February 2nd, 2022

January property market update (2022)

Industry News

Industry News

Over the past month, rental vacancy rates hit a 16-year low of 1.3% while rents in capital cities rose by 7.5%. National asking rents grew by 0.7% for homes to $560 per week, and 1.9% for units, reaching $424 a week. Asking prices Australia-wide grew by 1.8% for homes and 3.6% for units.

Over the past month, rental vacancy rates hit a 16-year low of 1.3% while capital city market rents rose by 7.5%.

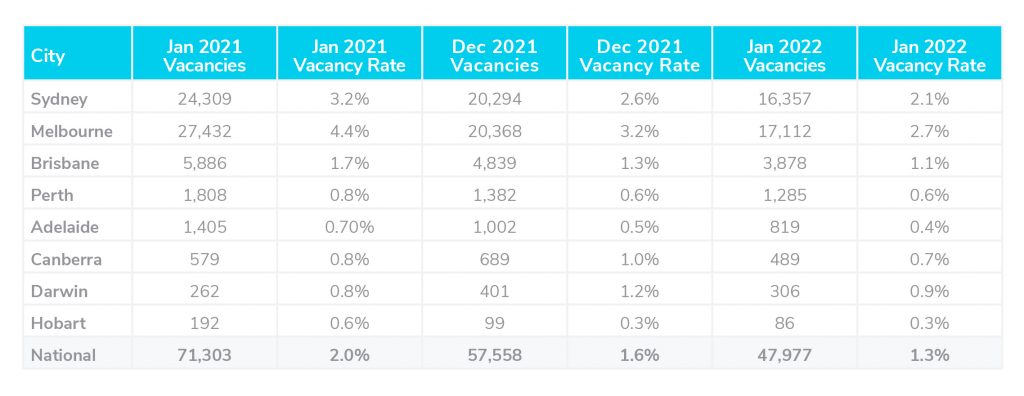

Across Australia, the total number of vacancies was reported at 47,977 on January 15th for residential properties. This is a drop from the 57,558 vacancies reported in December.

Across Melbourne, Sydney and Brisbane, there was a drop in vacancy rates from 3.2%, 2.6%, and 1.3% to 2.7%, 2.1%, and 1.1%. Vacancy rates in capital cities have now levelled out to the standard long-term averages which were seen as a standard before the COVID-19 outbreak. Sydney CBD and Melbourne CBD also saw a drop in vacancy rates to 4.5% and 4%. It is predicted there will be further drops in vacancy rates in the CBDs as the international border reopens alongside an uptake in employees returning to offices. Vacancy rates sat below 1.0% in Canberra, Adelaide, Perth, Hobart, and Darwin.

Louis Christopher, Managing Director of SQM Research said, “We were expecting a drop in rental vacancies over January due to seasonality, however, the drops were larger than expected. And worse for tenants, the weekly rental listings in February to date have fallen further for our two largest capital cities.”

Over February, national asking rents grew by 0.7% for homes to $560 per week, and 1.9% for units, reaching $424 a week.

During this same period, rents increased by 1.8% for homes and 1.6% for units in capital cities. With prices sitting at $622 for homes and $442 for units on average. Compared to the previous year, rents across all capital cities rose by 7.5%. This pricing growth is expected to surge over the year due to “an acute shortage of rental properties” as Louis Christopher has pointed out.

Louis Christopher noted, “the shortage has already been translating into large surges in weekly rents across the country. It is now very likely market rents will rise by over ten per cent this year. Indeed, it could actually be much more than this as we are recording a rise in capital city combined rents of 5.2% just in the last 90 days. As such there are major ramifications for core and headline inflation.”

Throughout February, asking prices Australia-wide grew by 1.8% for homes and 3.6% for units. In capital cities, prices rose by 0.9% for homes and 1.3% for units.

Compared to the same time last year, house prices have seen an increase of 22.5% and 13.6% for units. In capital cities, prices rose by 22.1% for homes over the year with particularly significant increases in Sydney, Brisbane, Adelaide, and Canberra. For unit prices during the same period, there was an increase of 5.5% however this was affected by an oversupply of units in inner-city Melbourne which capped price growth for the city.

Louis Christopher stated, “However, the national housing market appears to remain reasonably buoyant. Overall, supply remains below long-term averages and we are still recording capital city rises in asking prices. Yes, there is a slowdown occurring in some of our capital cities, however, it is proving to be a soft landing at this stage.”

The Reserve Bank has left the official cash rate at a record low of 0.1% however has suggested interest rates are likely to rise sooner than the previously anticipated 2024.