May 8th, 2024

April property market update (2024)

Industry News

Industry News

Vacancy rates marginally increased in April following seasonal patterns and rental prices experienced softening in May.

Vacancy rates increased to 1.1% over the month of April with the total number of vacancies now standing at 33,177 residential properties with the easing seen across both capital cities and regional areas.

Across capital cities;

Mixed results were seen across capital city CBDs with Sydney CBD, Melbourne CBD, Brisbane CBD and Adelaide CBD all recording rises in rental vacancies, while Canberra CBD, Perth CBD, Darwin CBD and Hobart CBD recorded steady to falling vacancy rates.

Louis Christopher, Managing Director of SQM Research said, “As stated in our last update, we have recorded a slight easing in rental vacancy rates for April, but the rental crisis is still, far from over at this stage. The immediate outlook is vacancy rates are set to rise somewhat into winter. This is the normal seasonality we get at this time of year so one should be a little careful about reading into these rises. Nevertheless, it might provide some minor relief to tenants who still have excessive difficulties in finding longer term rental accommodation around the country.

“The full year outlook remains the same in that we expect overall tight vacancy rates to be with us for 2024, driven by a fall in dwelling completions relative to ongoing growing demand.”

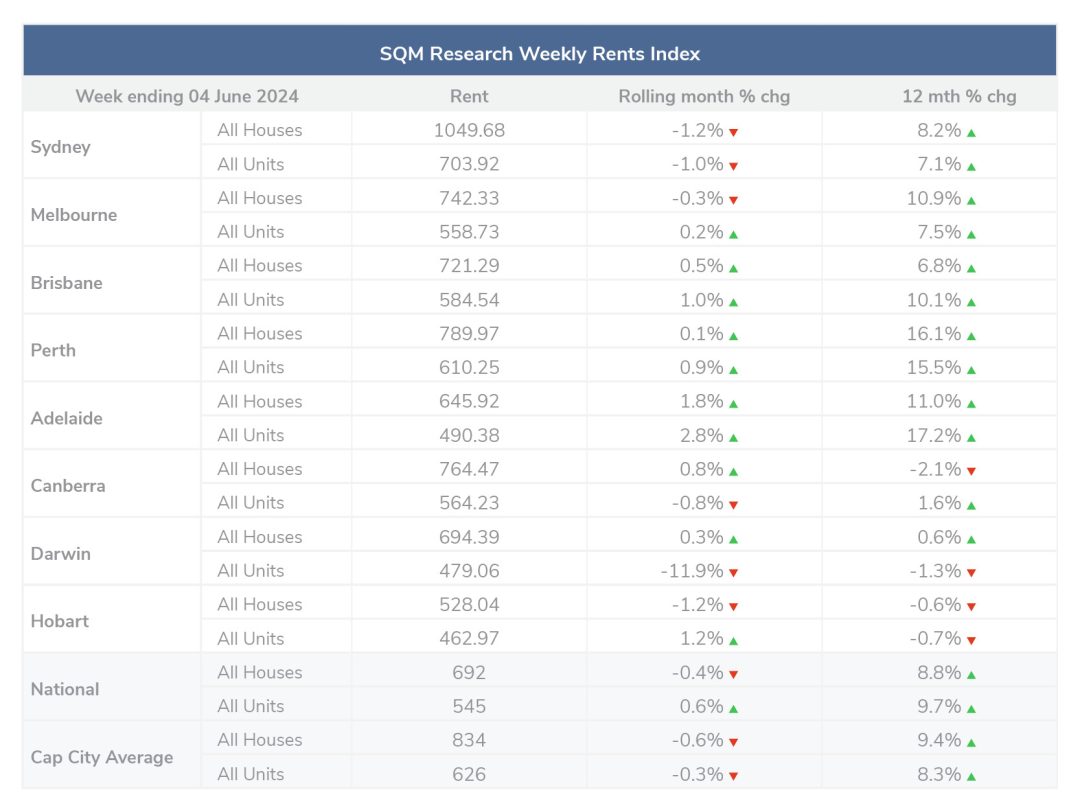

Over the past 30 days to 4 June 2024, national weekly asking prices dropped by -0.4% for houses and rose by 0.6% for units. The average national asking price is $692 for houses and $545 for units. Compared to last year, the national asking prices increased by 8.8% for houses and 9.7% for units.

Over the past 30 days to 4 June 2024, across capital cities there was an average -0.6% decrease in house prices to $834 per week and -0.3% decrease in unit prices to $626 per week. Compared to last year capital city asking prices increased by 9.4% for houses and 8.3% for units.

Mid-month, SQM Research reported a softer rise for the 30 days prior to 12th May 2024, compared to recent periods, noting “one of the slower rises in market rents since the outbreak of the national rental crisis in 2021”.

increase in listings from the holiday affected month of April. National new listings (less than 30 days) recorded a 12.4% rise in May, with 75,174 new listings entering the market.

National combined dwelling asking prices rose by 1.6%, marking an 8.9% increase compared to the same period in 2023. Brisbane and Perth stood out with significant increases of 14.7% and 18.4% respectively, across the past 12 months.

At 4 June 2024

The national median asking price for houses is $932,132, an increase of 1.5% over the past 30 days and a 9.2% increase over the past year. The national median asking price for units is $551,526, a 2.2% increase over the past 30 days and a 7.8% increase over the past year.

The capital city average asking price for houses is $1,382,044 and a unit is $681,445. Capital city average asking prices for houses increased by 0.4% over the past 30 days and 8.6% over the past year. Capital city unit prices increased by 0.9% over the past 30 days and 5.8% over the past year.

Louis Christopher, Managing Director of SQM Research said, “Total housing listings surged over the course of May, 2024 and are now up by 11.7% for the past 12 months… Asking prices also continue to rise, albeit at a moderate pace for our larger capital cities. Overall, this feels like very much like we have entered into a normal, unremarkable period for the national housing market. One that is not too hot, nor too cold.”

March saw the RBA hold the cash rate target at 4.35% stating, “Recent data indicate that, while inflation is easing, it is doing so more slowly than previously expected and it remains high. The Board expects that it will be some time yet before inflation is sustainably in the target range and will remain vigilant to upside risks. The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.”

Disclaimer: The information enclosed has been sourced from SQM Research and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.