November 5th, 2020

October property market update (2020)

Industry News

Industry News

Property prices are forecast to rise in 2021, the RBA held the cash rate at 0.1% and capital city rents are expected to drop for years before bouncing back according to NHFIC’s State of the Nation’s Housing report.

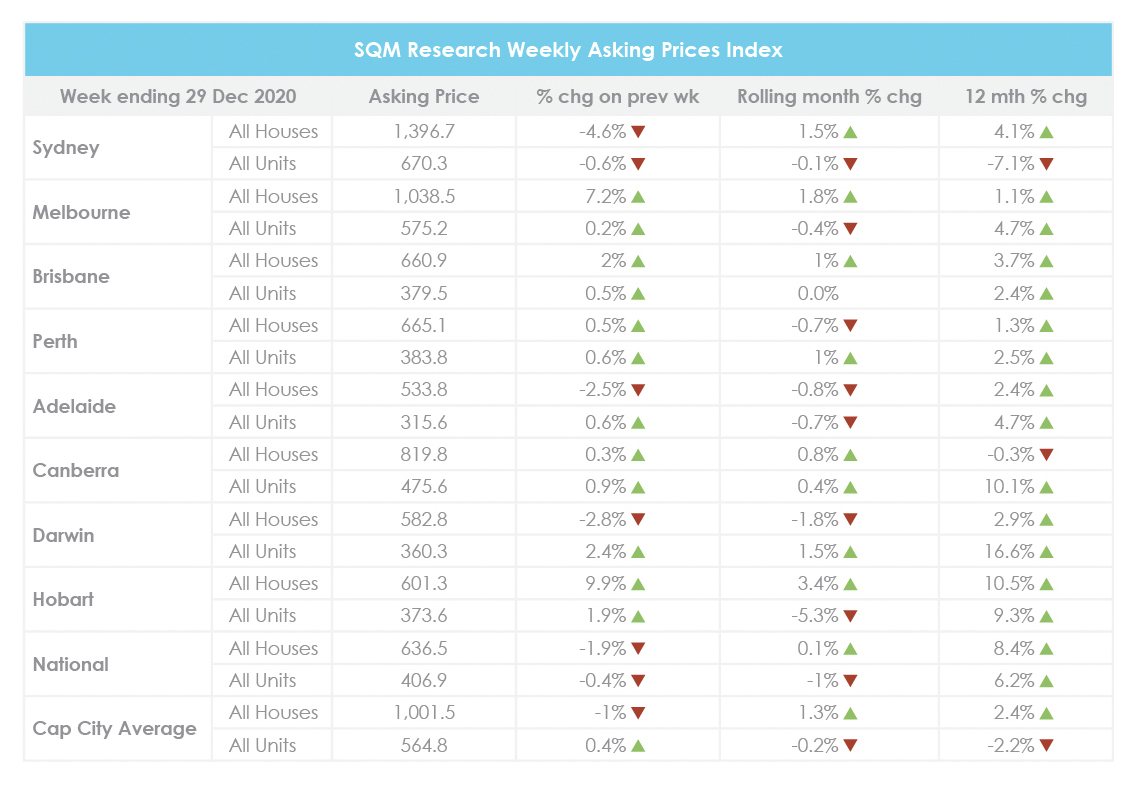

For the week ending 29 December 2020, national property prices decreased by 1.9% for houses and by 0.4% for units, compared to the week prior. Across capital cities, the asking price decreased by 1% for houses and increased by 0.4% for units.

Month on month, national property prices increased by 0.1% for houses and declined by 1% for units. Adelaide recorded an overall decrease in house and unit prices while Canberra recorded an overall increase.

Compared to the year prior, national house prices are up 8.4% and national unit prices are up 6.2%. Across capital cities, this reflects a 2.4% increase in house prices and 2.2% decline in unit prices. Further price breakdowns can be found here.

According to the Housing Boom and Bust Report 2021, Australian capital city property prices will rise between 5% to 9% in the base case forecast for 2021 as a result of “aggressive government stimulus, interest rate cuts and the upcoming changes to responsible lending laws.”

SQM Research Managing Director Louis Christopher said, “As 2020 draws to a close, the national housing market has responded to the unprecedented economic stimulus packages as well as record low lending rates. Auction clearance rates have lifted since mid-year and various dwelling price measurements have started to record price rises. It is likely that the housing market will gain further momentum on the back of increased investor activity, especially from those who seek some sort of income yield.”

“However, we have some misgivings on the longer-term consequences of these new stimulatory policies. If housing is regarded as an asset class that is not allowed to fall, Australia could have some rather serious social issues surrounding home ownership rates over the long term. In the meantime, risks have risen that this new recovery will be one of the more speculative rises seen in some time. Let’s keep in mind unemployment remains elevated and net migration is expected to be negative next year. We have a surplus of inner-city units in our two largest cities. And if there was another negative macro event in 2021, there is not much room left to cut lending rates further.”

