September 27th, 2019

September property market update (2019)

Industry News

Industry News

In October, the Morrison Government announced price caps for the first-home buyer deposit scheme, the cash rate was lowered to 0.75%, vacancy rates declined marginally and auction activity surged pre-Melbourne Cup.

Without further ado, here’s this month’s October property market update:

In October, the national asking price for houses and units fell by 0.1% respectively, compared to the month prior. Across capital cities, the asking price for houses decreased by 0.7% and increased by 0.3% for units. Hobart showed the strongest signs of growth with a 1.3% increase for houses and a 4.8% increase for units. Conversely, Darwin’s house prices declined 0.4% for houses and 8.6% for units.

Year on year, this reflects an increase in property prices nationwide and a decline in property prices across capital cities. Further price breakdowns can be found here.

Moreover, there was a 6.9% decrease in residential property listings nationwide in September. Hobart recorded the largest decline with a 6.4% decrease in stock, followed by Melbourne and Perth (5.8% decrease) and Sydney (5.7% decrease). Compared to the year prior, Sydney’s listings declined a whopping 20.4% while Perth and Darwin both recorded a 9% decrease.

Managing Director of SQM Research Louis Christopher said “September’s decline in listings was an abnormal result. Listings normally rise for the first month of the spring selling season. New listings did rise. It’s just that older listings recorded a large decline. It suggests stock is being absorbed at a quicker rate.”

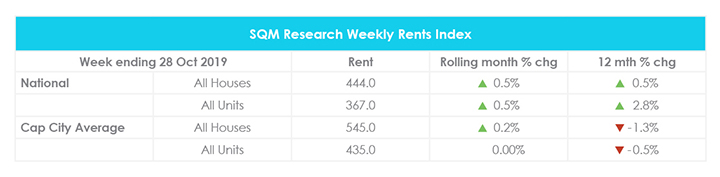

For the week ending 28 October 2019, the average weekly rent for houses and units increased by 0.5% nationwide to $444 and $367 respectively. Meanwhile, the average weekly rent across capital cities rose by 0.2% to $545 for houses and held steady at $435 for units.

Compared to the year prior, national weekly rents have increased by 0.5% for houses and 2.8% for units. Conversely, capital city weekly rents are 1.3% lower for houses and 0.5% lower for units.

Canberra showed the strongest signs of growth with a 1.5% increase for houses and a 0.4% increase for units. Meanwhile, Darwin led the decline in weekly rents with a 3.4% decrease for houses and 1.2% decrease for units. Further price breakdowns can be found here.

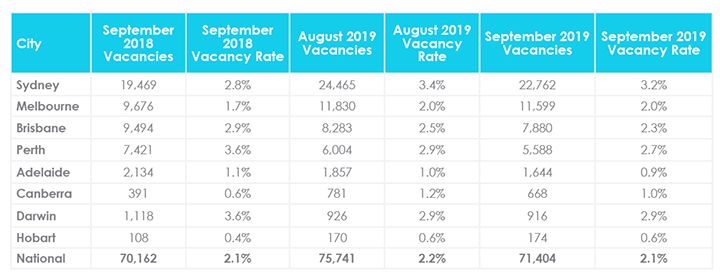

According to SQM Research, there were 71,404 properties sitting vacant Australia-wide in September, down from 75,741 properties in August. This brings the national residential vacancy rate down to 2.1% from 2.2% in August, which is the same vacancy rate that was recorded in September last year.

Across capital cities, Sydney, Brisbane, Perth, Adelaide and Canberra all recorded a slight decline compared to the month prior. Meanwhile, vacancy rates remained steady in Melbourne, Darwin and Hobart.

While Sydney’s vacancy rate dropped from 3.4% in August to 3.2% in September, it remains the highest in the country and is up from 2.8% the year prior. This is followed by Darwin at 2.9% then Perth at 2.7%. In contrast, Hobart continues to maintain the lowest vacancy rate nationwide at 0.6%. Further vacancy rate breakdowns can be found here.

