August 1st, 2019

July property market update (2019)

Industry News

Industry News

In August, the cash rate was held at 1% due to global economic uncertainty, preliminary auction clearance rates rose to 79.6% and a new study conducted by the Australian Housing and Urban Research Institute (AHURI) revealed the housing needs and aspirations of ageing Australians.

Without further ado, here’s this month’s August property market update:

In August, the national asking price for houses and units increased by 1.9% month on month. Across capital cities, the asking price for houses rose 1.5% while the asking price for units fell by 0.5%.

Year on year, this reflects a decline in property prices both nationally and across capital cities. Further price breakdowns can be found here.

Compared to the month prior, the average weekly rent for houses remained unchanged at $545 across capital cities and $438 nationwide in August. In contrast, the average weekly rent for units fell by 0.9% to $437 across capital cities and by 1.4% to $365 nationwide.

Hobart, Canberra, Sydney and Melbourne recorded a decline in average weekly rents for houses and units while Brisbane recorded a slight increase across the board. Overall, national weekly rents are 1.35% higher than they were in August last year and capital city weekly rents are 0.7% lower. Further rental value breakdowns can be found here.

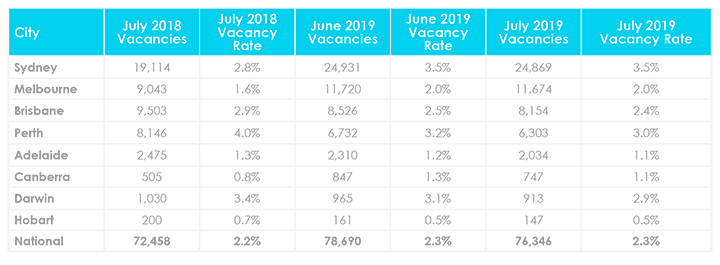

While the volume of vacant properties dropped from 78,690 to 76,346, the national residential vacancy rate remained at 2.3% from June to July. This is 0.1% higher than the vacancy rate recorded in July last year.

While vacancy rates remained steady in Sydney, Melbourne and Hobart, they fell for most other cities in July. Brisbane and Adelaide recorded a 0.1% decrease while Perth, Canberra and Darwin recorded a 0.2% decrease month on month.

Sydney’s vacancy rate continues to be the highest in the country at 3.5%, up from 2.8% the year prior. In contrast, Hobart continues to maintain the lowest vacancy rate nationwide at 0.5%. Further vacancy rate breakdowns can be found here.

Managing Director of SQM Research Louis Christopher said “Going forward, the expectation remains that Sydney and Melbourne will record higher rental vacancy rates in the 2nd half of this year driven by ongoing high levels of dwelling completions from the tail of the last property boom.”

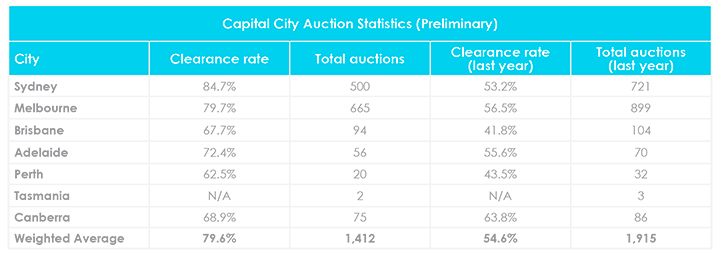

For the week ending 26 August 2019, 1,412 homes were taken to auction across combined capital cities, bringing the preliminary auction clearance rate to 79.6%, the highest its been since May 2017. This shows a vast improvement compared to the same time last year, where only 54.6% of homes were sold at auction.

The two largest auction markets, Sydney and Melbourne, yielded the highest preliminary auction clearance rates, as shown below. In particular, Sydney’s preliminary clearance rate of 84.7% is the highest that the city has seen since February 2017. For further auction clearance rate information across each capital city, click here.

In early August, the Reserve Bank of Australia (RBA) decided to keep the cash rate unchanged at 1% due to increased uncertainty in the global economy as a result of trade and political disputes. A “further monetary easing is widely expected”.

Bolstered by lower interest rates, stabilising housing markets, recent tax cuts and a more positive outlook for the resources sector, the Australian economy is expected to strengthen from here on out.

RBA Governor Philip Lowe said “An extended period of low interest rates will be required in Australia to make progress in reducing unemployment and achieve more assured progress towards the inflation target.”

The Australian Bureau of Statistics (ABS) predicts that the number of persons aged 55 and over will more than double from 5.8 to 14.1 million between 2012 and 2062. This prompted a study by the Australian Housing and Urban Research Institute (AHURI) into the housing needs and aspirations of ageing Australians.

It was found that approximately 35% of older Australians aspire to live in the middle or outer suburbs of the city, followed by approximately 20% of older Australians who prefer to live in small regional towns. Meanwhile, those aged 75 and over indicated a preference for inner city suburbs.

The majority of older Australians have a preference for detached dwellings with three bedrooms while those aged 75 and over are more likely to select attached dwellings or apartments with two bedrooms. Moreover, 80% of respondents indicated that home ownership would be the most ideal tenure.

Hopefully you enjoyed this August Property Market Update. Be sure to subscribe to our Monthly Insider below to receive email updates.

You might also be interested in the July Property Market Update and The Ultimate Guide to Leasing in a Slow Market.

Did we miss anything in this August Property Market Update? Email us at [email protected] to let us know.