October 5th, 2021

September property market update

Industry News

Industry News

Housing values have surpassed pre-COVID levels, Sydney and Melbourne apartment investors were the losers of 2020, but a reversal could be in the cards in 2021. The cash rate remained unchanged at the historic low of 0.1% with strong suggestions from the RBA that it may remain unchanged until 2024.

National housing prices continued to rise in January. According to CoreLogic, the national value of homes surpassed pre-COVID levels by 1%.

COVID-19 continued to have a marked impact on property prices. Continuing the shift out of capital cities, regional housing values rose at more than twice the pace of capital city markets. Since March 2020 regional housing values have surged by 6.5% compared to a -0.2% decrease in capital cities in the same period. Further property price breakdowns can be found here.

The divergence between regional and capital city housing values is particularly evident in New South Wales and Victoria. According to CoreLogic’s research director, Tim Lawless, “Internal migration data shows more people are leaving Sydney and Melbourne for regional areas, resulting in a transition of activity from the metro regions to the outer fringe and regional markets.

“This demographic trend is further compounded by the demand shock of stalled overseas migration. As Melbourne and Sydney historically receive the vast majority of overseas migrants, these metro areas have been the hardest hit by this demand shock.

“Better housing affordability, an opportunity for a lifestyle upgrade and lower density housing options are other factors that might be contributing to this trend, along with the newfound popularity of remote working arrangements.”

Another COVID-19 Australian property trend that has continued in January is the outperformance of houses over units. Over the past six month, national house prices have risen by 3.5% whilst unit prices have remained unchanged.

