March 25th, 2024

How PropertyMe can help prevent burnout

Property Management

Industry News

The housing shortage crisis continues to cause concern with vacancy rates decreasing to 1.0% in February and rental prices continuing to rise in many cities.

Decreasing vacancy rates in February demonstrates that the housing shortage crisis is continuing to impact renters across the country, with further tightening to 1% vacancy and 1,947 fewer properties available in February with 30,161 just available rental properties.

Perth and Adelaide vacancy rates remained stable, while Sydney, Canberra, Hobart, Melbourne and Brisbane decreased by -0.1 to -0.2%.

Vacancy rates in the Sydney CBD, Melbourne CBD and Brisbane CBD decreased to 3.3%, 2.7% and 2.1% over February.

Louis Christopher, Managing Director of SQM Research said, “It is a seasonal demand increase we see at the start of each and every year but is most certainly problematic due to the fact the current rental market remains in crisis.

“Going forward, we believe vacancy rates are likely to decline again for the month of March as thus far weekly rental listings have fallen since the start of the current month.”

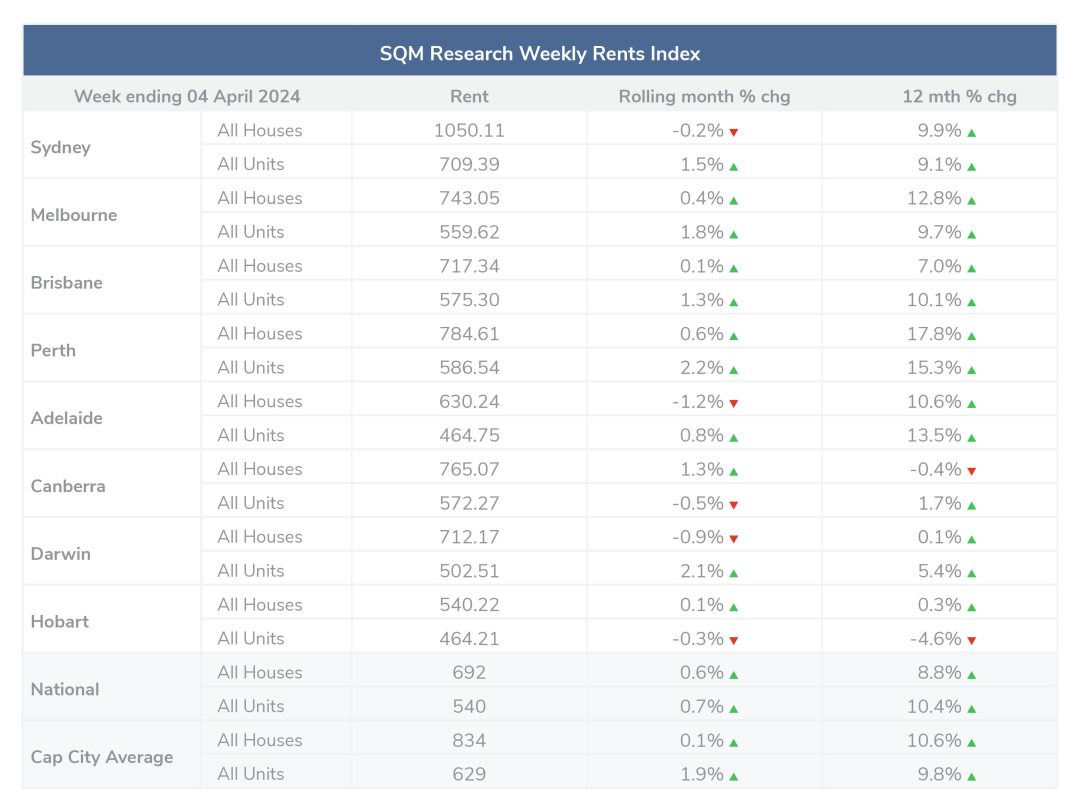

Over the past 30 days to 4 April 2024, national weekly asking prices rose by 0.6% for houses and 0.7% for units. The average national asking price is $692 for houses and $540 for units. Compared to last year, the national asking prices increased by 8.8% for houses and 10.4% for units.

Across capital cities, the gap between houses and units continues to shorten with a marginal 0.1% increase in house prices across the past 30 days to $834 per week, compared to a 1.9% increase in unit prices to $629 per week. Compared to last year capital city asking prices increased by 10.6% for houses and 9.8% for units.

All major cities saw an increase in listings across March, with the national average increase sitting at 6.9%. Of this, there was a 6.2% rise in new listings, with 79,296 fresh property listings entering the market and a 0.7% rise in distressed listings. For the 12-month period, there are 2.6% more listings than recorded in March 2023.

The national median asking price for houses is $913,513, an increase of 0.3% over the past 30 days, and an 11% increase over the past year. The national median asking price for units is $534,054, a 0.2% increase over the past 30 days and a 7.2% increase over the past year.

Capital city average asking prices four houses decreased by -0.8% over the past 30 days, and increased by 9.9% over the past year. Capital city unit prices decreased by -0.3% over the past 30 days, however increased by 5.3% over the past year.

The capital city average asking price for houses is $1,366,262 and a unit is $668,229.

March saw the RBA hold the cash rate target at 4.35% stating, “Higher interest rates are working to establish a more sustainable balance between aggregate demand and supply in the economy.”

And, “Inflation is still weighing on people’s real incomes and household consumption growth is weak, as is dwelling investment.”

The statement by the Reserve Bank board highlighted the following considerations:

While recent data indicate that inflation is easing, it remains high. The Board expects that it will be some time yet before inflation is sustainably in the target range.

Disclaimer: The information enclosed has been sourced from SQM Research and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.