In June, the national vacancy rate decreased to 2.5% while CBD vacancy rates continued to blow out, the unemployment rate rose to 7.1% and the mortgage rate wars escalated.

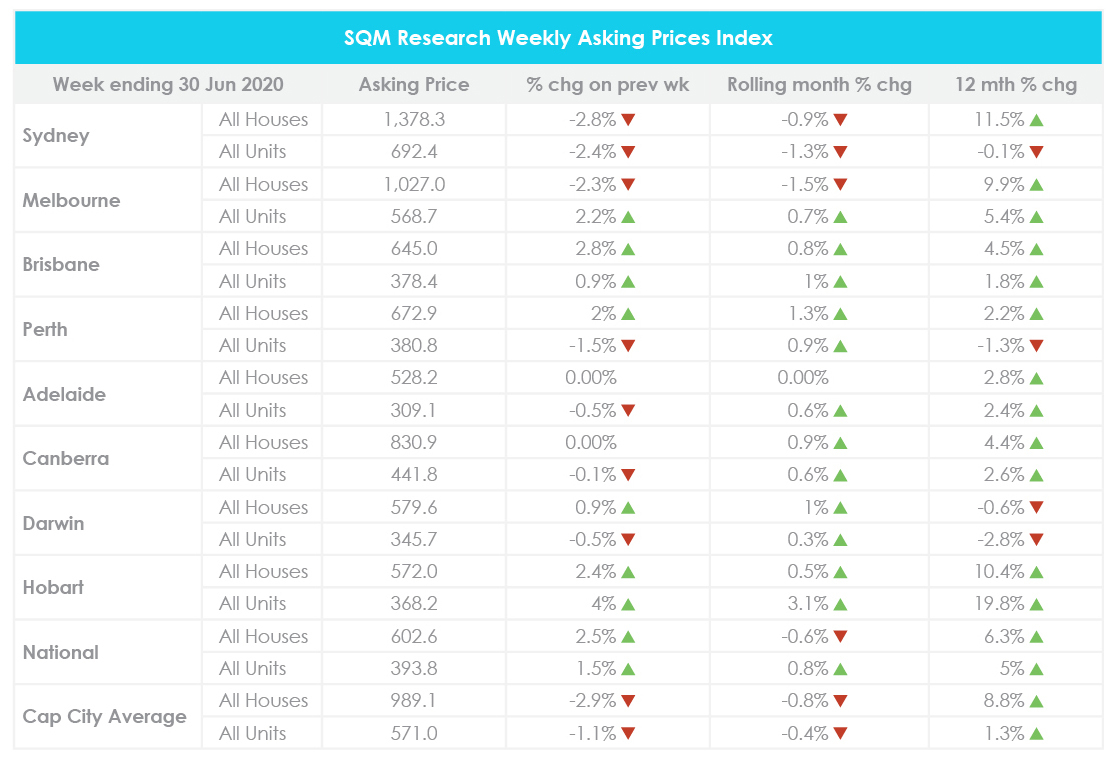

Property prices

For the week ending 30 June 2020, the national asking price increased by 2.5% for houses and 1.5% for units, compared to the week prior. Across capital cities, property prices decreased by 2.9% for houses and by 1.1% for units.

Month on month, the national asking price fell by 0.6% for houses and rose by 0.8% for units. Most capital cities recorded an increase in values across the board while Sydney recorded an overall decline and Melbourne recorded mixed results.

Year on year, this reflects a 6.3% increase in house prices nationwide and a 5% increase in unit prices nationwide. Across capital cities, this reflects a 8.8% increase in house prices and a 1.3% increase in unit prices. Further price breakdowns can be found here.

