What happens when you think about your trust account? Does your blood pressure skyrocket while you quiver in your shoes? If so, don’t worry as you’re not alone. It seems that many property managers are sometimes overwhelmed by the financial aspects of managing a trust, on top of managing their general business finances (if they own one).

Without further ado, let’s break down what a trust account is, trust money vs non-trust money, the purpose of a trust account in real estate and trust accounting best practice.

What is a trust account?

If you hold or manage client money as part of your business practice, that money is “entrusted” to you, and you may be required to keep that money in a “trust account”.

As defined by Commerce Western Australia, a trust account is a special type of bank account “where money is received or held by an agent (including any member of the agency’s staff) on behalf of another person in relation to real estate, business or settlement transaction.”

Trust accounts are governed by legislation and real estate agents in Australia are required to have a trust account when holding client money.

What is trust money?

According to the Queensland Government, trust money is “money you handle on behalf of someone else, under your appointment to act as an agent.”

It might include payments for residential, commercial or retail rent, sales deposits, utilities if they’re not already included in the rent, advertising expenses, maintenance costs, strata levies and bonds.

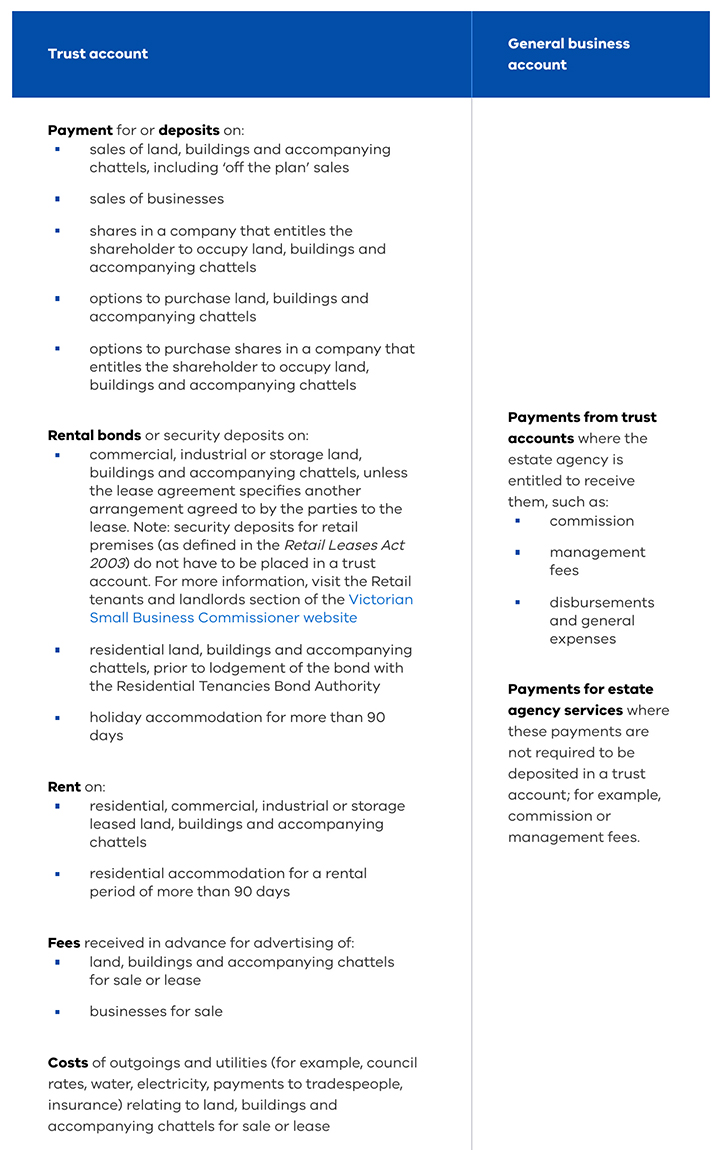

Trust money must be paid into a trust account, whereas non-trust money should be deposited in a general business account. See the table below from Consumer Victoria to see which payments should go into which accounts:

Image credit: Consumer Victoria

Image credit: Consumer Victoria

The purpose of a trust account in real estate

Trust accounts exist to protect everyone involved in the real estate transaction. They are heavily governed by legislation and failure to comply can result in hefty penalties and even loss of licence. For example, in Queensland, misuse of trust monies can lead to a fine of up to $24,380 or 1 year imprisonment!

As a real estate agent, not only are you kept accountable for the health of your trust account, but it also helps ensure best practice trust accounting. This way, you’ll be able to ace your trust account audit and should any legal disputes arise, you’ll have a clear digital paper trail to refer to.

Trust accounting best practice

Imagine receiving cash for a rental payment then rushing off to an open for inspection. Hours later, you find a wad of cash in your pocket…but who is it from? And what is it for?

To avoid the above scenario, be sure to avoid common trust accounting mistakes such as accepting cash. You should have trust-specific policies and procedures in place to ensure consistency and minimise any chance of error.

Here are some simple trust accounting principles to follow:

- All trust money must be deposited into your trust account and be tracked and reported

- Your trust accounting software transactions must match your bank account transactions

- Always be transparent when receipting and withdrawing money

- Try not to accept cash, as this will increase your risk and will also need to be banked manually

To simplify your workload, be sure to use modern trust accounting software with automation for bills, reconciliation and disbursements. Not only will this make it far easier to document and track your trust account transactions and stay compliant, but it also saves you bucket loads of time. Stop fighting your clunky old software system and update from the spreadsheets you’ve been using!

Additional trust account resources

Different Australian states and territories have different rules and regulations when it comes to trust accounts. Be sure to check your state or territory’s consumer affairs website for more details:

Consumer Affairs Northern Territory

About PropertyMe

PropertyMe is game-changing trust accounting software that you can access from anywhere, any time. With automated reconciliation, one-click disbursements, bill scanning and end of month in minutes, you’ll save hours every week. Just check out how this property manager saves $3,437 every month.

Book a demo today to see why thousands of property managers have switched to the PropertyMe cloud.

Did we miss anything in Understanding Your Trust Account? Please let us know in the comments below.