August 28th, 2019

August property market update (2019)

Industry News

Industry News

The RBA slashed the cash rate to a new historic low of 0.1%, property listings increased significantly over the month, the government announced an extension to the First Home Loan Deposit Scheme and rental affordability is at its highest in 13 years.

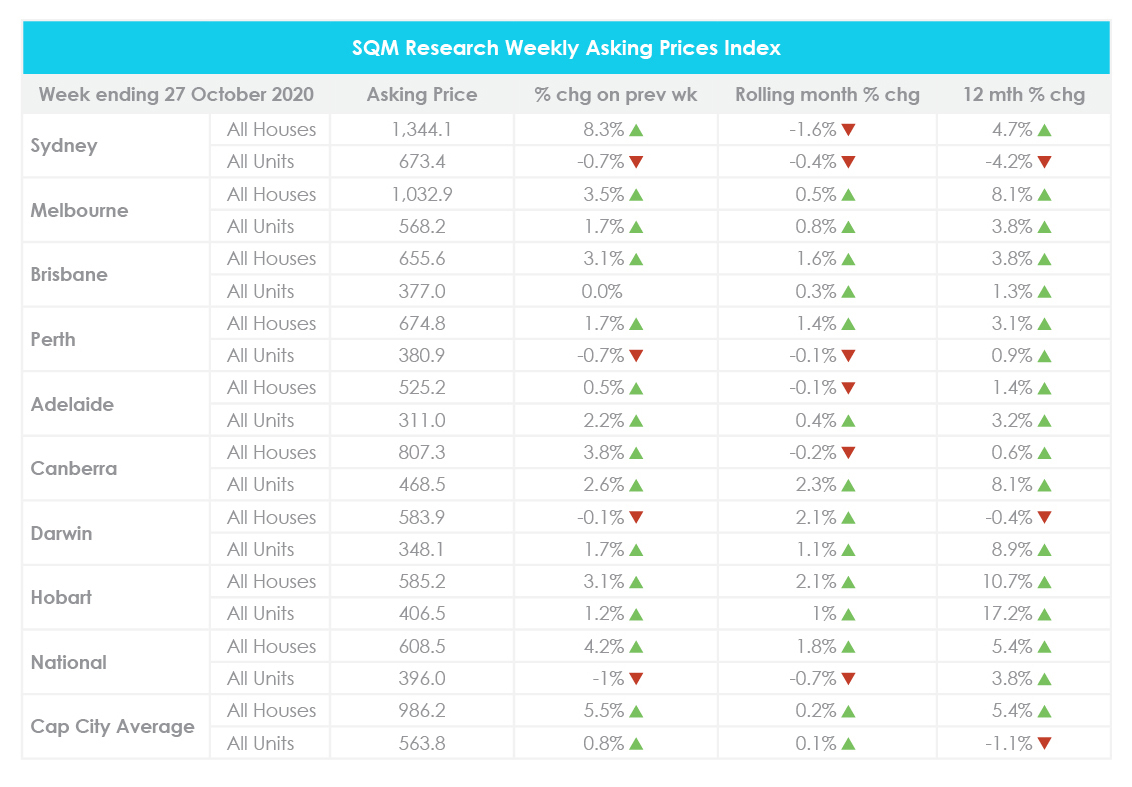

For the week ending 27 October 2020, national property prices increased by 4.2% for houses and decreased by 1% for units, compared to the week prior. Across capital cities, the asking price rose 5.5% for houses and 0.8% for units.

Month on month, national property prices increased by 1.8% for houses and decreased by 0.7% for units. Sydney recorded an overall decline in house and unit prices while Perth, Adelaide and Canberra recorded mixed results and the remaining capital cities recorded an overall increase.

Compared to the year prior, national house prices are up 5.4% and national unit prices are up 3.8%. Across capital cities, this reflects a 5.4% increase in house prices and 1.1% decline in unit prices. Further price breakdowns can be found here.

Recent SQM Research data shows that national property listings increased by 6.5% from 289,566 listings in September to 308,413 listings in October. One year ago, listings were down by 3.3%. While all capital cities recorded an increase over the month, Melbourne recorded the highest increase of 26.7%. This was followed by Sydney and Canberra with an increase of 8.4%.