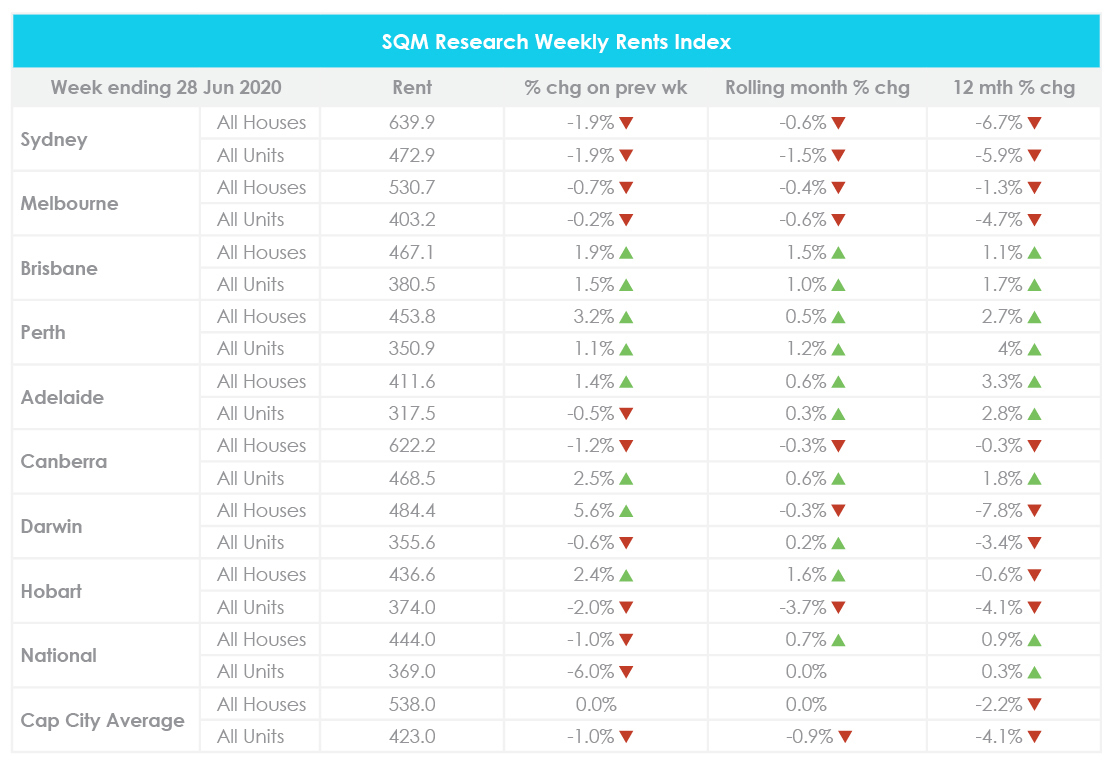

Rental values

For the week ending 28 June 2020, the average weekly rent across Australia decreased by 1% to $444 for houses and decreased by 6% to $369 for units, compared to the week prior.

Compared to May, the national weekly rent rose by 0.7% for houses and held steady for units. Sydney and Melbourne recorded overall declines in weekly rents while Brisbane, Perth and Adelaide recorded overall increases.

Year on year, national weekly rents have increased by 0.9% for houses and 0.3% for units. Meanwhile, capital city weekly rents have decreased by 2.2% for houses and by 4.1% for units. Further price breakdowns can be found here.

