December 1st, 2019

November property market update (2019)

Industry News

Industry News

Property prices increased by 4% over the quarter to end the year on a high, national vacancy rates increased marginally and the First Home Loan Deposit Scheme kicked off on 1 January.

Without further ado, here’s this month’s December property market update:

In December, the national asking price for houses increased by 0.8% and decreased by 0.3% for units. Across capital cities, both house prices and unit prices recorded an overall increase. Year on year, this reflects an increase in property prices nationwide and across capital cities.

Sydney and Hobart both recorded a rise in property prices across the board. Meanwhile, Melbourne, Brisbane, Perth and Adelaide recorded an increase in house prices and decrease in unit prices. Darwin was the only capital city that recorded a decline for both houses and units at 2% and 1.2% respectively. Further price breakdowns can be found here.

According to CoreLogic, property prices increased by 4% over the last quarter. This represents the fastest rate of national property price growth for any three month period since November 2009. However, property prices across Australia remain 3.1% below their October 2017 peak.

CoreLogic Head of Research Tim Lawless said “A nominal recovery in housing values implies home owners are becoming wealthier, which may also help to support household spending. However, the flipside is that housing affordability is set to deteriorate even further as dwelling values outpace growth in household incomes, signaling a set-back for those saving for a deposit.”

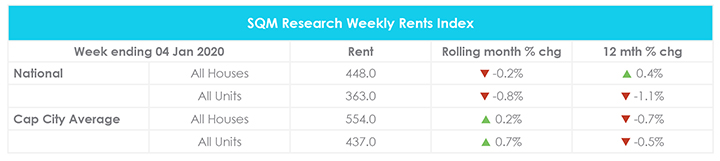

For the week ending 4 January 2020, the average weekly rent across Australia decreased by 0.2% to $448 for houses and by 0.8% to $363 for units. Meanwhile, the average weekly rent across capital cities rose by 0.2% to $554 for houses and by 0.7% to $437 for units.

Compared to the year prior, national weekly rents have increased by 0.4% for houses and decreased by 1.1% for units and capital city weekly rents are 0.7% lower for houses and 0.5% lower for units.

Across capital cities, Melbourne and Adelaide recorded increases in weekly rents for both houses and units in December. In contrast, weekly rents in Canberra decreased by 1.9% for houses and by 0.4% for units.

Despite recording a 5.6% decrease in weekly rents for units in December, Hobart still shows the strongest growth year on year with a 9.5% increase in weekly rents for houses and 22.9% increase in weekly rents for units. Further price breakdowns can be found here.

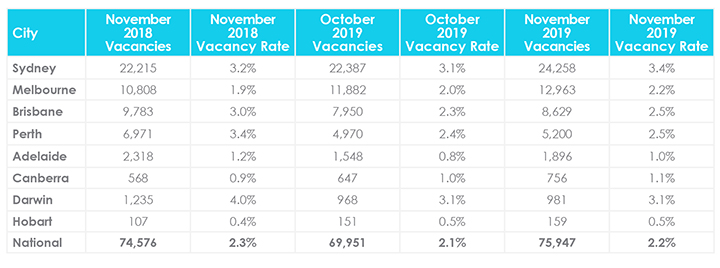

According to SQM Research, there were 75,947 properties sitting vacant Australia-wide in November, up from 69,951 properties in October, bringing the vacancy rate up from 2.1% to 2.2%. However, this is still 0.1% lower than the vacancy rate recorded in November last year.

Across capital cities, almost all capital cities recorded a marginal increase in vacancy rates compared to the month prior. Meanwhile, vacancy rates held steady in Darwin and Hobart at 3.1% and 0.5% respectively.

Sydney continues to record the highest vacancy rates nationwide at 3.4%, up from 3.1% in October. In contrast, Hobart continues to maintain the lowest vacancy rate nationwide at 0.5%, followed by Adelaide at 1% and Canberra at 1.1%. Further vacancy rate breakdowns can be found here.

