In February, weekly rents decreased nationwide, auction activity recovered, the national vacancy rate decreased marginally and the RBA cut the cash rate to a new record low of 0.5%.

Without further ado, here’s this month’s February property market update:

Property prices

In February, the national asking price rose 1.4% for houses and 0.5% for units. Across capital cities, house prices rose by 0.4% and unit prices recorded a 0.9% decrease.

Year on year, this reflects a 5.1% increase in house prices nationwide and a 3.5% increase in unit prices nationwide. Across capital cities, this reflects a 6.9% increase in house prices and a 0.4% decline in unit prices.

Brisbane and Hobart recorded increases in asking prices for both houses and units. Conversely, Perth recorded an overall decline in property prices compared to the month prior. Further price breakdowns can be found here.

Rental values

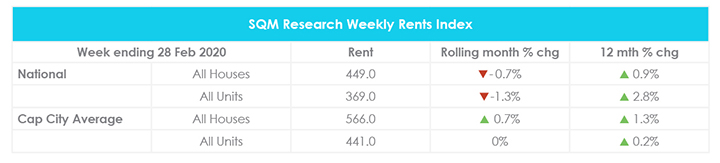

For the week ending 28 February 2020, the average weekly rent across Australia decreased by 0.7% to $449 for houses and by 1.3% to $369 for units. Meanwhile, the average weekly rent across capital cities rose by 0.7% to $566 for houses and held steady at $441 for units.

Compared to the year prior, national weekly rents have increased by 0.9% for houses and by 2.8% for units. Meanwhile, capital city weekly rents have increased by 1.3% for houses and by 0.2% for units.

Across capital cities, Sydney, Melbourne and Canberra recorded increases in weekly rents for both houses and units in February. In contrast, Darwin recorded decreases in weekly rents across the board.

Hobart still shows the strongest growth year on year with a 6.5% increase in weekly rents for houses and 11.8% increase in weekly rents for units. Further price breakdowns can be found here.

Vacancy rates

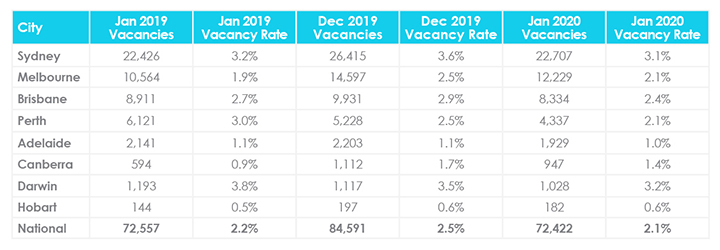

The national vacancy rate decreased from 2.5% in December to 2.1% in January. This is 0.1% lower than the vacancy rate recorded for January 2019. There are now 72,422 properties sitting vacant Australia-wide, down from 84,591 properties in December.

Across capital cities, almost all capital cities recorded a decrease in vacancy rates, with the exception of Hobart where vacancy rates held steady at 0.6% from December to January.

Darwin recorded the highest vacancy rate nationwide at 3.2%, overtaking Sydney’s vacancy rate of 3.1%. In contrast, Hobart continues to maintain the lowest vacancy rate nationwide at 0.6%. This is followed by Adelaide at 1% and Canberra at 1.4%. Further vacancy rate breakdowns can be found here.

SQM Research Managing Director Louis Christopher said “Following on from December, January’s vacancy rates are also affected by seasonality. We will have a clear picture of the rental market when the numbers for February are released. However, we do believe that rental vacancy rates have now peaked in Sydney, Brisbane, Perth and Darwin. And assuming a stable economy, these cities are likely to record gradually lower vacancy rates as 2020 progresses.”

Auction clearance rates

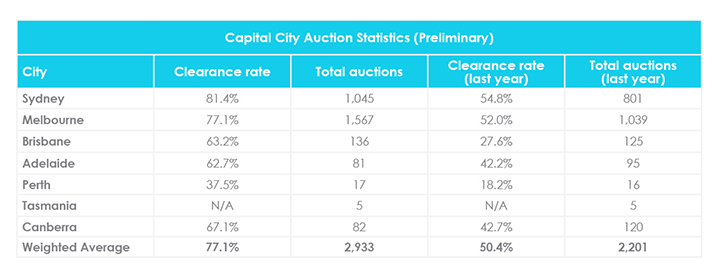

For the week ending 1 March, 2,933 homes were taken to auction and 1,592 homes were cleared across combined capital cities, bringing the preliminary auction clearance rate to 77.1%. Over the same week last year, 2,201 homes were taken to auction with a clearance rate of 50.4%.