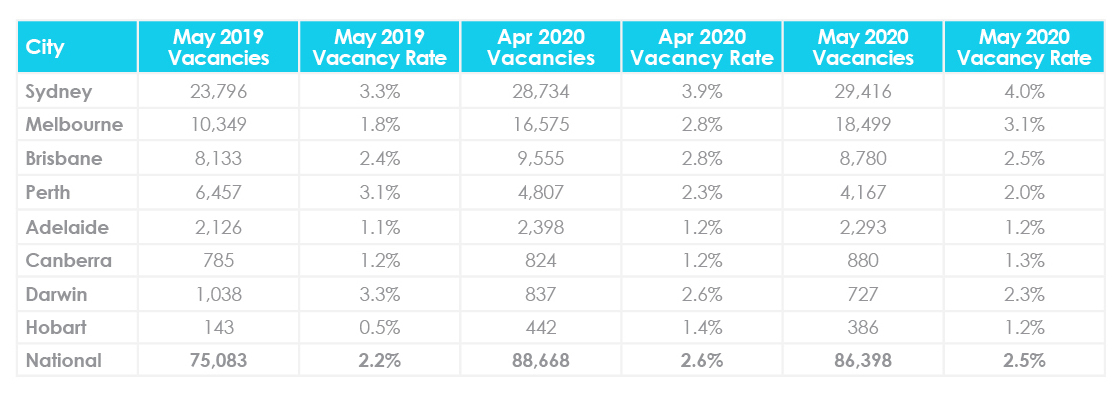

Vacancy rates

The national vacancy rate decreased from 2.6% in April to 2.5% in May with 86,398 vacant residential properties Australia-wide. Sydney recorded the highest vacancy rate nationwide at 4%, making it the highest rate on record since 2005. In contrast, Hobart and Perth recorded the lowest vacancy rates nationwide at 1.2%.

Compared to the month prior, vacancy rates increased in Sydney, Melbourne and Canberra. Conversely, vacancy rates decreased in Brisbane, Perth, Darwin and Hobart and held steady in Adelaide.

Year on year, the national vacancy rate is 0.3% higher than the 2.2% vacancy rate recorded for May 2019. Across capital cities, almost all cities recorded a higher vacancy rate with the exception of Perth and Darwin. Further vacancy rate breakdowns can be found here.

In May, CBD vacancy rates continued to blow out. Sydney CBD recorded a vacancy rate of 16.2%, up from 13.8% in April. Meanwhile, Brisbane CBD increased to 13.3% and Melbourne CBD increased to 9.3%. Furthermore, Melbourne Southbank recorded a vacancy rate of 16.8% and Sydney’s Palm Beach recorded a vacancy rate of 16.7%.

SQM Research Managing Director Louis Christopher said, “After the results for May, we may now be hitting a short-term peak in vacancies. Weekly rental listings suggest a slight decline in supply for the first half of June.”

“I think what is happening here is Airbnb property owners have now pulled back from listing long term and are now waiting this time out in the hope that the borders will be open shortly.”

“However, with an expected 170,000 dwelling completions for this year and still no imminent opening of the international border, I still think rental vacancy rates are going to remain elevated for 2020.”

“While First Home buyer grants may assist in soaking up some of the new supply, let’s just remember the bulk of underlying demand growth in recent years has come from net migration. Also note that many First Home Buyers are tenants.”

Auction clearance rates

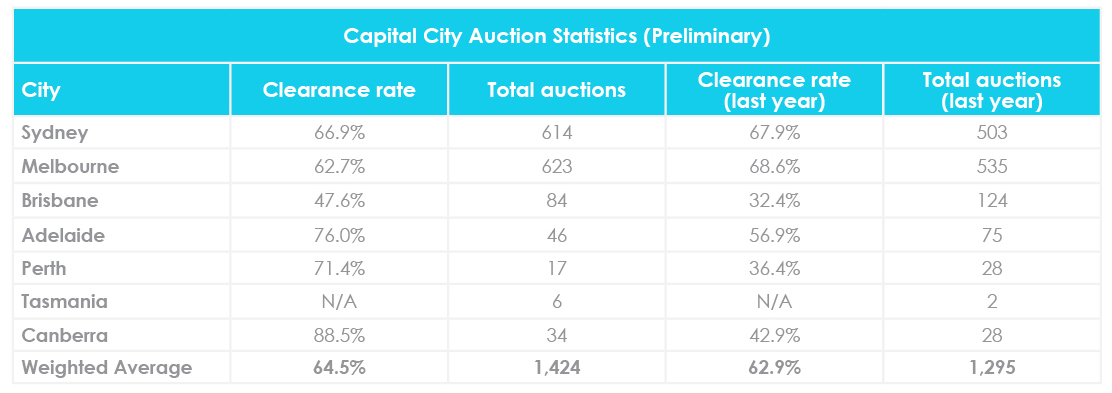

For the week ending 28 June 2020, there were 1,424 homes scheduled for auction across capital cities, returning a preliminary clearance rate of 64.5%. Despite recording the highest auction volume in nine weeks, auction clearance rates have held strong, reflecting an increase in seller confidence.