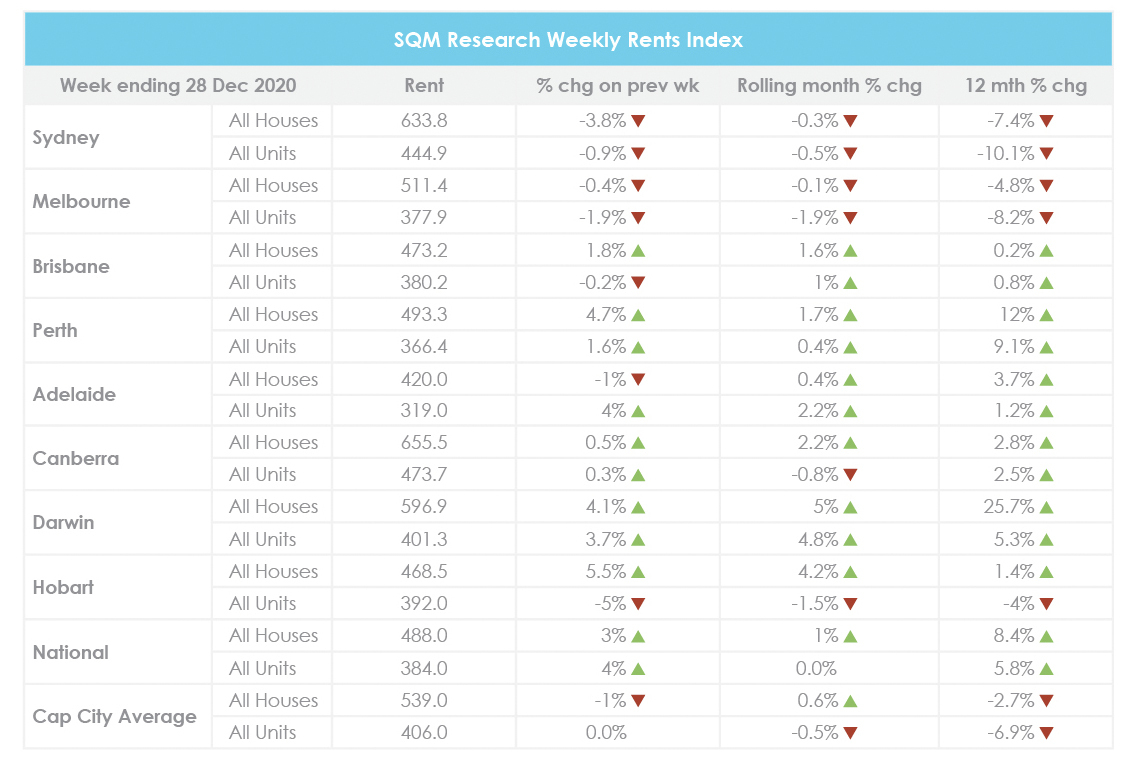

For the week ending 28 December 2020, the average weekly rent across Australia rose by 3% to $488 for houses and by 4% to $384 for units, compared to the week prior.

Across capital cities, the average weekly rent decreased by 1% to $539 and remained stable at $406 for units. Canberra recorded the highest average weekly rent for houses at $655.50 and for units at $473.70. Conversely, Adelaide recorded the lowest weekly rent for houses at $420 and for units at $319.

Compared to the month prior, the national weekly rent increased by 1% for houses and remained unchanged for units. Most cities recorded overall increases in weekly rents while Sydney and Melbourne recorded overall declines. Meanwhile, Hobart and Canberra recorded mixed results.

Year on year, national weekly rents have increased by 8.4% for houses and by 5.8% for units. Across capital cities, weekly rents have decreased by 2.7% for houses and by 6.9% for units. Further price breakdowns can be found here.

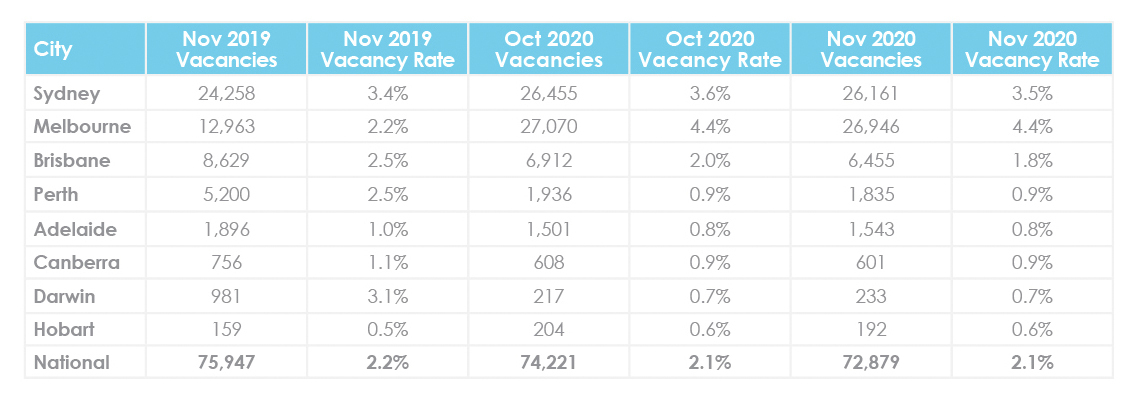

The national residential vacancy rate remained unchanged from October to November at 2.1%. There are now 72,879 vacant residential properties Australia-wide.