Notably, new listings rose by 27.45% over the month with 17,154 additional new properties listed for sale. Melbourne led the increase with a 322.6% surge in new listings followed by Hobart at 44%, Canberra at 15.6% and Sydney at 12.7%.

SQM Research Managing Director Louis Christopher said, “It seems like we are moving back to the usual spring selling season with all capital city listings rising in October. Melbourne in particular, has bounced back in a big way after the relaxing of Stage 4 restrictions. In fact, we are expecting another big rise in listings during the month of November for Melbourne.”

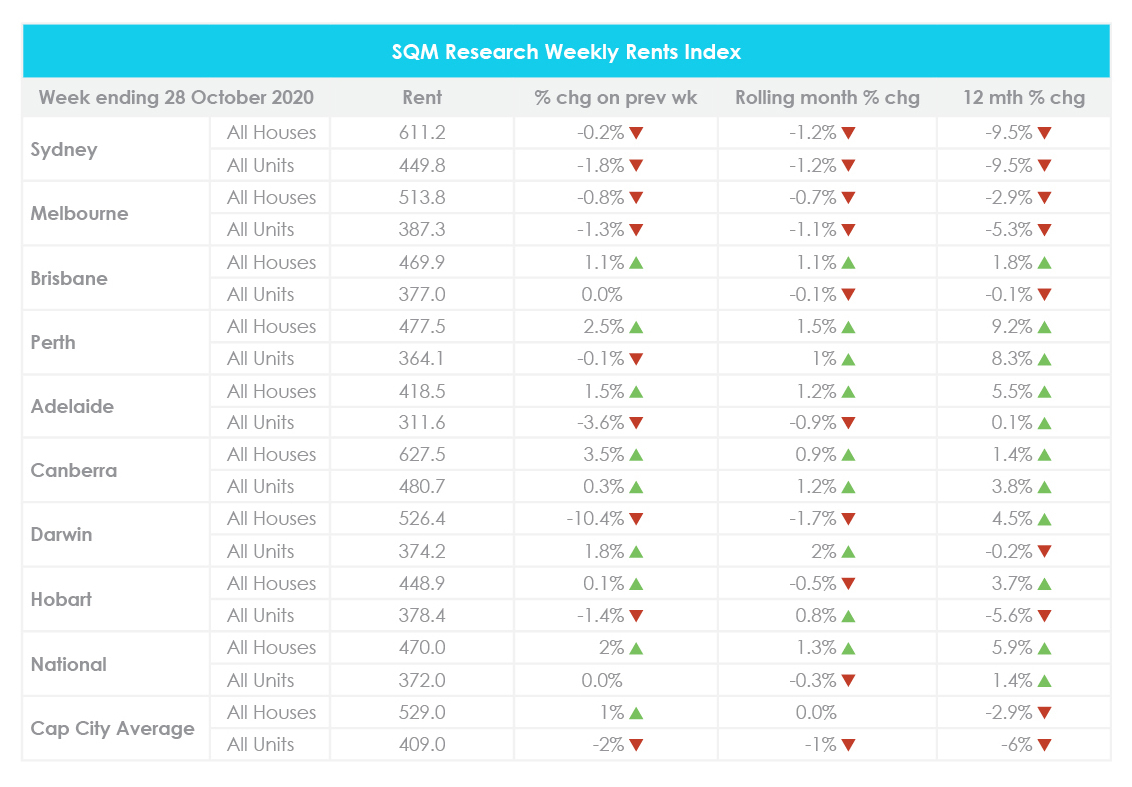

For the week ending 28 October 2020, the average weekly rent across Australia increased by 2% to $470 for houses and held steady at $372 for units, compared to the week prior.

Across capital cities, Canberra recorded the highest average weekly rent for houses at $627.50 and for units at $480.70. In contrast, Adelaide recorded the lowest weekly rent for houses at $418.50 and for units at $311.60.

Month on month, the national weekly rent rose 1.3% for houses and decreased by 0.3% for units. Sydney and Melbourne recorded overall declines in weekly rents while Brisbane, Adelaide, Darwin and Hobart recorded mixed results.

Compared to a year ago, national weekly rents have increased by 5.9% for houses and by 1.4% for units. Meanwhile, capital city weekly rents have decreased by 2.9% for houses and by 6% for units. Further price breakdowns can be found here.

