April 18th, 2018

The ultimate guide to EOFY for property managers

Property Management

Property Management

We know EOFY is a busy time for property managers, principals and trust accountants alike. That’s why we’ve assembled a panel of industry experts to answer all your questions in one place in the lead up to EOFY.

Here are all your EOFY questions answered:

1. Belinda Campbell: For EOFY, what do I need to prepare and check beforehand?

There are many great videos and documents on this in the PropertyMe knowledge base. Click on the (?) button at the top right hand corner of your screen and type End of Financial Year. You will get all the information you need here on procedures for producing the EOFY Statements.

The most important thing to check on before EOFY would be that any withholds are removed and owners are disbursed all income from their folio and that any adjustments for unknown deposits have been allocated where possible–sometimes you might need to have your bank do a trace on unknown deposits–we would recommend getting this done as early in the month as possible as it can take some time.

–Tamara and Chloe, Balance Rec n Roll

2. Megan Niven: This will be my first EOFY with PropertyMe. Do you do the EOM and then the EOFY? What is the best day to do them?

If you are providing your owners an EOFY statement based on ‘Transactional date’, then receipting for 30th June will be done on the 1st July to capture the whole of June’s transactions. On Wednesday 1st July close the month as at 30th June and run EOFY statements.

If you are providing your owners an EOFY statement based on ‘Statement date’ then after you disburse your owners on the 26th, 27th, 28th etc. you can go ahead and generate this for them straight away as you won’t be disbursing again and everything you give them has already been captured by their last disbursement.

–Jane Morgan, End of Month Angels

3. Lindy Klein: It’s my first time doing EOFY with PropertyMe. Do you have a cheat sheet or step-by-step EOFY guide?

Yes, we have a 10 step EOFY checklist on the Knowledge Base along with a number of articles and video tutorials to guide you through EOFY. Click on the (?) button on the top right corner of PropertyMe to check it out.

–Steven Vlamis, PropertyMe

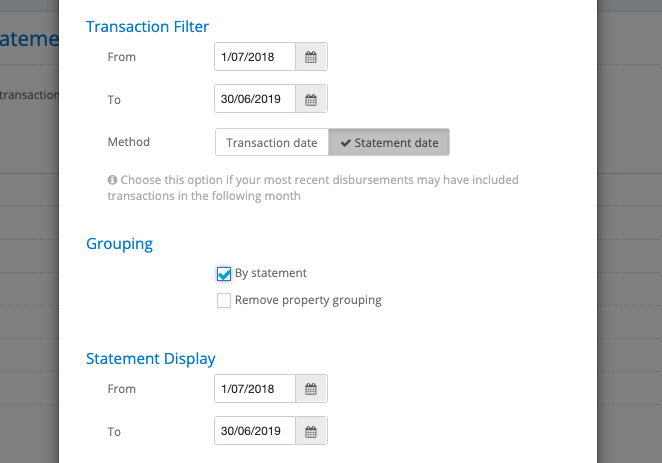

4. Natasha Goodwin: Which EOFY statement option is best and reflects their monthly statements?

There is a great option on the EOFY statements: when setting your options choose ‘Statement date’ also Grouping ‘By Statement’. This summarises each statement that the owner has received this year and lays them out in number order.

–Natalie Hastings, hastings + co

5. Megan Young: How do I issue statements for archived properties?

From the Owner Financial Summary Statement report, enter the date range you are looking to report on. PropertyMe will search for all transactions in that date range including those in archived folios. The list of folios with transactions within your specified range will be listed. Select Create Statements to generate your email messages with statement links. The statement is also listed on the owner access page.

–Amber Rolfe, Complete Real Estate Services

Watch our EOFY Owner Financial Summaries tutorial to learn more about owner financial summaries.

6. Santosh Nune: What sort of training and help is available for EOFY?

We’ve created a comprehensive collection of EOFY resources including articles, checklists, tutorials and training courses on the Knowledge Base to help you out. Click on the (?) button at the top right of PropertyMe to access the Knowledge Base and search EOFY.

–Gavin Brightwell, PropertyMe

7. Brad Minhinnick: How do non-cloud based agencies survive EOFY?

Non-cloud based agencies have to manually generate and print reports to be filed away in a physical file “just in case” and back up their data. This process can be time consuming, unproductive and costly.

–Helen Rolfe, Complete Real Estate Services

8. Michael Perrior: A common question we get asked is, should I run EOFY before, on or after 30 June?

It depends on what state or territory you’re in as legislation differs. It’s best to check with your local Real Estate Institute to find out the exact requirements.

–Peter Vellonio, PropertyMe

9. Liz Hyde: How do you get an EOFY statement in PropertyMe for owners?

You can easily generate single or bulk EOFY statements in PropertyMe using the Owner Financial Summary Statements report. Preview statements as needed then click the Create Statements button to generate email messages with attached statement links. These statements also appear in respective owner access pages.