The week prior, 1,251 homes were scheduled for auction with a final clearance rate of 59.6%. Meanwhile, the same period last year saw 1,295 homes taken to auction with a final clearance rate of 62.9%.

Across capital cities, Canberra recorded the highest clearance rate at 88.5%. This was followed by Adelaide at 76% and Perth at 71.4%. In contrast, Brisbane recorded the lowest clearance rate at 47.6%. For further auction clearance rate information across each capital city, click here.

Cash rate and predictions

The Reserve Bank of Australia (RBA) kept the cash rate unchanged at 0.25% at the beginning of June in response to the global economic downturn and sharp rise in unemployment.

According to the meeting minutes, “Members recognised that the Australian economy was experiencing the biggest economic contraction since the 1930s. A very large number of people had lost their jobs or were working zero hours, household spending had weakened considerably and some investment was being deferred or had been cancelled.”

“Notwithstanding these developments, it was possible that the downturn would be shallower than earlier expected. The rate of new infections had declined significantly and some restrictions had been eased earlier than had previously been thought likely. However, the outlook remained highly uncertain and the pandemic was likely to have long-lasting effects on the economy.”

With interest rates at the effective lower bound, the RBA has undertaken quantitative easing by purchasing more than $40 billion of government bonds. This move is designed to create more money and boost liquidity in the system.

RBA Deputy Governor Guy Debelle told The Guardian, “While the bond purchases by the RBA increase liquidity in the system, I do not see this posing any risk of generating excessively high inflation in the foreseeable future.”

The next RBA board meeting will be held on the 7th of July. However, RBA Governor Phillip Lowe previously ruled out the possibility of moving towards negative interest rates and experts from NAB and Westpac expect the cash rate to remain at 0.25% throughout 2020.

Labour market

Recent Australian Bureau of Statistics (ABS) figures show that almost 1 million Australians are now unemployed, bringing the unemployment rate to 7.1% in May—the highest level in nearly two decades.

Speaking at the Bloomberg Invest Global virtual event, Treasurer Josh Frydenberg said that more than 800,000 jobs have been lost since the beginning of March.

“Unemployment will get higher in the coming months, we are forecasting 8% for the September quarter but there are also more people coming back to the workforce as restrictions are eased which is a good thing.”

Additionally, the participation rate slumped to 62.9% in May, the lowest level since January 2001. If the number of people actively looking for and available for work had not declined, the unemployment rate would be much higher than 7.1%.

ABS Head of Labour Statistics Bjorn Jarvis said, “The ABS estimates that a combined group of around 2.3 million people—around one-in-five employed people—were affected by either job loss between April and May or had less hours than usual for economic reasons in May.”

Mortgage rate wars

While the cash rate remains on hold at a record low of 0.25%, major banks and non-bank lenders are slashing variable and fixed rates in a battle for new customers.

Data from financial comparison website RateCity revealed that more than 330 fixed home loan rates and almost 160 variable rates have been cut since the beginning of May.

More recently, NAB has dropped its lowest-advertised variable rate to 2.69% to match Westpac’s lowest-advertised variable rate. All eyes are now on CBA and ANZ to see if they will reduce their variable rates from 2.79% and 2.72% to match that of NAB and Westpac.

On the non-bank lender front, Freedom Lend is offering a record low variable rate of 2.17%. However, new customers must have a deposit of 30% or more. This is followed by Reduce Home Loans with a variable rate of 2.19%.

RateCity Research Director Sally Tindall said, “Over the last couple of months, smaller providers have had to chip away at their rates in order to stay ahead of the big banks.”

“With the number of new home loans on the decline, lenders desperately need new business so they’re looking to refinancers to make up the difference.”

“The recent increase in refinancing activity suggests rock bottom rates are prompting people to switch to take advantage of the relentless market competition.”

Hopefully you enjoyed this June Property Market Update. Be sure to subscribe to our Monthly Insider below to receive email updates.

You might also be interested in:

Let us know your thoughts on this month’s June property market update by emailing [email protected].