The CoreLogic Quarterly Report shows that the decline in national rental rates eased over the September quarter. Capital city rents are 0.7% lower over the quarter while regional market rents are 1.2% higher due to the shift to regional living.

Across capital cities, four of the eight cities saw an increase in rental values over the September quarter. Conversely, Melbourne, Sydney and Hobart recorded the largest declines in rents.

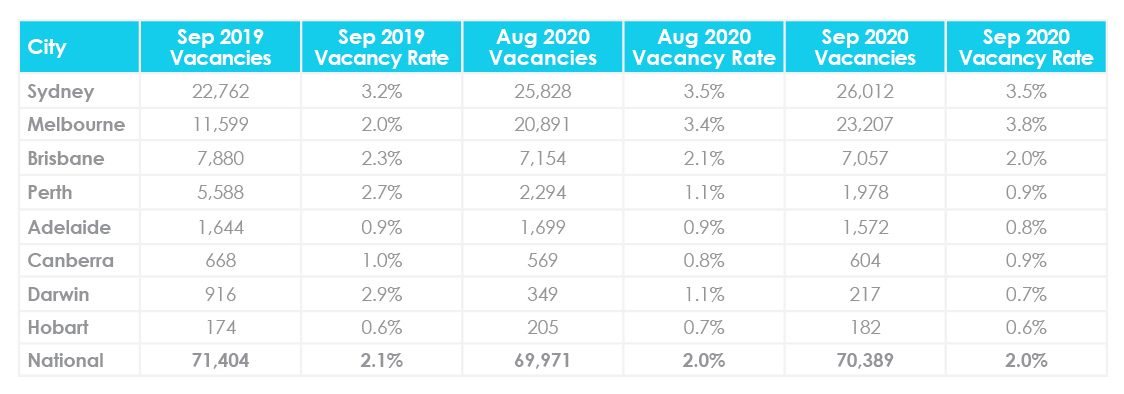

The national residential vacancy rate held steady at 2% from August to September, with a total of 70,389 vacant residential properties Australia-wide. Most capital cities recorded a decline in vacancy rates, with the exception of Canberra and Melbourne.

Melbourne recorded the highest vacancy rate nationwide at 3.8%. This was followed by Sydney at 3.5% then Brisbane at 2%. Conversely, Hobart recorded the lowest vacancy rate nationwide at 0.6%.

The national vacancy rate is 0.1% lower than one year ago. Across capital cities, Darwin’s vacancy rate decreased by 2.2% compared to the year prior and Perth’s vacancy rate decreased by 1.8%. Meanwhile, Melbourne’s vacancy rate is almost double what it was 12 months ago. Further vacancy rate breakdowns can be found here.

Melbourne CBD’s vacancy rate increased from 10% in August to a new record-high of 10.8% in September. Similarly, Brisbane CBD’s vacancy rate rose from 11.4% in August to 12.5%. In contrast, Sydney CBD recorded a slight decrease from 12.9% to 12.8%.

SQM Research Managing Director Louis Christopher said, “Elevated rental vacancy rates in Sydney and Melbourne continue to push city rents downwards. This is particularly the case in the CBD and inner ring suburbs close to the CBDs. However, outside Sydney and Melbourne vacancy rates are falling again. And then when we consider regional locations Vacancy rates have fallen below 1% which really represents the point of little to no rental vacancy. In short, in September the population was still looking to stay away from the large cities. We think this trend may soon reverse, but to what extent remains a mystery.”