Month on month, vacancy rates held steady across most capital cities, with the exception of Sydney and Brisbane where minor decreases were recorded. Melbourne’s vacancy rate remained the highest nationwide at 4.4% while Hobart’s vacancy rate remained the lowest at 0.6%.

Compared to November 2019, the national vacancy rate decreased marginally from 2.2% to 2.1%. Most capital cities recorded a decline in vacancy rates with the exception of Sydney, Melbourne and Hobart where vacancy rates increased. Further vacancy rate breakdowns can be found here.

While Melbourne and Sydney CBD vacancy rates have declined from record-highs, they remain elevated at 9.1% and 9.5% respectively. As of early December, there are 2,030 vacant units in Melbourne CBD and 705 vacant units in Sydney CBD.

SQM Research Managing Director Louis Christopher said, “Rents for units in our two largest cities are still falling, though I note there appears to be a commencement of a reversal in the abundance of listings in the CBD’s of these two cities. They are still very elevated. But we could be starting to see some of the population moving back to the CBD and inner city locations.”

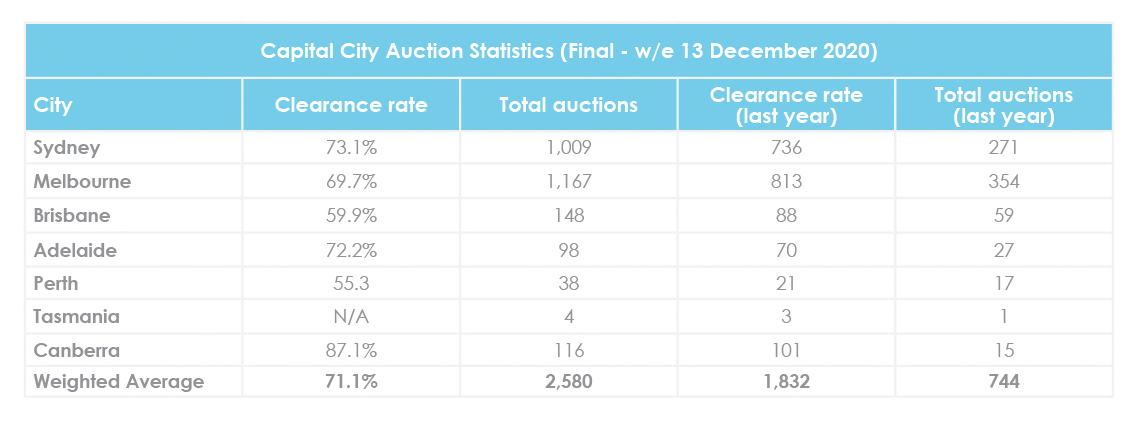

For the week ending 13 December 2020, 2,580 homes were taken to auction across capital cities, making it the busiest week for auctions since early April. This returned a final auction clearance rate of 71.1%.

The week prior, 2,085 homes were taken to auction with a clearance rate of 69.9%. One year ago, 2,804 homes were taken to auction with a final clearance rate of 64.9%.

Historically, auction activity slows down before Christmas, but the week ending 18 December 2020 saw 2,347 homes scheduled for auction. In comparison, the same week last year saw only 909 homes taken to auction across capital cities.

Across capital cities, Canberra recorded the highest clearance rate at 87.1%. This was followed by Sydney at 73.1%, Adelaide at 72.2% and Melbourne at 69.7%. For further auction clearance rate information across each capital city, click here.

At its December board meeting, the RBA kept the cash rate unchanged at 0.1% due to the uncertainty of the pandemic and its impact on the global economy. The next monetary policy meeting is scheduled for 2 February 2021.

Bloomberg Economics predicts that the record-low cash rate of 0.1% will be held till the end of 2021. This prediction is echoed by FocusEconomics panelists and NAB economists.

Bloomberg Economics Australia and New Zealand economist James McIntyre said, “The Reserve Bank of Australia took the plunge into asset purchases and yield curve control in 2020. In 2021, it’s likely to fine tune policy, with further easing via adjustments to bond buying rather than a lower cash rate. One aim will be to curb currency appreciation — at the cost of fueling asset inflation. The reinstatement of macro-prudential policy restraints may complement efforts directed at boosting domestic demand and absorbing labor market slack.”

The National Housing Finance and Investment Corporation (NHFIC) has just released the State of the Nation’s Housing 2020 report. The report revealed the impact of COVID-19 on population growth and its projected impact on the real estate market for the next five years.

Key findings include:

Hopefully you enjoyed this December Property Market Update. Be sure to subscribe to our Monthly Insider below to receive email updates.

You might also be interested in:

Let us know your thoughts on this month’s December property market update by emailing [email protected].