January 8th, 2024

December property market update (2023)

Industry News

Industry News

Residential vacancy rates rose slightly in December, with seasonal patterns affecting most areas; rental values increased overall despite more properties entering the market, and property listings dropped in January with a strong start to the auction season expected to boost February’s housing activity.

The residential vacancy rates saw a rise from 1.1% in November to 1.3% in December, reflecting an increase in total vacant dwellings from 33,471 to 39,797 over the same period. This uptick is largely attributed to seasonal patterns.

Notably, the capital cities of Sydney, Melbourne, and Brisbane experienced predictable seasonal uplifts in vacancy rates, ranging between 0.2% and 0.3%, which aligns with the expectations for December. Canberra also showed a typical December increase, registering a rise of 0.38%.

Adelaide’s vacancy rate saw a slight increase of 0.1%, indicative of the city’s stringent rental market conditions. Perth and Darwin experienced a similar modest rise of 0.1%, while Hobart maintained consistent rates, underscoring the extremely tight rental market conditions there.

In terms of specific areas, the vacancy rates in Sydney and Brisbane’s CBDs climbed to 5.6% and 3.2% respectively, whereas Melbourne’s CBD rate remained stable at 5.1%, illustrating the varying impacts of seasonality across these regions.

Harry Bawa, Head of Property and Business Analytics for SQM Research said, “While all capital cities (except Hobart) showed an increase in vacancy rates, Sydney and Canberra led the race, increasing by 0.3% from November. The CBD regions showed the greatest movement as overseas students returned home at the end of semester. And there were very small increases for Adelaide, Perth and Darwin, showing that rental conditions remain tight.

Hobart isn’t impacted by the seasonality in December. It went in the opposite direction with the rental market tightening further in December, however slightly.”

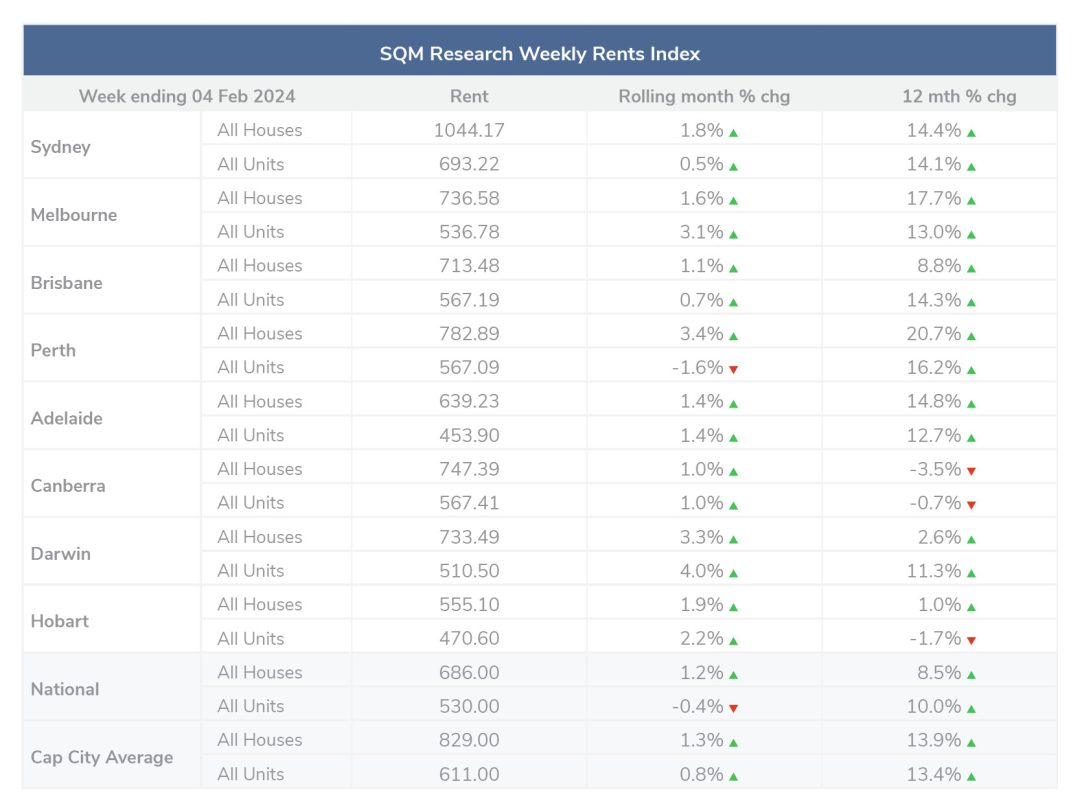

Over the past 30 days to 4 February 2024, national weekly asking prices rose by 1.2% for houses and decreased by -0.4% for units. The capital city average weekly rent increased by 1.3% for houses and 0.8% for units.

Compared to last year, the national asking prices increased by 8.5% for houses and 10% for units. The capital city average asking price increased by 13.9% for houses and 13.4% for units.

On 4 February 2024, the national median weekly asking rent was $686 per week for a house and $530 per week for a unit. The median capital city asking rent for a house was $829 per week for a house and $611 per week for a unit.

Harry Bawa, Head of Property and Business Analytics for SQM Research said, “Despite a few more properties coming into the rental market, asking rents rose nationally. Every capital city showed an increase month-on-month, except Canberra.”

In January 2024, there was a 5.7% drop in residential property listings across the nation from the previous month, with all major cities seeing a notable decline, aligning with seasonal expectations. Despite this, listings in five capital cities showed increases over January 2023.

The country saw a significant decrease in new listings (properties listed for less than 30 days), falling 17.5% to 44,883 dwellings. However, Sydney and Darwin bucked the trend with increases of 3.7% and 12.2% respectively, and both Sydney and Melbourne saw new listings jump by over 20% year-on-year, indicating a robust start to 2024’s market.

This week, the number of scheduled auction events has surged to 2,516, marking a 31% increase from the same period last year. This unusually strong beginning to the auction season is expected to lead to a considerable rise in total listings for February.

Over the past year, national residential property listings rose by 2.7%, with Canberra and Hobart experiencing significant increases of 24.4% and 18.1%, respectively, returning to their long-term market supply averages.

The national average asking price for combined dwellings increased by 1.9% to $821,710. Perth stood out, with a 2.6% monthly increase in asking prices, culminating in a 13.4% rise over the past 12 months, indicating high confidence among sellers in the area.

Harry Bawa, Head of Property and Business Analytics for SQM Research said, “The country recorded a typical January hiatus in the housing market. However, forward listings suggest that February will be a very strong month for housing activity. Auction numbers are up by 31% compared to this time, last year.

However, there is also now a concerning trend emerging out of NSW and Victoria for ongoing rises in distressed listings activity. The nine percent rise in NSW for the month was very abnormal and suggests some vendors in NSW are increasingly desperate to offload their properties.

I caution the industry right now not to get too far ahead of itself and not overly read into the jump in clearance rates last week. Yes, it may be a positive sign. Yes, there may be an interest rate cut at some point this year. However, the market right now is very mixed, and vendors need to realise that buyers will be sensitive to any economic slowdown that may be presently occurring.”

The RBA did not meet in January, the cash rate remained at 4.35%.

Disclaimer: The information enclosed has been sourced from SQM Research and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.