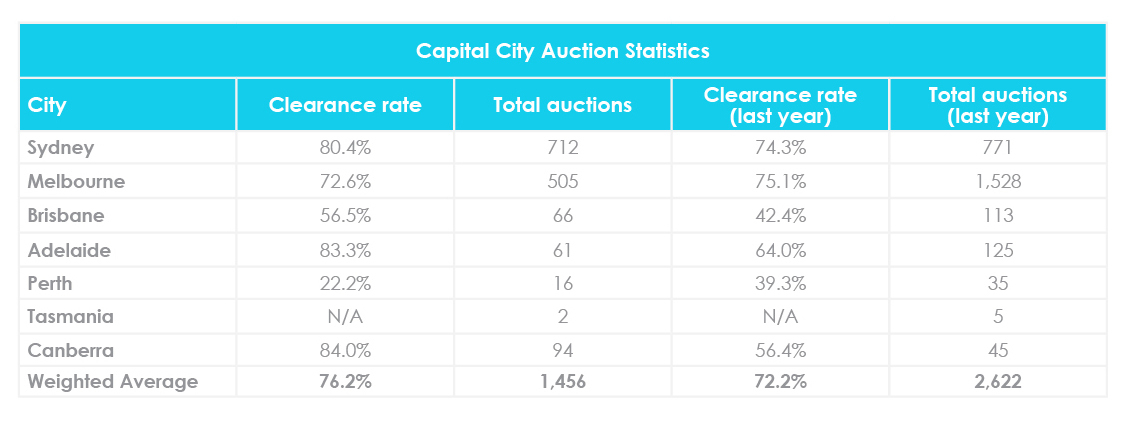

For the week ending 26 October 2020, 1,456 homes were taken to auction across capital cities with a preliminary clearance rate of 76.2%. This is the largest volume of auctions seen since early April and can be attributed to an increase in activity across Melbourne. For the same week one year ago, 2,622 homes were taken to auction with a clearance rate of 72.2%.

Across capital cities, Canberra recorded the highest clearance rate at 84%, followed by Adelaide at 83.3%, Sydney at 80.4% and Melbourne at 72.6%. Meanwhile, Perth recorded the lowest clearance rate across the country at 22.2%. For further auction clearance rate information across each capital city, click here.

In October, the RBA kept the cash rate unchanged at 0.25%. However, on the 3rd of November, the Bank slashed the cash rate by 15 basis points to a new historic low of 0.1% “to support job creation and the recovery of the Australian economy from the pandemic.”

This is the first time that the cash rate has been cut since March 2020 and the cut was widely anticipated by a number of banks, experts and lenders. In fact, a number of lenders reduced home loan rates ahead of the expected rate cut.

RBA Governor Philip Lowe said, “With Australia facing a period of high unemployment, the Reserve Bank is committed to doing what it can to support the creation of jobs.”

“Encouragingly, the recent economic data have been a bit better than expected and the near-term outlook is better than it was three months ago. Even so, the recovery is still expected to be bumpy and drawn out and the outlook remains dependent on successful containment of the virus.”

In the Bank’s new central scenario, GDP growth is expected to reach 6% over the year to June 2021 and unemployment is expected to peak a little below 8%, rather than the 10% expected previously.

“Given the outlook, the Board is not expecting to increase the cash rate for at least three years. The Board will keep the size of the bond purchase program under review, particularly in light of the evolving outlook for jobs and inflation. The Board is prepared to do more if necessary.”

According to the Real Estate Institute of Australia (REIA) Rental Affordability Report, rental affordability has improved over the June quarter and is the highest it has been in over a decade.

REIA President Adrian Kelly said, “Rental affordability has not been this high since December 2007, a positive for renters in these COVID times.”

“The proportion of income required to meet rent payments decreased to 23.3 per cent in the quarter, a decrease of 0.4 percentage points over the quarter and down 0.5 percentage points compared to the same time last year.”

Kelly attributes the increase in rental affordability to the reduction of rents during the June quarter, with only the Australian Capital Territory recording an increase in rents.

Here’s a breakdown of the REIA Rental Affordability Report by state and territory:

An extension of the First Home Loan Deposit Scheme (FHLDS) was announced in Treasurer Josh Frydenberg’s budget address on the 6th of October. The scheme will support an additional 10,000 first home buyers between 2020-21.

Launched in January 2020, the FHLDS allows first home buyers to purchase newly-built homes with a deposit of only 5%. The scheme has already been accessed by 20,000 Australians.

Other measures proposed in the budget include additional funding for the Indigenous Home Ownership Program, proposed capital gains exemptions for granny flats from July 2021, changes to ease credit regulations, funding for state social housing services and proposed low-cost financing for affordable housing.

Flatmates.com.au surveyed almost 13,000 renters who live in shared housing for their National Share Accommodation Survey. The survey revealed that:

Hopefully you enjoyed this October Property Market Update. Be sure to subscribe to our Monthly Insider below to receive email updates.

You might also be interested in:

Let us know your thoughts on this month’s October property market update by emailing [email protected].