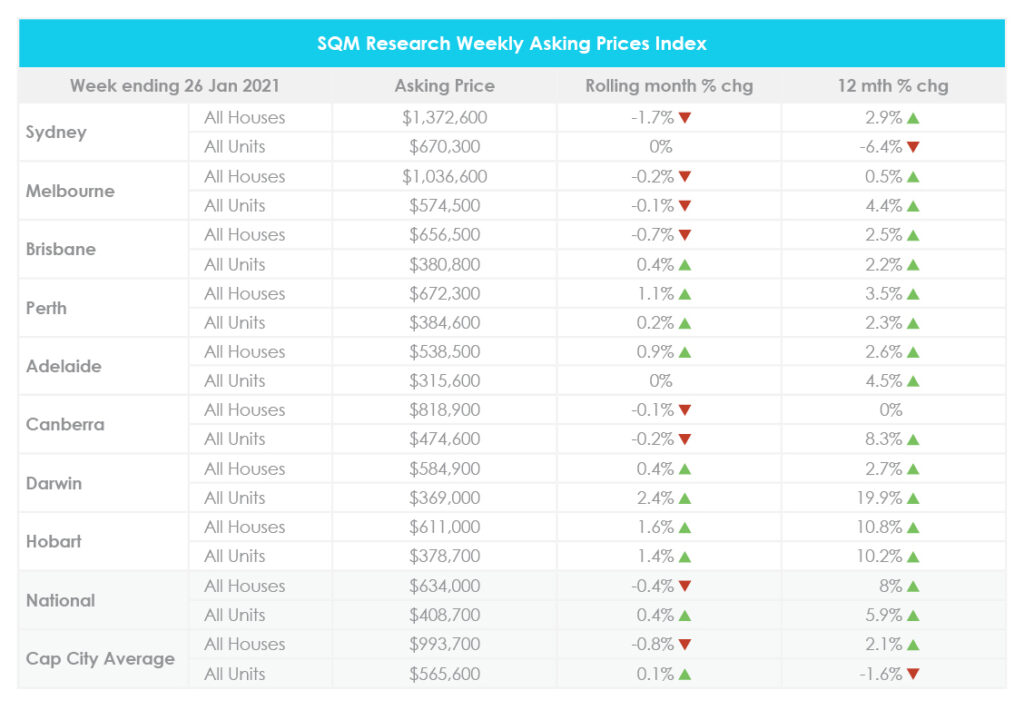

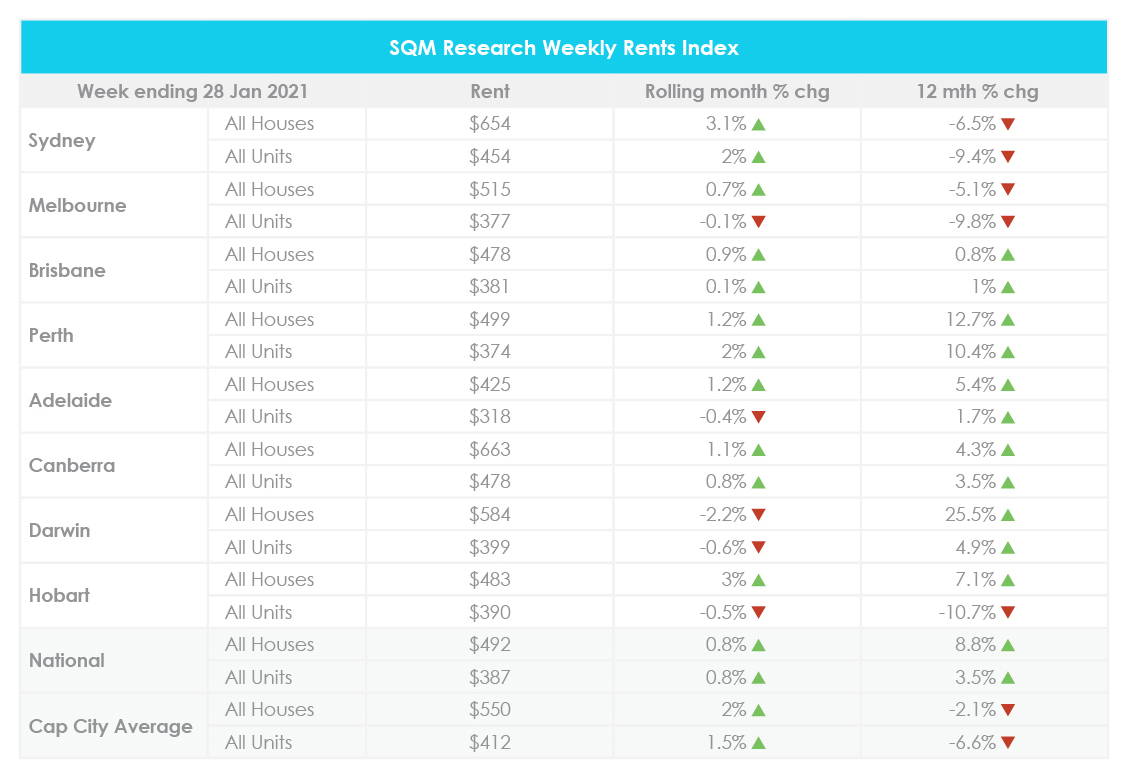

National rental values also continued to rise, again particularly in houses which were up 8.8% from 12 months ago. Units also saw a rise up 3.5% from the same time last year. Further price breakdowns can be found here.

On a state level, these improvements were largely driven by Perth, Adelaide, Canberra, Darwin. Conversely, Sydney and Melbourne saw significant decreases from 12 months prior.

Managing Director of SQM Research, Louis Christopher, said, “It’s clear Sydney and Melbourne apartment investors were the losers of 2020 with rents and prices falling. However, if you owned an investment property in Darwin or Perth, or indeed regional Australia, you have had one of the best years ever.

“The move towards regional living was the primary reason why investors outside our two largest capital cities did so well.”

Does Christopher think this trend will continue into 2021? “The truth is we are starting to see at least a part reversal. CBD and inner suburban vacancy rates have been falling again. And inner urban agents have been telling me demand has clearly picked up for such properties. But I don’t think it is going to be a complete reversal. Demand for inner city property will remain affected by the closure of the international border as well as ongoing caution on future city lockdowns. This will mean 2021 will remain largely a tenant’s market in the inner cities but will also very much remain a landlord’s market for regional Australia.”

