October 29th, 2025

Australian residential property market now worth $12 trillion

Industry News

Industry News

If you manage a rent roll, you know December numbers rarely tell the full story.

January has confirmed what many teams expected. The brief holiday lift in listings has been absorbed, leasing activity has picked up and underlying demand is still doing the heavy lifting.

For rent roll teams, the holiday bump is over and the core supply and demand balance is back in focus. Here are the key takeaways shaping the market at the start of 2026.

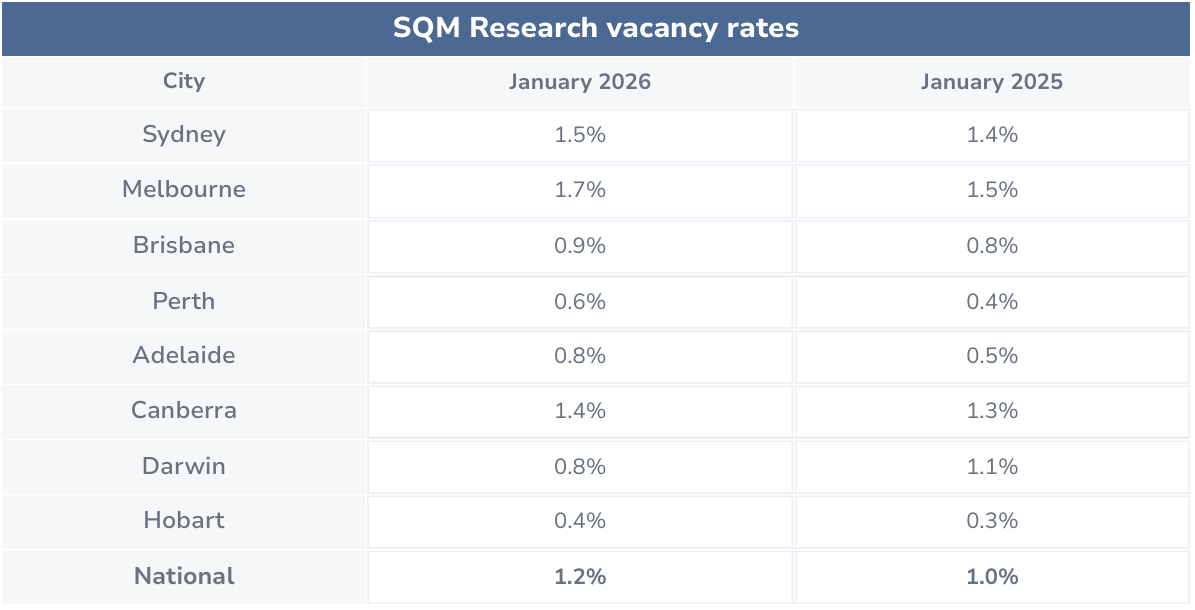

The national vacancy rate fell to 1.2% in January, down from 1.4% in December. Around 37,630 homes were sitting empty across the country. Much of the extra stock that came online over summer has now been leased.

All capital cities except Hobart became tighter again. In Sydney and Melbourne, the brief lift in empty homes over the holidays has already been absorbed. Interestingly, Sydney, Melbourne and Canberra are the only capital cities with vacancy rates above 1%. Even Melbourne, which long had the most balanced market is tightening rapidly, with its number of vacancies dipping below 10,000 in January.

Rental options remain extremely limited in cities where less than 1% of homes are available: Brisbane, Perth, Adelaide, Darwin and Hobart.

Hobart remains the tightest market in the country. With vacancy at just 0.4%, only 112 homes were available for rent.

The pattern is clear. Listings often build up in December as people move or delay decisions over the break. But once January arrives and tenants return to the market, those homes are taken quickly. The broader supply shortage has not gone away.

As vacancy tightened, rents began to lift again. National combined rents rose 2.2% over the past 30 days to $683.26 per week. Over the past year, rents are up 7.3%.

House rents were mostly steady over the month but still sit 7.5% higher than a year ago at an average of $762.00 per week. Unit rents edged higher over the month and are 6.9% above last year, with the national average at $592.00 per week. This suggests many renters are still looking for more affordable options.

Across the capitals, most markets saw rents move higher in January. Sydney (1.7%) and Melbourne (2.2%) both recorded monthly gains respectively as demand picked up after the break. Hobart, Darwin and Brisbane showed the strongest annual growth at 10.1%, 9.4% and 8.5% respectively. Even in cities where monthly growth was small, rents remain well above year-ago levels.

When vacancy is low, rent pressure tends to return quickly. January’s data shows that once the holiday pause ends, the market goes back to being driven by limited supply and steady tenant demand.

Sam Tate, SQM Research’s Head of Property, expects rents to keep going up in the next few months.

“Unless we see a meaningful increase in new rental supply, upward pressure on rents is likely to persist through the first half of 2026,” Tate said.

January shows that demand is holding firm in many markets. In cities with low vacancy, competition for rental stock remains strong. For Property Managers and leasing teams, this is a time to stay close to the data and guide landlords with clear advice to set rents strategically.

Disclaimer: The information enclosed has been sourced from SQM Research and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy and disclaimer notices on those websites.