February 19th, 2018

9 trust accounting mistakes you need to stop making now

Property Management

Property Management

To ace your trust account audit, you need to first ask yourself this — do you really understand your trust account?

Essentially, a trust account is a special type of bank account “where money is received or held by an agent, including any member of the agency’s staff, on behalf of another person in relation to real estate, business or settlement transaction.”

The purpose of a trust account audit is to report on whether the records relating to trust monies have been properly kept, whether there are any discrepancies in trust monies and whether the trust account is compliant with legislation. Failure to comply can result in hefty penalties and even loss of licence.

To help you out, here are our top seven trust account audit tips.

The simple act of diarising your audit period and due date will help keep you accountable and ensure that you stay one step ahead. However, the uncertainty of the COVID-19 pandemic means that obtaining a trust account audit may be difficult during this period.

CPA Australia is monitoring the impacts of the pandemic and as it currently stands, most trust account audits are due on 30 September 2020. Keep in mind that trust account audit requirements, periods and due dates vary depending on the state or territory which you operate in. Be sure to check out the below resources for more information.

Audits for the year ending 30 June 2020 must be lodged by 31 December 2020. This is an extension of the normal deadline of 30 September due to the pandemic.

Learn more about NSW trust account audit requirements.

Depends on when your licence was issued. Your audit report must be lodged within four months after the end of your audit period, unless it is your last year of business where it must be lodged with us within two months after you stop carrying on a business.

Learn more about QLD trust account audit requirements.

You must have your trust accounts audited within three months after 30 June by an approved auditor using the new CAV-approved auditor form, and must lodge a copy of the audit report within 10 days of receiving it from your auditor.

Learn more about VIC trust account audit requirements.

Calendar year annual audit reports for real estate and real estate business agents must be lodged by 31 March of each year, while financial year annual audit reports for settlement agents and business settlement agents must be lodged by 30 September of each year.

Learn more about WA trust account audit requirements.

The property agent must provide their trust account records to their auditors within sufficient time for the audit to be completed and the report lodged with the Board by 30 September 2020.

Learn more about TAS trust account audit requirements.

The report is due within three months after the end of the audit period (30 September 2020).

Learn more about ACT trust account audit requirements.

The report is due within three months after the end of the audit period (30 September 2020).

Learn more about NT trust account audit requirements.

Depends on when your licence is due to expire. The report is due at the end of the month of licence expiry.

Learn more about SA trust account audit requirements and download the audit checklist.

Note that some states and territories require more than one audit per trust year, through unannounced visits, so it is best to be prepared at all times.

Besides diarising trust account audit dates, it’s important to know where to lodge your audit results as many regulators no longer accept paper-based auditor reports. Be sure to check out the below resources for more information:

We’re often asked: how often should I reconcile my accounts? While this varies depending on state and territory legislation, we always recommend reconciling more frequently than recommended, with reconciling daily being the gold standard.

The more often you reconcile, the easier it is to identify and rectify any discrepancies in your trust account so that your records are always up-to-date and accurate. This is critical to preventing administrative issues and catching fraud before it’s too late.

Just imagine performing EOM and finding a discrepancy — would you rather comb through an entire month of transactions or a single day of transactions?

Not only does reconciling daily prevent mistakes from snowballing into bigger problems, but it also ensures that you’re always prepared for an unannounced trust account audit.

Picture this. A tenant comes to your agency and hands you some cash to cover their rent. You receive an urgent phone call and have to rush off that very minute. You come back to the office after half a day, only to realise that you have no idea where the cash went…

While it can be tempting to accept cash for rent payments and other fees, it opens you up to a plethora of risks as it needs to be banked manually. For example, you might forget to write the tenant a receipt for their payment which can result in a he-said-she-said legal dispute or you might lose the cash like the aforementioned scenario. So do yourself a favour and avoid accepting cash. After all, keeping a clear digital paper trail is key to acing your trust account audit.

Another top trust account audit tip is to document your processes in the form of playbooks and checklists. These should be formal and detailed to help minimise human error and ensure consistency across the business. This way, come audit time, the auditor is better able to understand and navigate your trust account.