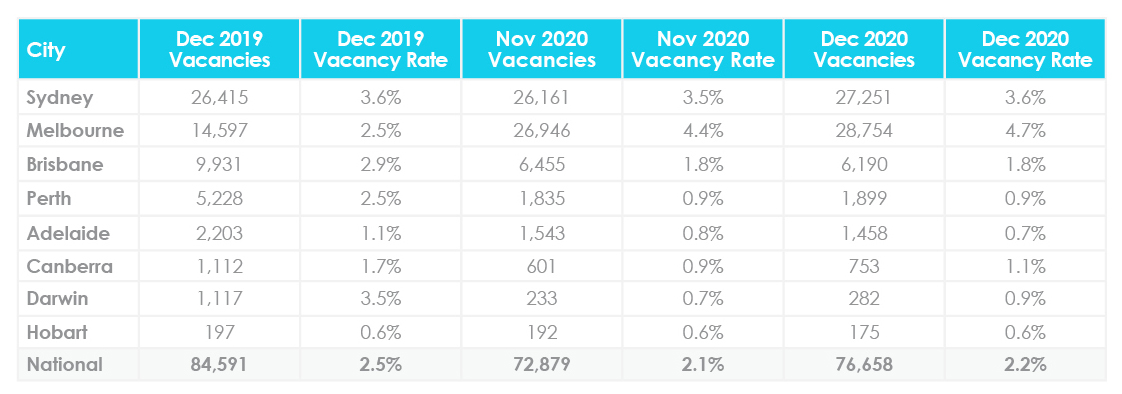

In January vacancy rates remained quite low at 2.2%. Sydney and Melbourne had the highest vacancy rates at 3.6% and 4.7% respectively. Darwin and Hobart had the lowest capital city vacancy rate in the country at a tiny 0.9% and 0.6% respectively. Further price breakdowns can be found here.

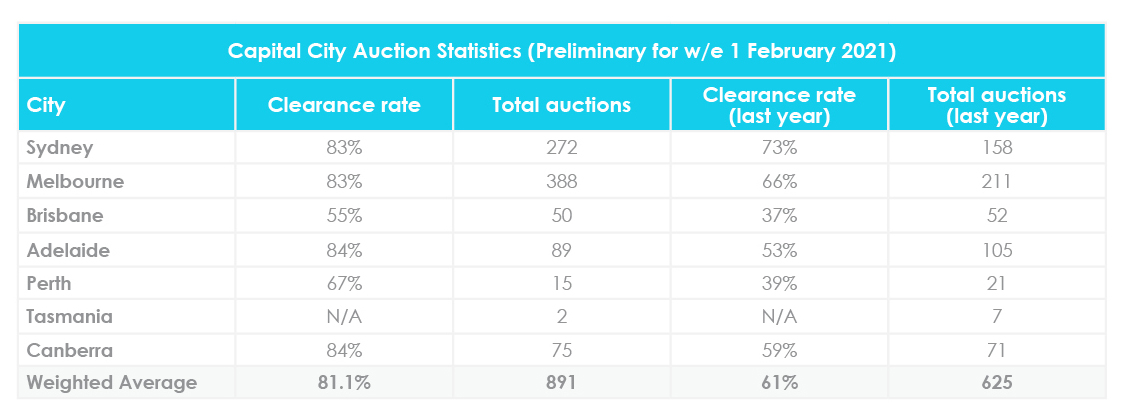

According to the latest SQM data, auction clearance rates were at 81% marking a 20% jump from the same period in 2020. Whilst this increase was evident across all states, it was particularly pronounced in Adelaide which saw an increase of 31 percentage points from 53% in 2020 to 84%.

For further auction clearance rate information across each capital city, click here.

At the first RBA board meeting of 2021, the RBA kept the cash rate unchanged at 0.1%.

According to the RBA release, “The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest.”