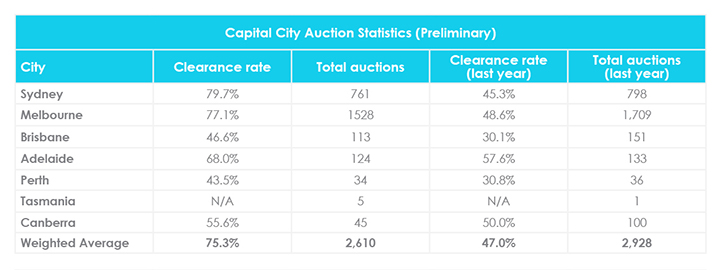

For the week ending 27 October 2019, 2,610 homes were taken to auction and 1,497 homes were cleared across combined capital cities, bringing the preliminary auction clearance rate to 75.3%.

This surge in activity is typical the weekend before Melbourne Cup and represents the busiest week for auctions since early December 2018. However, volumes are still lower than the same period last year when 2,928 homes were taken to auction with a clearance rate of 47%.

Sydney yielded the highest preliminary auction clearance rate across the country at 79.7% with Melbourne following closely behind at 77.1%. Melbourne led the surge in volumes with 1,528 homes scheduled for auction. For further auction clearance rate information across each capital city, click here.

Following the release of labour force data indicating a rise in unemployment to a one-year high of 5.3% in September, the Reserve Bank of Australia (RBA) lowered the cash rate by 25 basis points to 0.75% at the beginning of October to stimulate economic activity and reduce unemployment.

RBA Governor Philip Lowe told Property Observer that the recent cash rate cuts are working as the unemployment rate dropped from 5.3% to 5.2% by mid October. He said that “low interest rates are supporting jobs and overall income growth”. However, “at the same time, though, we recognise that monetary policy is not working in exactly the same way that it used to.”

The Australian Broadcasting Corporation (ABC) reports that the chance of another rate cut in early November is now priced at 10%. Meanwhile, the Australian Financial Review’s (AFR) economist survey for the September quarter predicts that the cash rate will fall to 0.5% by June 2020. Notably, AMP Capital economist Shane Oliver and NAB economist Kaixin Owyong expect the cash rate to fall to 0.5% by the end of 2019.

Additionally, in his most recent speech in Canberra, Dr Lowe said that “It is extraordinarily unlikely that we will see negative interest rates in Australia“ and urged businesses to take advantage of the historically low interest rates now.

In a speech at the CFA Societies Australia Investment Conference, RBA Deputy Governor Guy Debelle said that “There is a sizeable downturn in construction underway. Contacts in the Bank’s liaison program indicate that demand for new houses and apartments has remained around the low levels of late 2018.”

Dr Debelle noted that residential construction activity has declined by 9% since September 2018 and building approvals were approximately 40% lower than their peak in late 2017.

“We are forecasting a further 7 per cent decline in dwelling investment over the next year and there is some risk the decline could be even larger.”

This is concerning considering the flow on effects the downturn in housing construction will have on the broader economy. While the residential construction sector accounts for approximately 2% of total employment, 5.8% of employment is closely related to the residential construction sector.

One of Australia’s biggest banks, National Australia Bank (NAB), has announced that they will be committing $2 billion over three years to support affordable and social housing initiatives.

Launch Housing, one of Victoria’s largest homelessness and housing support service providers, will be benefiting from NAB’s initiative. It is projected that the not-for-profit will have completed 57 “tiny homes” to create affordable accommodation for at-risk and low income people by June next year.

Meanwhile, the Morrison Government has announced price caps for the first-home buyer deposit scheme which is due to kick off in January next year. The scheme will allow up to 10,000 eligible buyers to enter the property market with a 5% deposit.

Price caps for the scheme differ by state and area. For example, there is a price cap of $700,000 on houses in Sydney and $600,000 on houses in Melbourne. If you’re purchasing outside of capital cities or large regional centres, the price cap is lower.

Housing Minister Michael Sukkar says that there’s no set number of deposit guarantees per state. However, applicants must have earned less than $125,000 in the previous financial year as a single or $200,000 as a couple.

Hopefully you enjoyed this October Property Market Update. Be sure to subscribe to our Monthly Insider below to receive email updates.

You might also be interested in the September Property Market Update, August Property Market Update and The Ultimate Guide to Leasing in a Slow Market.

Did we miss anything in this October Property Market Update? Email us at [email protected] to let us know.