In March, the effects of the global coronavirus crisis rippled through the Australian property market. The RBA made an out of cycle decision to cut the cash rate to the effective lower bound of 0.25% and the Australian government banned public auctions and open house inspections before announcing a six-month moratorium on rental evictions.

Property prices

In March, the national asking price rose 0.2% for houses and units. Across capital cities, house prices rose 0.7% and unit prices recorded a 0.6% increase.

Year on year, this reflects a 5.3% increase in house prices nationwide and a 4% increase in unit prices nationwide. Across capital cities, this reflects a 8.8% increase in house prices and a 2.1% increase in unit prices.

Sydney, Melbourne, Perth and Darwin recorded increases in asking prices for both houses and units. Conversely, Brisbane recorded an overall decline in property prices compared to the month prior. Further price breakdowns can be found here.

Rental values

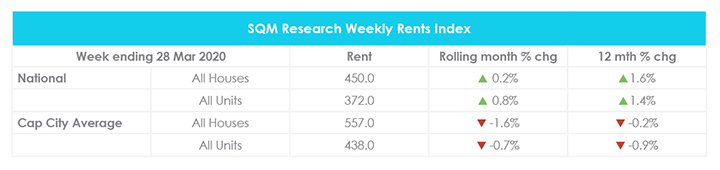

For the week ending 28 March 2020, the average weekly rent across Australia increased by 0.2% to $450 for houses and by 0.8% to $372 for units. Meanwhile, the average weekly rent across capital cities decreased by 1.6% to $557 for houses and by 0.7% to $438 for units.

Compared to the year prior, national weekly rents have increased by 1.6% for houses and by 1.4% for units. Meanwhile, capital city weekly rents have decreased by 0.2% for houses and by 0.9% for units.

Most capital cities across Australia recorded decreases in weekly rents for both houses and units in March. In contrast, Perth, Adelaide and Canberra recorded increases in weekly rents across the board.

Hobart still shows the strongest growth year on year with a 4.8% increase in weekly rents for houses and 12% increase in weekly rents for units. Further price breakdowns can be found here.

Vacancy rates

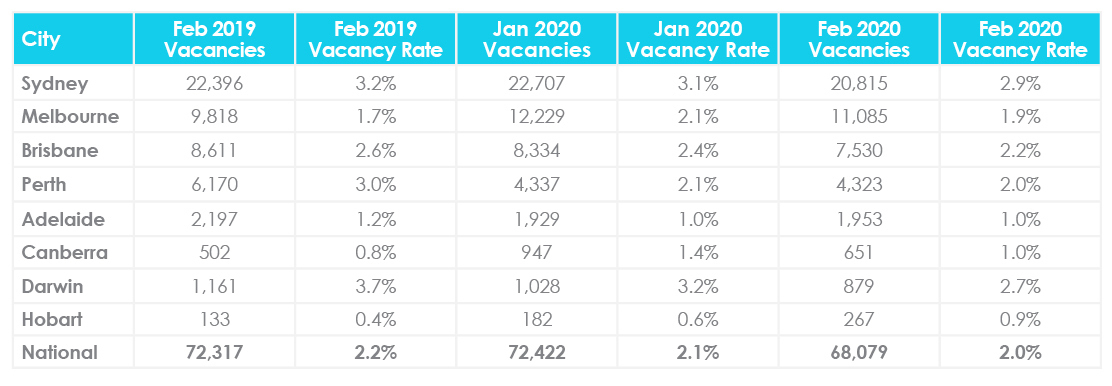

There are now 68,079 properties sitting vacant Australia-wide, bringing the national vacancy rate to 2% in February. This is 0.1% lower than the vacancy rate recorded for the month prior and 0.2% lower than the vacancy rate recorded for February 2019.

Across capital cities, almost all capital cities recorded a decrease in vacancy rates, with the exception of Adelaide where vacancy rates held steady at 1% from January to February, and Hobart where vacancy rates increased from 0.6% to 0.9% month on month.

Sydney surpassed Darwin and recorded the highest vacancy rate nationwide at 2.9%. In contrast, Hobart continues to maintain the lowest vacancy rate nationwide at 0.9%. This is followed by Adelaide and Canberra at 1%. Further vacancy rate breakdowns can be found here.

SQM Research Managing Director Louis Christopher said “February marks the start to the new year in the property industry and gives us a clearer picture of the rental market. The decline in vacancy rates is a reflection of a seasonal increase in rental demand plus ongoing decline in dwelling completions and the ongoing increase in population. We are likely to record further declines in rental vacancy rates as 2020 progresses unless the country enters into a prolonged economic depression.”

Auction clearance rates

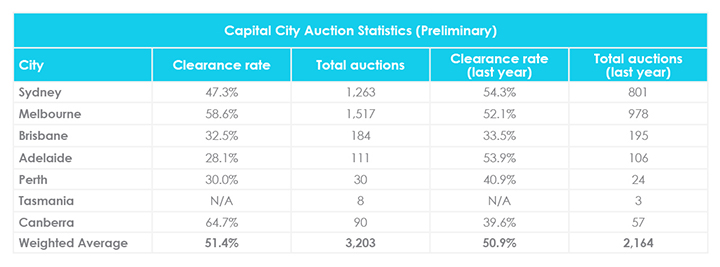

The last week of March was set to be the busiest week of the year with 3,203 homes scheduled for auction. However, with the ban on public auctions in response to the coronavirus pandemic, withdrawals increased to 40%, up from 7.5% the week prior.

