May 31st, 2020

EOFY countdown: Your questions answered

Property Management

Property Management

There are four words that cause every Property Manager to have a visceral reaction…

End. Of. Financial. Year.

But it doesn’t have to be that way.

Preparation is the key to a stress-free end of financial year and we’ve got you sorted with our ultimate guide to end of financial year for Property Managers and trust accountants alike.

According to our friends over at End of Month Angels, there are three things you must do in the lead up to end of financial year:

Errors in your end of financial year statements not only look unprofessional but can cause a headache for your owners when calculating their tax obligations. Not to mention, the mistakes that you’ve made will come back full circle and can impact your reputation.

To mitigate this, be sure to preview your statements and amend any errors or inconsistencies in addresses, expenses and income prior to sending them out. For example, if a landlord has advised that he has paid a bill himself and wants to see that reflected in his summary, you would go in and manually enter that.

Additionally, if you charge a statement fee, you should double-check that you have charged the correct fee. In PropertyMe, you can set a recurring yearly fee for this so that it’s automated each year. Moving forward, these errors should be fixed on a month to month basis rather than annually. This way you can avoid a backlog of mistakes and additional work during end of financial year.

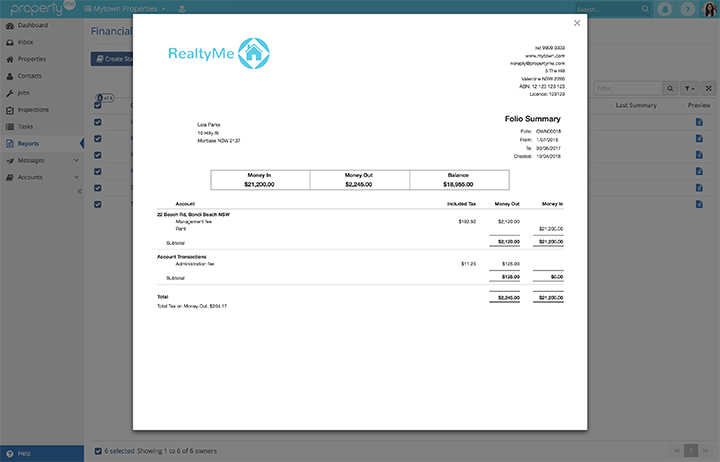

If you’re a PropertyMe user, here’s how to create, preview, edit and send Financial Summary Reports (EOFY statements). Creating Financial Summary Reports for your owners is delightfully simple in PropertyMe. In a few simple steps, you’ll have your reports sorted and sent.

Never, ever leave bank reconciliation to the last minute. Reconciling your accounts is crucial to every property manager’s end of financial year process and failure to do so within the prescribed period can result to trust account breaches.

While each state has slightly different legislation, it is always best to reconcile your accounts daily rather than monthly. This way, you can avoid having mistakes snowball. This will also ensure a smooth audit, allow you to easily spot fraud and mitigate end of month and end of financial year stress.

If you’re using a comprehensive property management software like PropertyMe, daily reconciliation should be a complete breeze. You have no excuse not to do it! PropertyMe has lots of automation around property accounting that allows you to minimise your workload e.g. simply import bank files and PropertyMe will do the balancing for you. Read more on how PropertyMe is different.

If you use a server-based system and don’t back up daily, be prepared to lose a whole day’s (or multiple days) worth of work. Just imagine working on receipting rent, paying bills and disbursing funds, only to have your software crash. Uh-oh. You definitely don’t need that additional stress during end of financial year. Or ever.

You can easily avoid this by upgrading your software to a cloud-based system like PropertyMe that automatically backs up your data to the cloud.

Think of running end of financial year as you would end of month, except with a few additional steps.

Be sure to:

*With PropertyMe, you can preview, edit and create EOFY statements at any time. Plus, everything is continually backed up in the cloud so you can skip those steps!

If you’re looking to upgrade your property management software, book a free demo to see the PropertyMe difference.

If you’re a PropertyMe user, we have a whole collection of EOFY resources in the Knowledge Base to help you out. Click here to download our 10-step EOFY checklist to ensure nothing gets missed.

Hopefully, this ultimate guide to end of financial year for Property Managers has helped you better prepare for and process your end of financial year.