Managing Director of SQM Research Louis Christopher said “The rise in vacancy rates across most cities is expected in November as the year winds up and demand for rental accommodation drops. Sydney’s oversupply of rental accommodation continues, with the vacancy rate up from 3.2% a year ago. The city is still a renter’s market as is Darwin.”

“Our expectation is rental vacancy rates will rise again in December due to a seasonal decline in rental demand, predominantly driven by students returning back home.”

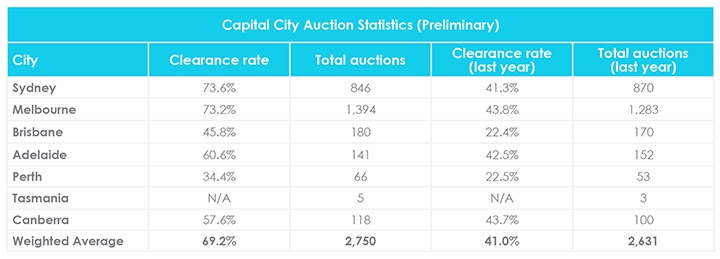

For the final week of auction reporting, 2,750 homes were taken to auction and 1,415 homes were cleared across combined capital cities, bringing the preliminary auction clearance rate to 69.2%. This drop in auction activity is usual for this time of year and isn’t expected to pick up until early February.

Auction volumes were 5.6% lower than the week prior when 2,912 homes were taken to auction with a clearance rate of 71.1%. Over the same week last year, 2,631 homes were taken to auction with a clearance rate of 41%.

Sydney yielded the highest preliminary auction clearance rate across the country at 73.6%, followed by Melbourne at 73.2%. In contrast, Perth yielded the lowest preliminary auction clearance rate at 34.4%. For further auction clearance rate information across each capital city, click here.

At the beginning of December, the Reserve Bank of Australia (RBA) kept the cash rate unchanged at 0.75% from November and October as “the Australian economy appears to have reached a gentle turning point.” Policymakers will continue to monitor the labour market and assess the impact of the three cuts delivered in 2019.

RBA Governor Philip Lowe said “The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, the upswing in housing prices and a brighter outlook for the resources sector should all support growth.“

However, the RBA has indicated that it will lower cash rates and resort to unconventional monetary policies if necessary. The next rate cut is widely predicted to occur in the first quarter of 2020 with Westpac and Commonwealth Bank economists and 18 of 22 economists polled by Bloomberg expecting the cash rate to be cut to 0.5% when the board meets in February.

The First Home Loan Deposit Scheme (FHLDS) kicked off on the 1st of January 2020 to support up to 10,000 eligible first home buyers purchase a property with as little as a 5% deposit. The Australian government will guarantee up to 15% of the property’s value and first home buyers will not be required to pay thousands for Lenders Mortgage Insurance (LMI).

The scheme is open to singles earning a taxable income of up to $125,000 per year and couples earning a taxable income of up to $200,000 per year. Additionally, property price thresholds apply and applicants must intend to be owner-occupiers. You can read more about the FHLDS here.

CoreLogic recently released their Regional Market Report which analysed 25 of Australia’s largest regions outside of capital cities. Notably, 29 of the 50 markets analysed have seen values rise over the 12 months to October with houses outperforming units.

16 regions saw a rise in house values and nine regions saw a decline in house values over the 12 months. Meanwhile, 13 regions saw a rise in unit values and 11 regions saw a decline in unit values.

The best performing house market across 25 regions was the Mackay, Isaac, Whitsunday region in Northern Queensland. It recorded an annual growth rate of 5.9%. In contrast, houses in the Illawarra region of New South Wales recorded a 5.9% decline in values.

For units, the best performing market was the Launceston and North East region of Tasmania, with a 10.7% increase in values. Conversely, units in Bunbury in Western Australia recorded the most significant decline in values.

Hopefully you enjoyed this December Property Market Update. Be sure to subscribe to our Monthly Insider below to receive email updates.

You might also be interested in the November Property Market Update, October Property Market Update and 5 Sure-Fire Ways to Improve Tenant Relations.

Did we miss anything in this December Property Market Update? Email us at [email protected] to let us know.