Additionally, anyone who handles your trust account should have the proper training and qualifications necessary to maintain your records. After all, it’s your licence that’s on the line if a breach is detected.

Think about the in-depth look into your accounts and processes that your auditor is privy to. There lies an opportunity for your auditor to provide value-add services in addition to completing your audit. These might include recommendations to streamline your business operations, bolster your compliance processes or enhance internal record-keeping.

If your current auditor doesn’t help you get the most out of your trust account audit, it might be time to consider a different auditor. Be sure to ask your network for recommendations as a starting point.

Plus, with advancements in technology and many agencies going paperless, tech-savvy auditors can conduct audits remotely if your internal systems allow for it. During the pandemic, this can help you mitigate risk and ensure the safety and wellbeing of your staff.

Keep in mind that if you switch auditors, you must notify your relevant state or territory body of the change. Timeframes and requirements vary depending on where you operate so it’s best to check with your relevant regulator.

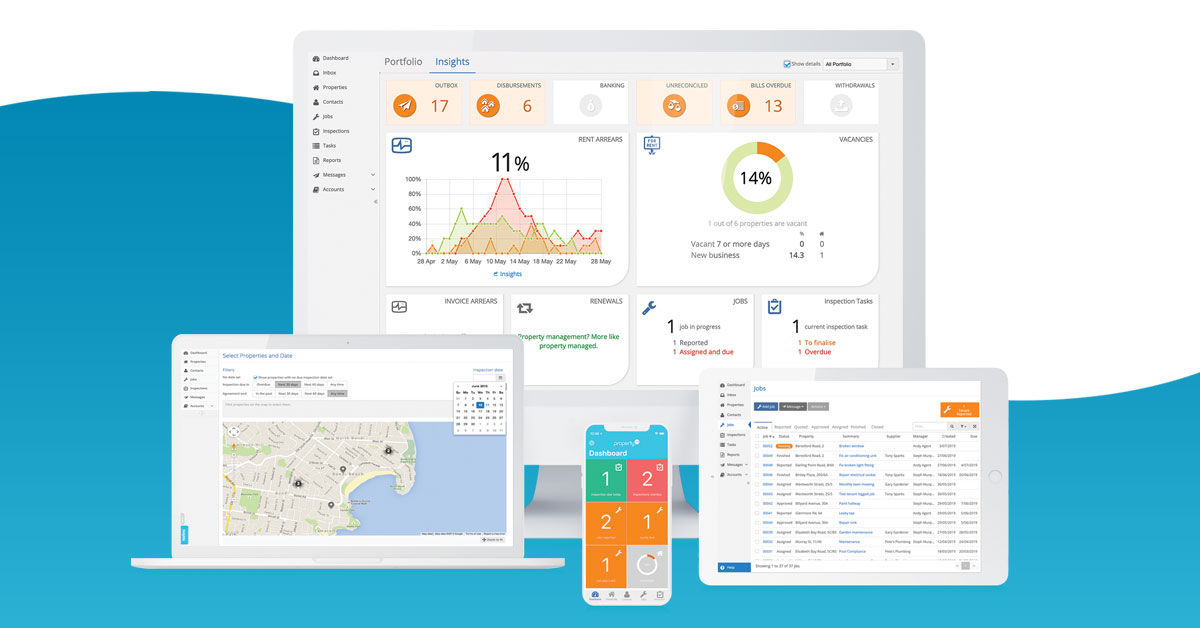

Using a 100% compliant trust accounting software like PropertyMe can make your life a whole lot easier. With automated workflows, PropertyMe allows you to disburse all your owners and suppliers with the click of a button, import transactions directly from your bank for easy reconciliation and scan bills into the system, just to name a few. Plus, if you use Xero, PropertyMe has a great Xero integration, amongst others.

Not only does this mitigate human error caused by manual data entry, but it also saves you time and money — just check out how this property manager saves $3,437 every month. More importantly, it means that come audit time, your digital paper trail will be squeaky clean!

Here are our top seven trust account audit tips:

Thanks for reading this blog on trust account audit tips. You might also be interested in:

Let us know your thoughts on Top 7 trust account audit tips by emailing [email protected].