–Gavin Brightwell, PropertyMe

10. Charlene Amber: What are the requirements and what do I need to do for EOFY?

It’s really important that all money received in the trust up to and including the 30th June is receipted and reconciled so that the owner receives an accurate EOM and EOFY statement. Also for meeting legislative requirements, all of the 30th June transactions must be entered into the correct period.

–Jerome Carpen, End of Month Angels

11. Gavin Brightwell: A common question we get asked is, what is the difference between EOFY and EOM?

EOFY is the time for ensuring all related income and expenses in the past financial year are accounted for to ensure accurate reporting to your owners. Whereas EOM is the procedure of closing the month to ensure you have balanced PropertyMe to your bank statement and generated the required statutory reporting.

–Nicole Johnston, AgentDesk

12. Nicole Mansour: How do I charge an EOFY statement fee when the fees differ from owner to owner?

You would need to create a fee in your fee template in settings as a fixed amount fee. You can select the most common amount and apply the fee template to all. Afterward, you can change the exceptions.

–Tamara and Chloe, Balance Rec n Roll

13. Joanna Vaughan: Just a question with the EOFY statement run in VIC, would we have to disburse all owners and suppliers so all account balances are $0?

As per the NSW reforms as at 23rd March 2020, all landlords must be disbursed at EOM, unless the landlord has provided specific instructions in writing to withhold funds in their account. This is the same requirement for most states across Australia.

It may not be possible to pay all accounts to a NIL balance but you’ll need to provide a legitimate explanation if requested by your auditor or governing body. Now is the perfect opportunity to start working on allocating unidentified deposits and clearing adjustments to a NIL balance.

–Veronique Dimanche, End of Month Angels

14. Cat Bensein: What PropertyMe features make tax time easier for owners?

You can select ‘Statement date’ and grouping ‘By statement’ when you generate EOFY statements. This summarises owner statements and lays them out in number order. Plus, these statements appear in respective owner access pages that your owners can access 24/7.

–Amanda Hall, PropertyMe

15. Steven Vlamis: A common question we get asked is, how do I fix a mistake on my EOFY statement?

If you made an error transacting during the year, you can edit the owner financial summary. First, identify the incorrect transaction, open the Owner Folio, select Reports then Folio Summary, then Edit Financial Summary.

–Tamara and Chloe, Balance Rec n Roll

16. Megan Young: How do I issue statements for properties that haven’t had payouts since we migrated over to PropertyMe but they have had funds going in and expenses going out?

The EOFY statement option you’ll need to select is Transaction date reporting as this will pick up all financial activity against the Owners folio since the migration.

–Jane Morgan, End of Month Angels

17. Luke O’Kelly: How do I make changes to the EOFY statement, if required?

If you find that some transactions have been incorrectly allocated, you can make changes to the EOFY statement by going to Owner Folio, then Folio Summary, then Edit Financial Summary.

–Nicole Johnston, AgentDesk

18. Chris Craft: A common question we get asked is, does it make any difference for migrated data if I choose transaction or statement date?

It depends on when you started receipting with PropertyMe. If you migrated to PropertyMe just before or after EOFY, we recommend you use Statement Reporting. If you’re unsure, contact PropertyMe Support.

–Amber Rolfe, Complete Real Estate Services

19. Gavin Brightwell: A common question we get asked is, owners who were active this financial year but inactive before migration to PropertyMe – will PropertyMe create EOFY statements for these owners?

It depends on what system you migrated from and what your agency selected during migration. We would recommend double-checking owner and financial info.

–Nicole Johnston, AgentDesk

20. David Traeger: What are the pros and cons of transactional vs statement reporting?

Transactional Reporting allows you to include all transactions for an exact date range, for example you can extract data for a full financial year 01/07/18 to 30/06/19. Whilst this option sounds the simplest, it may not be the best option for your owners as it does not match the statements generated throughout the year, most owners want to see the income recorded based on when it was actually paid to them, not when it was received in trust.

Statement date reporting matches the exact payments made to your owners throughout the financial year.

–Natalie Hastings, hastings + co

21. Michael Perrior: A common question we get asked is, what details need to be included in my EOFY statement?

Your EOFY statement needs to include totals of all income and expenses and then a balance of funds that were received by the owner. PropertyMe will generate your EOFY statement and show this as per the transactions you have entered into the system.

–Tamara and Chloe, Balance Rec n Roll

Thanks for reading EOFY Countdown: Your Questions Answered. Hopefully it helped answer all your EOFY questions!

If you’re a PropertyMe customer, we’ve created a comprehensive collection of EOFY resources in the Knowledge Base to help you out. There are lots of step-by-step articles, tutorials, checklists and resources so be sure to check it out.

You might also be interested in:

Have questions about EOFY countdown: your questions answered? Email [email protected] to let us know.