December 8th, 2022

Switch on Arrears Automation to switch off over the break

Property Management

Property Management

Navigating the landscape of payment platforms can be a challenging task, given the numerous opinions available from third-party payment providers with high fees to trust-free platforms. To help you find the best solution that works with your property management systems, we have compiled a list of frequently asked questions, from our experience.

In real estate, trust accounts are authorised accounts to receive money on behalf of another person. For example, rental payments received on behalf of landlords.

Although laws vary per state, there are stricter laws governing the operation of real estate trust accounts, including an essential audit each year. (NSW Fair Trading).

A system that manages real estate trust transactions, in accordance with the relevant state or territory guidelines. Trust accounting software often forms part of a complete property management system.

With no-trust, trustless or trust-free payment transaction, instead of tenants paying rent into a trust account, they pay rent directly to the landlord via a digital wallet, direct debit or BPAY-style transaction. A portion of this is paid to the managing agency as a management fee. If money is required for bills, this may be charged to an owner as a separate bill, or tenant funds may be held in the digital wallet.

As described by some providers of trust-free property management systems, the benefits of no-trust systems can include:

While trust accounts are audited annually to ensure that the funds being paid to agencies are in line with legislation and agency agreement instructions, this is not typically performed for trust-free accounts.

There are a number of options available for trust account Property Managers, including;

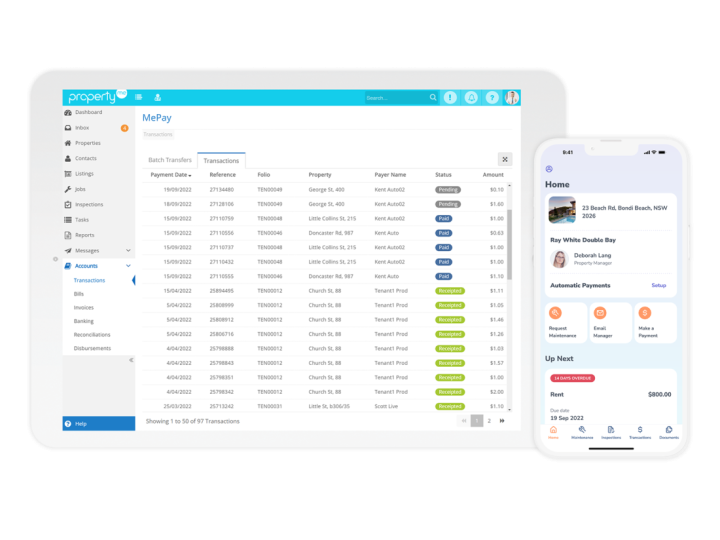

Secure. Transparent. Free.

MePay allows tenants to set up transfers directly from their PropertyMe tenants mobile app and online access, with one-off or scheduled payments. The only product that records payments in real-time reporting with no importing of transaction files or next-day receipt matching to be done.

MePay is embedded within the PropertyMe platform meaning no reference matching or receipting is required, and MePay direct debit is free to use across every PropertyMe subscription.

Third-party payment platforms are offered by a range of companies processing direct debit or one-off transfers of rent payments. The platforms run independently to a property management trust account system and payments may be deposited into a variety of account types.

As the services are independent of property management trust account platforms, they are monetised by fees and charges to tenants, landlords, or agents, varying between each provider. PropertyMe integrates with providers listed here.

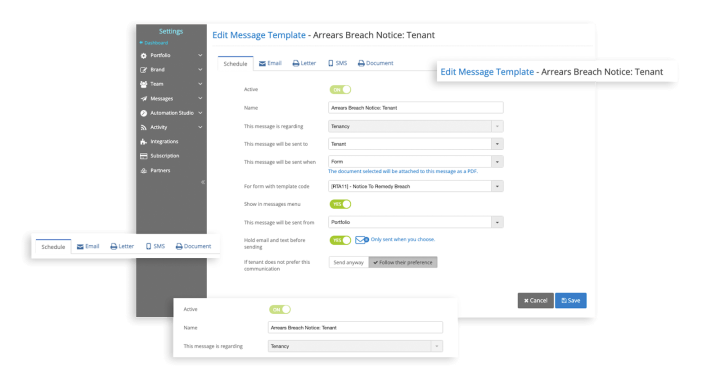

Arrears Automation sends out gentle, and not so gentle, arrears reminders to all relevant tenants at the press of a button. It is available for every PropertyMe plan, including Basic!

With the options of scheduled or flexible arrears automation, you can be in complete control of exactly what gets sent when, with a simple five-minute setup.

It sends exactly what you would be entering manually, without you needing to do the hard work. You can enter the exact wording that you typically type to a tenant into our templates, so from their perspective, nothing has changed!

Arrears Automation can be set to two different modes – flexible or scheduled.

Scheduled

If you select Scheduled, your Automations will run automatically on the day(s) and time(s) you set. As shown below, you can select any day you like and this will run automatically each week, right on schedule! This option is perfect for extra busy Property Managers, or when some of the team are off on leave – it is completely automated. Keep in mind, if you need to run the Automation earlier than your set time you can simply tick the Automation and select ‘Process’.

Flexible

If you select Flexible, your Automations will only run whenever you press the magic ‘Process’ button. This option is perfect for those who are just starting out and would like some extra control over when the Automation is run.For more information, check out our guide on Flexible and Scheduled Automations.

Import transactions

Simply import your transaction files and let PropertyMe do the data entry and balancing for you. Currently we support OFX, BRF, PAY, TXN, QIF, and Westpac PayWay RECall bank file types.

Bank feeds

Transactions are automatically imported directly from your bank and matched to different parts of your PropertyMe portfolio. All you have to do is process the transactions to reconcile your accounts.

Disbursements

Easily process single or bulk disbursements with different payment options for your owners and suppliers.

You can also set up triggers to control when an owner is due to be disbursed. This trigger may be by date or based on the balance in the owners account, or both.

Audit reporting

Store all audit reports and statements and automatically group transactions by calendar month.

Automated fees and Xero integration

Automatically charge a range of fees to your owner including management, letting, and administration.

Bills AI

Enhance your everyday with the power of AI for faster and more accurate Bill processing.

Please reference the relevant state or territory’s website.

Queensland Office of Fair Trading

Disclaimer: the information enclosed is provided for general information only. It should not be taken as constituting professional advice. Information current at time of publishing.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.

This content relates to the MePay payment product and has been prepared by MePay Holdings Pty Ltd (ABN 55 638 819 575 / AFSL no 528836) (MePay Holdings). Any financial services provided in relation to MePay (including the issue of MePay) are provided by MePay Holdings. To the extent any information provided to you in this content constitutes financial product advice, such advice is general advice only and has been prepared without taking into consideration your objectives, financial situation or needs. You should consider your needs prior to acting on any advice or making any financial decisions and seek independent financial advice regarding your own personal circumstances. Cooling-off rights do not apply to MePay. A product disclosure statement (PDS) has been issued by MePay Holdings for MePay and is available at https://propertyme.com.au/mepay/pds. The PDS explains the features, risks and benefits of the service and you should consider it in deciding whether to use the product.