Sydney yielded the highest preliminary auction clearance rate across the country at 81.4%, followed by Melbourne at 77.1% and Canberra at 67.7%. In contrast, Perth yielded the lowest preliminary auction clearance rate at 37.5%. For further auction clearance rate information across each capital city, click here.

Cash rate and predictions

The Reserve Bank of Australia (RBA) has cut the cash rate by 25 basis points to a new record low 0.5% to “support the economy as it responds to the global coronavirus outbreak.”

RBA Governor Philip Lowe said “The coronavirus has clouded the near-term outlook for the global economy and means that global growth in the first half of 2020 will be lower than earlier expected.”

The coronavirus outbreak is expected to delay progress towards full employment and the inflation target until it is contained.

“Given the evolving situation, it is difficult to predict how large and long-lasting the effect will be. Once the coronavirus is contained, the Australian economy is expected to return to an improving trend.”

The board will continue monitoring the impacts of the cuts on the economy and is prepared to ease monetary policy further to support the Australian economy.

Quarterly regional market update

According to the newly-released CoreLogic Quarterly Regional Market Update Report, property prices increased in 23 out of 50 regional property markets. Houses outperformed units in 15 regions, compared to 8 regions where units outperformed houses.

Launceston and North East Tasmania recorded the largest overall increase with a 7.1% increase in houses prices and a 13.6% increase in unit prices over the 12 month period to January 2020. Conversely, Bunbury recorded the lowest annual growth with a 6.6% decline in house prices.

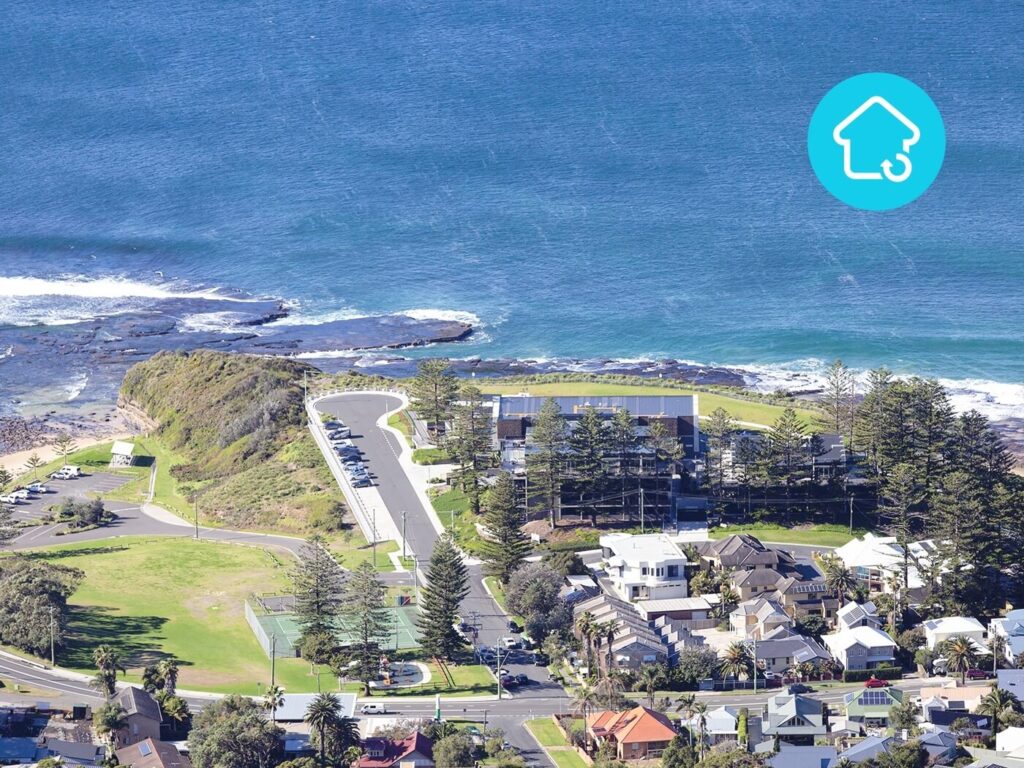

CoreLogic Head of Residential Research Eliza Owen said “Looking forward to the rest of 2020, the regions most likely to see continued growth are high amenity areas with close proximity to major capital cities. These include the Gold Coast and Sunshine Coast, Geelong and the Newcastle and Lake Macquarie regions.

As housing affordability becomes a resurgent issue in 2020, capital city residents may once again seek relatively affordable housing in nearby regions, or regional areas with high levels of amenity.”

Hopefully you enjoyed this February Property Market Update. Be sure to subscribe to our Monthly Insider below to receive email updates.

You might also be interested in the January Property Market Update, December Property Market Update and Australian Property Investor Report 2020.

Did we miss anything in this February Property Market Update? Email us at [email protected] to let us know.