September 2nd, 2025

Spring clean your portfolio with our tailored 10-week challenge!

Property Management

Industry News

Australia’s August 2025 property update: vacancy rates hit 1.2%, rents climb and house prices surge as spring market momentum builds.

Vacancy pressures showed little sign of easing in July, with the national vacancy rate edging down to 1.2%, its lowest level in more than a year (SQM Research). Just 37,863 rental properties were available nationwide, a drop from both June’s 39,027 and 39,701 a year earlier.

The squeeze is being felt most in Sydney, Brisbane and Perth where vacancies remain below 1.6%, while Melbourne and Adelaide hint at early signs of stabilisation.

For tenants, relief remains elusive as landlords hold the upper hand, with tight supply fueling competition and rental growth. With the spring leasing season around the corner, all eyes will be on whether new housing supply can ease conditions or if the pressure continues to build.

Louis Christopher, Managing Director of SQM Research said, “Vacancy rates remain tight across most capital cities, and this is continuing to place upward pressure on rents.

“While there are short-term fluctuations—particularly in Perth and Canberra—the broader trend is clear: rental affordability is deteriorating, especially in Sydney, Brisbane, and Hobart. Unless we see a meaningful uplift in rental supply, particularly in the inner and middle rings of our major cities, the market will remain challenging for tenants heading into spring.”

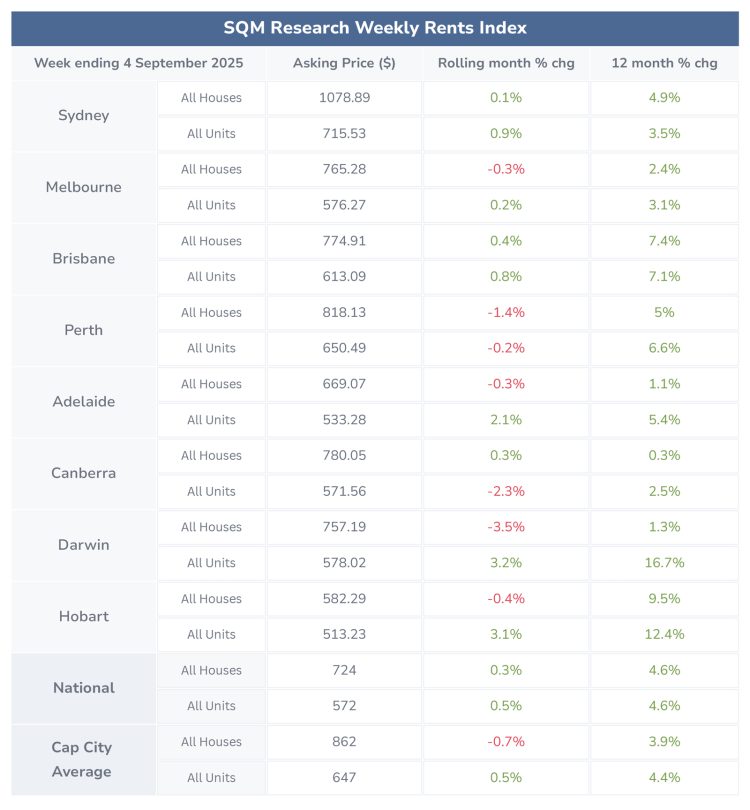

Over the past 30 days to 4 September 2025, the national median asking rents for houses increased by 0.3% and for units increased by 0.5%. Across capital city averages, the median asking rent decreased by -0.7% for houses and increased for units by 0.5%.

Compared to this time last year, all capital cities reported an increase in values, with the largest variation seen in Darwin units at 16.7%.

Average national asking prices

The average national rental asking price on 4 September 2025 was $724 for houses and $572 for units. Compared to last year, the national rental asking prices increased by 4.6% for both houses and units.

Capital city average asking prices

The capital city average rental asking price on 4 September 2025 was $862 for houses and $647 for units. Compared to last year, capital city asking prices increased by 3.9% for houses and 4.4% for units.

National asking prices surged in the week ending 2 September 2025, with momentum building across both houses and units, according to SQM Research.

Houses led the charge, climbing 2.25% in just seven days to reach a national average of $1,296,482, up 6.9% year-on-year.

Units followed closely, rising 1.53% weekly and 6.8% annually, underscoring a broad-based lift in market confidence.

While Sydney recorded the sharpest weekly jump in house prices, Melbourne, Perth, and Hobart continued their steady recovery paths. Meanwhile, weaker conditions in Brisbane, Canberra, and Darwin highlighted the uneven nature of this spring upswing, with demand shifts and buyer resistance starting to show in some capitals.

Louis Christopher, Managing Director of SQM Research said, “Overall, the market is showing signs of life, but it’s uneven. We’re not in boom territory, and vendors need to be realistic. Buyers are still discerning, and overpriced stock is sitting. The spring season will be a litmus test for sentiment and price elasticity.”

On 13 August 2025, the RBA decided to reduce the cash rate target by -0.25 points to 3.60%.

Disclaimer: The information enclosed has been sourced from SQM Research and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.