May 6th, 2021

April property market update (2021)

Industry News

Industry News

House prices across Australia continue to rise, led by Hobart and Sydney. Unlike the previous month, national vacancy rates dropped over April. However, both Melbourne and Sydney CBD saw an increase in vacancy rates, likely due to an apartment oversupply.

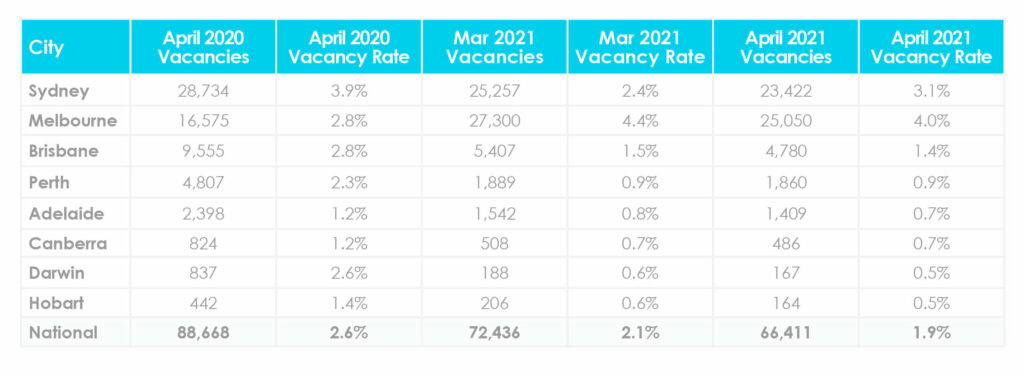

Over April, the national residential rental vacancy rate dropped to 1.9%. Suburban vacancy rates continued to fall across Australia. Consequently, landlords have begun demanding huge rent increases in certain locations including the Gold Coast and North Coast NSW. The total number of vacancies Australia-wide dropped from 72,436 residential properties in March to 66,411 in April.

Melbourne and Sydney saw a drop in vacancy rates. Melbourne saw a drop of 0.4% from March, while Sydney saw a drop of 0.3% over the month. However, Sydney CBD and Melbourne CBD both saw vacancy rates jump to 7.3% and 8.3%, respectively. This is likely due to an apartment oversupply. The vacancy rate remained below 1.0% in Perth, Adelaide, Canberra, Darwin and Hobart. In Brisbane, the rate fell to 1.4%.

Louis Christopher, Managing Director of SQM Research said: “Suburban vacancy rates continue to fall and that is now encompassing inner-suburban regions. In contrast, rates for Melbourne and Sydney CBDs remain elevated with the loss of international student tenants combined with apartment oversupply.”

Over April, asking rents across Australia’s capital cities rose by 0.4% for houses and 0.2% for units. Compared to the previous year, capital city rents rose 3.3% for houses but fell 3.7% for units. Melbourne and Sydney unit rents have dropped substantially by 11.0% and 5.6%, respectively.

Across Australia, there was a 15.9% increase in house rents and a 7.6% increase in unit rents. This growth in rents was propelled by strong growth in regional and coastal locations.

Rental value breakdowns by suburb can be found here.

Over May, national asking prices rose by 1.7% for houses but fell by 0.2% for units compared to April.

Over the last year, asking house prices and units grew by 14.2% nationally. This growth was led by Hobart and Sydney. Unit prices saw an increase of 6.6% compared to last year, led by smaller capital cities and regional locations. However, in capital cities, unit prices have fallen by 2.1%. This can be seen clearly in Sydney where asking prices for units fell by 5.5% over the last year. Over May, asking house prices in capital cities grew only 0.4% while unit prices fell by 0.4%.

Louis Christopher, Managing Director of SQM Research said: “The downward trend in old listings suggests strong absorption rates, so new property listings are not completely offsetting the falls in old listings, indicating there are more buyers than sellers in the market, which is fuelling the property boom.”

Property price breakdowns by suburb can be found here.

At its meeting on 1 June, the RBA kept the cash rate unchanged at 0.1%. The board has signalled that the cash rate is likely to remain on hold until 2024 at the earliest.