July 23rd, 2025

“A time saver”: Hear what our customers say about Automations

Case Studies

Blog

Australia’s rental and property markets show signs of seasonal adjustment, with vacancy rates edging up slightly, though experts warn the market remains tight, especially in key capitals.

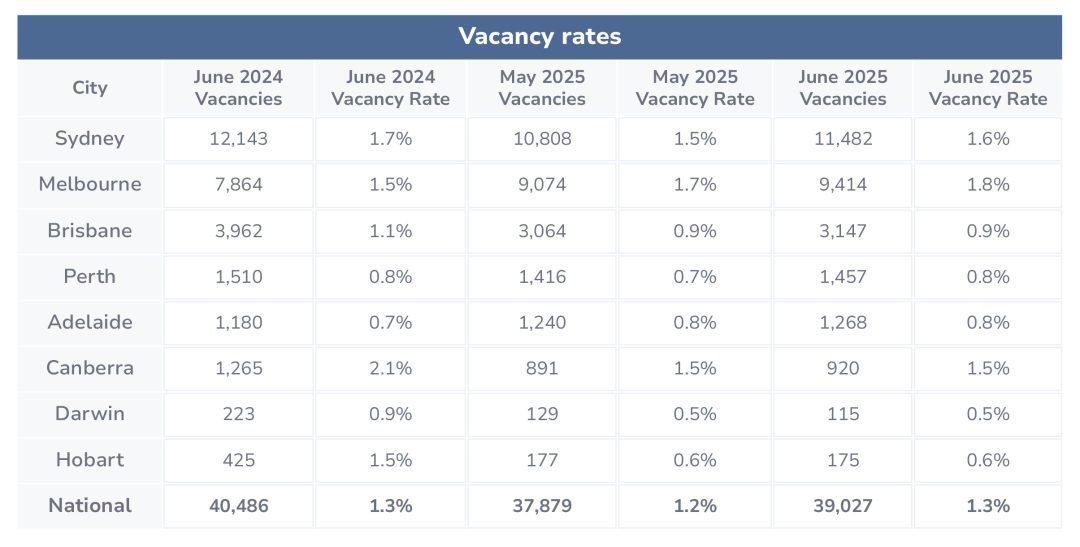

Mid-July SQM Research has reported a slight uplift in vacancy rates across June from 1.2% in May to 1.3% in June. However, the commentary from Managing Director, Louis Christopher suggests that this should not be interpreted as a market turnaround.

“Most regions still show signs of stress, and the recent spike in dwelling approvals needs to translate into physical supply before rental conditions meaningfully improve. June’s figures suggest the beginning of a seasonal rebalancing in some regions. However, we are far from a renter’s market, especially in cities like Darwin (0.5%) and Hobart (0.6%) where vacancy rates are critically low,” said Louis Christopher, Managing Director of SQM Research.”

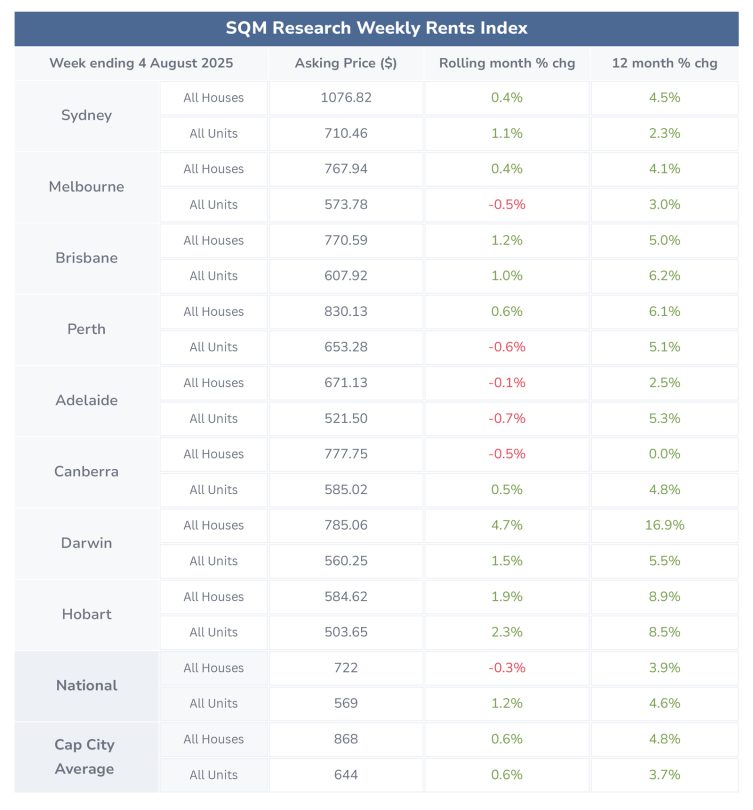

Over the past 30 days to 4 August 2025, the national median asking rents for houses decreased by –0.3% and increased for units by 1.2%. Across capital city averages, the median asking rent increased by 0.6% for houses and units.

The largest variation in values was seen in Darwin houses, with an increase of 4.7%

Compared to this time last year, all capital cities reported an increase in values, with the largest variation seen in Darwin houses at 16.9%.

Average national asking rents

The average national rental asking price on 4 August 2025 was $722 for houses and $569 for units. Compared to last year, the national rental asking prices increased by 3.9% for houses and 4.6% for units.

Capital city average asking rents

The capital city average rental asking price on 4 August 2025 was $868 for houses and $644 for units. Compared to last year, capital city asking prices increased by 4.8% for houses and 3.7% for units.

Australian property prices continued to climb in early August, with national dwelling values up 0.3% week-on-week to $918,674 (SQM Research). Houses rose 0.1% to $1,008,727, while unit prices jumped 1.4% to $592,803. Two-bedroom units saw strong growth, rising 1.1% for the week and 2.3% over the quarter. Three-bedroom houses dipped slightly by 0.1% but still posted 6.6% growth over the year.

Long-term trends remain strong, with combined dwelling prices growing at an average annual rate of 7.5% over three years and 7.8% over seven. SQM notes that balanced growth across houses and units reflects shifting buyer preferences, as affordability and lifestyle needs continue to shape demand.

Louis Christopher, Managing Director of SQM Research said, “The July decline in total listings reflects a seasonal slowdown, but what’s notable is the continued rise in older stock across key capitals. This suggests that while new listings remain subdued, turnover of existing inventory is lagging. We’re also seeing a meaningful drop in distressed listings, which points to improving financial stability among homeowners. Overall, the market appears to be in a holding pattern ahead of the spring selling season.”

On 9 July 2025, the RBA decided to hold the cash rate target at 3.85%.

Disclaimer: The information enclosed has been sourced from SQM Research and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.