During the previous month, the national residential property rental vacancy rates sat at a 10 year low of 1.6%. While national asking rents rose 1.7% for houses to $548 per week and units rose by 0.5% to $413 a week over the month to 28 November 2021.

When it comes to dwelling prices, SQM Research predicts a sharp slowdown in pricing from the 20%-plus growth seen in the last two years.

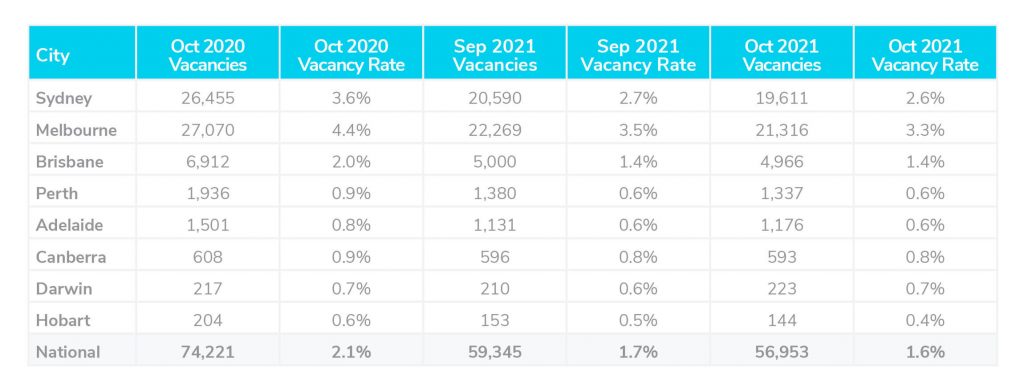

Vacancy rates

Over October, the national residential property rental vacancy rates sat at a 10 year low of 1.6%. The total number of vacancies sat at 56,953 on the 12th of November 2021, down by 2,392 since the end of October.

Vacancy rates in Melbourne, Hobart and Sydney dropped from 3.5%, 0.5% and 2.7% in September, to 3.3%, 0.4% and 2.6% in October. Across Adelaide, Canberra, Brisbane and Perth, the vacancy rate remained under 1.0%. The vacancy rate in both Melbourne and Sydney CBD sat quite high compared to historical averages but saw a slight drop, lowering to 8% and 7.5% respectively.

Louis Christopher, Managing Director of SQM Research said:

“The last time we recorded national vacancy rates this low was March 2011. Other capital cities were largely steady and that was also the case for a number of the regional townships, albeit regional Australia really has not much room to fall lower. Indeed a number of regional towns are now recording no vacancies whatsoever.”

Rental values

Over the month to 28 November 2021, national asking rents rose 1.7% for houses to $548 per week and units rose by 0.5% to $413 a week. Capital city rents rose by a considerable 2.4% for houses, reaching an average rental value of $596 per week. While units in capital cities saw rents grow by 0.5% standing at $426 per week. Compared to the same period in the previous year, capital city house rents have grown by 11.2% and units have grown 4.4%. The biggest increase in rents compared to the previous year was seen in Darwin, with a growth of 19.2% in rents for units, standing at $456.3 per week.

The highest increase in rents over the month was seen in houses in Darwin followed by Sydney, with a 4.3% and 3.2% increase respectively.

Property prices

Over the past 2 years, Australia has seen immense growth in property prices. SQM Research predicts that this is all going to change in 2022.

The team at SQM predict that during the first half of 2022 Australian capital city residential property prices will see a peak. However, there is likely to be a sudden slowing in price growth as soon as mid-2022 primarily due to the anticipated intervention from the banking regulator. Further interventions will be made to limit home lending, according to the Housing Boom and Bust Report 2022, released by SWM Research.

The report highlights one primary forecast, being a sharp slowdown in pricing from the existing over 20% growth seen in the last 2 years.

It is expected that Brisbane will experience the greatest growth in prices over 2022 at an 8% to 14% increase. This rise is driven by the anticipated steady migration from other states such as Sydney and Melbourne. Migration will primarily be propelled by factors such as better housing affordability compared to Sydney and Melbourne CBDs. Nevertheless, this growth will still appear slow compared to the 2021 increases.

From mid-2022 it is expected that Sydney and Melbourne will note a drop in house prices due to the intervention by APRA to balance the property market, similar to the intervention which ran in 2017. Both cities are the most vulnerable to any actions which come out of home lending restrictions. There may also be an interesting flip in the market where unit price growth could overcome house price growth in 2022 within Sydney and Melbourne. This prediction is based on the fact that houses are quite overvalued while apartments remain relatively affordable in comparison. Apartments may also be in greater demand once overseas travel and migration resume.

Louis Christopher, Managing Director of SQM Research said: “If the Australian housing market does not slowdown by mid-2022, APRA will likely keep intervening in home lending until the market does slow down. We cannot afford another year of 20%-plus gains across the national housing market. And so, to ensure a soft landing for the market, it is best we see additional intervention sooner rather than later to reign in property valuations.”

Cash rate and predictions

The Reserve Bank has left the official cash rate at a record low of 0.1% however has suggested interest rates are likely to rise sooner than the previously anticipated 2024.