MePay is built into PropertyMe, providing bank-grade security and strong audit trails for all rental payments.

Does MePay support Australian trust accounting requirements?

Yes. MePay is made for Australian residential Property Managers and supports the trust accounting and reporting rules they work with every day.