September 5th, 2025

August property market update (2025)

Industry News

Industry News

Australia’s rental vacancy rate didn’t budge in August, sitting at 1.2%, according to the latest data from SQM Research. There were 37,742 vacant properties across the country, only 121 fewer than in July. It paints a fairly steady picture of the market, with just small changes showing up across the capital cities. Overall, renters still face tough competition for homes in every capital city.

The smaller capitals are the most competitive for renters, with Hobart and Darwin holding the shared title for tightest rental market in the country.

Among the capitals with vacancy rates above 1%, the results were mixed.

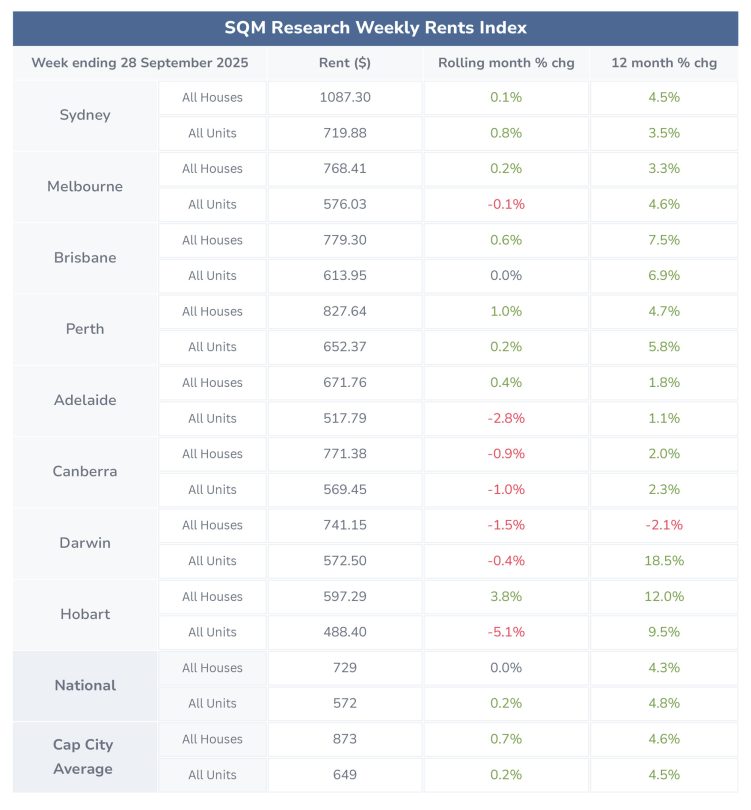

Nationally, advertised weekly rents for units grew faster than house rents in the 30 days to 28 September 2025.

Across the capital cities, growth was slightly stronger:

The strongest lift was seen in Hobart houses, which jumped by 3.8% in the month.

Louis Christopher, Managing Director of SQM Research, said the data suggested “ongoing shortages in rental supply across most capital cities”.

But rents didn’t go up in every city in the past month, with Hobart units seeing the biggest drop of -5.1% to $488.

National asking prices continued to rise in the week ending 30 September 2025, suggesting strong confidence among sellers.

In the latest monthly results, Brisbane and Adelaide stood out as the two strongest capital city markets.

On a yearly basis, Darwin, Brisbane and Adelaide recorded double-digit price growth across both house and unit markets.

But not all markets moved upward.

Mr Christopher said: “Vendor confidence remains firm, particularly in Brisbane, Adelaide, and Perth, where annual price growth is outpacing the national average.”

“Overall, the market is showing resilience, but affordability constraints and interest rate settings will remain key factors to watch as we head deeper into the selling season.”

The RBA Board held the cash rate at 3.60%, leaving it unchanged from the month prior. The central bank has made three rate cuts this year, slashing the rate from 4.10% in February 2025 by 75 basis points.

These rate cuts appear to be working, with the RBA noting that private spending is on the rise.

“The housing market is strengthening, a sign that recent interest rate decreases are having an effect. Credit is readily available to both households and businesses.”

Disclaimer: The information enclosed has been sourced from SQM Research and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.