This dropped the preliminary auction clearance rate to 51.4%, the lowest it has been since June 2019. The week prior, the final clearance rate sat at 56.9% across 2,599 auctions. Over the same week last year, 2,164 homes were taken to auction with a clearance rate of 50.9%.

Canberra overtook both Melbourne and Sydney and yielded the highest preliminary auction clearance rate across the country at 64.7%. In contrast, Adelaide yielded the lowest preliminary auction clearance rate at 28.1%. For further auction clearance rate information across each capital city, click here.

The surge in withdrawals was widely anticipated given the rising uncertainty from buyers and sellers. According to realestate.com.au, many of the auction withdrawals have reverted to private treaty sales “with early indicators suggesting that at least 400 of the nearly 1,260 auctions originally scheduled for the week shifted to non-auction listings.”

With many agencies shifting to remote and virtual auction platforms like AuctionNow and Openn Negotiation, experts anticipate that it will take some time for the market to adjust.

Cash rate and predictions

On the 19th of March, the Reserve Bank of Australia (RBA) made an out of cycle decision to cut the cash rate to an unprecedented low of 0.25% to support jobs, income and businesses as the economy responds to the global coronavirus pandemic. This is the first time an out of cycle decision has been made since 1997.

RBA Governor Philip Lowe said “The Board will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2 to 3 per cent target band.”

The decision to lower the cash rate to 0.25% is significant as the RBA has previously defined it as the effective lower bound—the point at which further reductions to the cash rate will not stimulate additional spending or benefit the economy.

Furthermore, housing experts said the move will likely have a long-term impact on the market rather than provide the desired short-term boost in economic activity.

SQM Research Managing Director Louis Christopher told news.com.au that “interest rates had a history of pushing up prices but the effect of the latest stimulus would only be felt once there was more certainty about the COVID-19 pandemic.”

“Buyers could get rates in the low twos. This will make a huge difference later but it won’t help much right now.”

My Housing Market Economist Andrew Wilson said that “uncertainty and fear were already eroding home buyer confidence and the latest rate cut wouldn’t change that.”

“It’s too early for the cut to offset the uncertainty around coronavirus, but once things become more certain it could be different.”

Coronavirus and the Australian property market

As of the 25th of March, the Australian government has banned real estate auctions and open house inspections to prevent the spread of coronavirus or COVID-19.

Prime Minister Scott Morrison said “We’re trying to limit the gathering of people in large numbers that can relate to the transmission of that virus.”

However, private appointments for inspections are permitted. Agents are rapidly transitioning to virtual inspections, tenant assisted inspections and remote online auctions using PropTech software and apps like Skype, Zoom, FaceTime, Google Hangouts and Whatsapp.

On Sunday night, Mr Morrison announced a six-month moratorium on residential and commercial rental evictions to assist those under financial distress as a result of the COVID-19 pandemic.

“State and territories will be moving to put a moratorium on evictions of persons as a result of financial distress if they are unable to meet their commitments. There’ll be a moratorium on evictions for the next six months under those rental arrangements.”

However, residential tenancies are governed by state and territory laws. Here’s what different states and territories across Australia have announced:

- Tasmania: The state has moved to stop evictions due to coronavirus last week with tenancy advocates calling for all governments to copy emergency laws being debated in the Tasmanian Parliament.

- New South Wales: Premier Gladys Berejiklian indicated she would roll out the new rules in NSW, banning landlords from evicting tenants who fail to pay their rent from COVID-19 job losses.

- Queensland: State Treasurer Jackie Trad has pledged that the QLD government will backdate the eviction moratorium to 29 March and has announced emergency rental assistance payments of up to $500 a week for up to four weeks.

- Victoria: Premier Dan Andrews has confirmed evictions will be frozen for six months for residential and commercial renters experiencing financial stress due to COVID-19.

- South Australia: Following a $350 million pledge, Premier Steven Marshall announced a $650 million jobs package but no news of rent relief or restrictions on evictions yet.

- Western Australia: In conjunction with the NSW government, WA will develop new rules to prevent evictions and ease pressure on commercial tenants. Additionally, Premier Mark McGowan and Treasurer Ben Wyatt announced a $25 million rent relief plan.

- Northern Territory: The NT government has launched a $50 million Small Business Survival Fund but there has been no news on rent relief or restrictions on evictions yet.

- Australian Capital Territory: The ACT government is offering payroll tax deferrals for businesses but there has been no news on rent relief or restrictions on evictions yet.

More detail on the moratorium is expected after the National Cabinet meeting on the 3rd of April. You can check here for updates.

Hopefully you enjoyed this March Property Market Update. Be sure to subscribe to our Monthly Insider below to receive email updates.

You might also be interested in the February Property Market Update, January Property Market Update and Australian Property Investor Report 2020.

Did we miss anything in this March Property Market Update? Email us at [email protected] to let us know.