January 7th, 2026

December 2025 market update: growth expected to ease heading into 2026

Industry News

Industry News

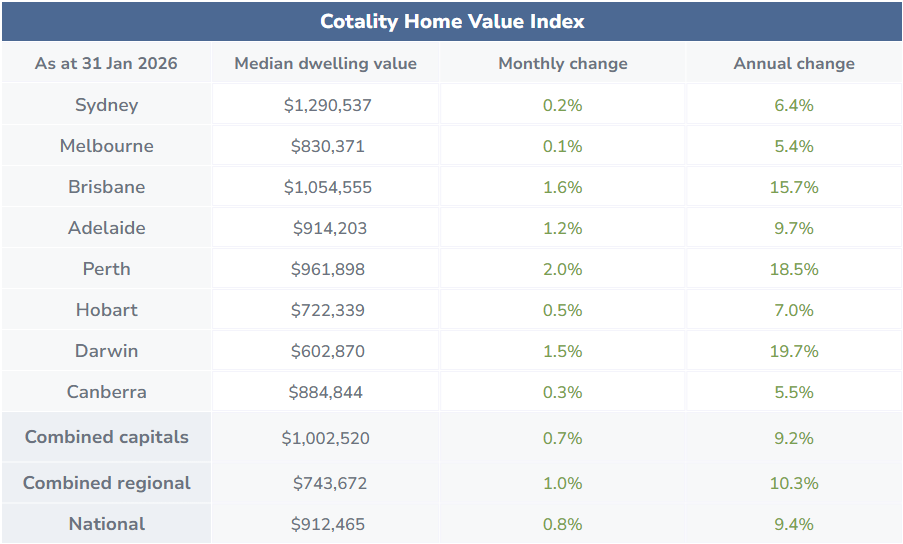

Australia’s housing market kicked off 2026 with another month of growth, even as cost of living pressures and affordability continue to bite. National dwelling values inched up by 0.8% in January, taking the median home value to $912,465, slightly higher than December’s pace, according to Cotality’s latest data.

January’s result points to a market that’s still moving forward, just not in the same way everywhere. Prices rose across every capital city and regional market, but growth was uneven. Some areas are powering ahead, while others are ticking along more steadily, shaped by affordability and what buyers can realistically pay right now.

If there’s one key takeaway from January’s data, it’s this. As growth becomes more uneven, local insights from Property Managers and agencies matter more than ever.

On the surface, January looks stronger than December. National growth lifted from 0.7% to 0.8% and every capital city and broad regional market recorded price gains.

But underneath, there’s less momentum. Cities that surged last year are slowing and growth is increasingly dependent on specific pockets rather than broad demand.

Low housing supply is still supporting prices. Listings remain 19% below last year and 25% below the five-year average, Cotality estimates, while sales activity has held up reasonably well. That’s keeping prices from falling, but it’s no longer driving strong gains across the board.

After small declines in December, Sydney and Melbourne returned to growth in January, signalling a stabilisation in Australia’s two biggest housing markets.

Sydney home values rose 0.2% over the month to $1,290,537, while Melbourne values edged 0.1% higher to $830,371. While the gains were modest, they mark a shift away from the late-2025 softness and suggest buyer confidence is holding, even under tighter affordability conditions.

Both cities remain just below their previous peak levels, but the return to positive growth shows demand hasn’t disappeared. Instead, it’s become more selective, with buyers taking a more measured approach at higher price points.

The mid-sized capitals are still doing the heavy lifting and Perth remains the standout.

Perth dwelling values rose 2.0% in January to a median of $961,898, the strongest monthly increase of any capital city. While the rapid growth has eased from late last year, the city is shifting from a surge phase into a steadier, more sustainable pace.

Brisbane values rose 1.6% to $1,054,555, easing from earlier highs. Darwin continued to outperform with a 1.5% rise to $602,870. Adelaide followed with a 1.2% lift to $914,203, also down on December’s pace.

Elsewhere, growth was less strong. Hobart increased by 0.5% to $722,339 and Canberra lifted 0.3% to $884,844.

Across all capitals, housing values were up by 0.7% in January, pushing the combined capital city median to $1,002,520.

One of the clearest signals in January’s data is where growth is coming from.

Across the combined capitals, lower-priced houses rose by 1.3% over the month, compared with just a 0.3% increase for higher-priced homes. That gap shows buyers are focusing on what they can still afford, rather than stretching into premium stock.

This trend helps explain why markets with lower median values continue to outperform. It’s also why overall price growth is holding up, even as borrowing limits and living costs squeeze households.

Regional markets fit this pattern too. Combined regional dwelling values rose 1.0% in January, taking the median to $743,672, compared with a 0.7% lift across the capitals. Affordability remains the key drawcard.

What January really shows is that opportunity hasn’t disappeared, it’s just become more targeted.

For investors, the upside now lies in knowing where to look, whether that’s more affordable suburbs with growth potential, specific property types or regional markets still delivering solid gains.

For Property Managers and agencies, the current landscape makes your role even more valuable. When growth isn’t uniform, owners rely more heavily on advice around pricing, positioning and long-term strategy. Buyers need guidance on which markets represent the best value. In a market like this, good advice matters just as much as good timing.

Disclaimer: The information enclosed has been sourced from Cotality and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy and disclaimer notices on those websites.