January 7th, 2026

December 2025 market update: growth expected to ease heading into 2026

Industry News

Industry News

Australia’s rental market ended 2025 with some seasonal easing, but the underlying story remains one of tight supply and renewed rent growth as 2026 begins. Conditions continue to favour landlords in most markets, even though agencies may have noticed a slight drop-off in enquiry volumes in the holiday season.

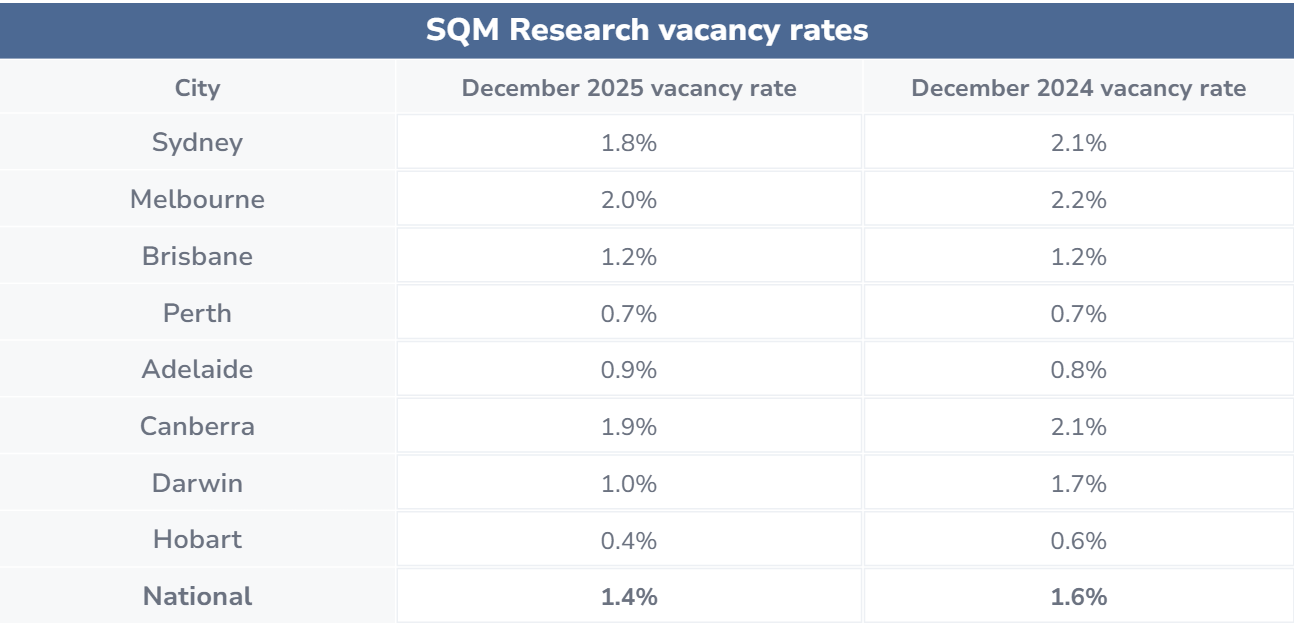

Nationally, the residential vacancy rate rose to 1.4% in December, according to SQM Research’s latest data, up from 1.3% in November. Total vacancies lifted to around 43,850 dwellings, a typical end-of-year increase driven by higher tenant turnover and more listings coming to market.

Despite this lift, vacancy rates remain historically low. As SQM Research’s Head of Property Sam Tate noted, the increase is “largely seasonal” and does little to change the broader picture of a tight rental market.

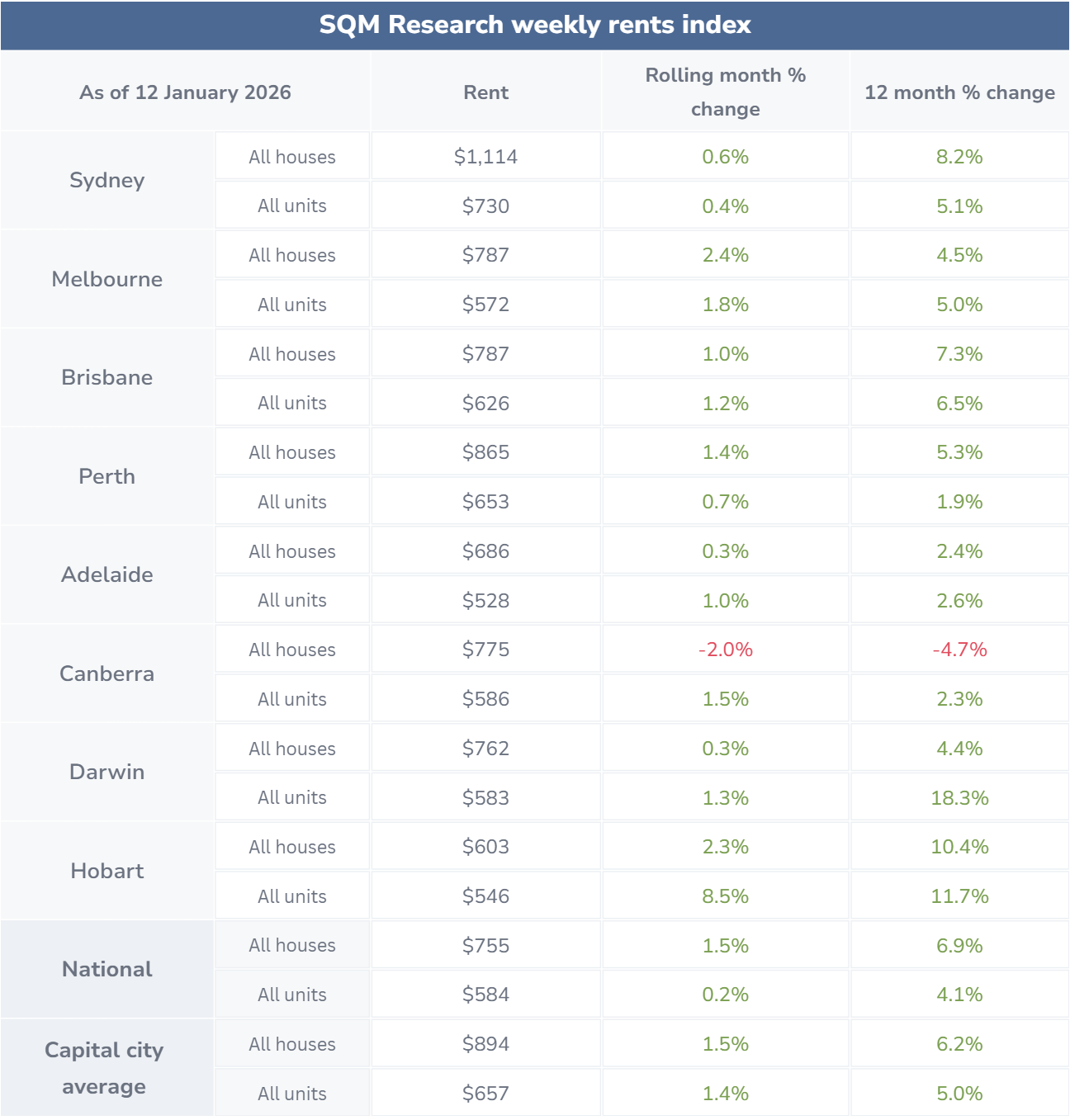

After some easing through November and December, advertised rents have picked up again in early January. Combined rents increased by 2.4% over the 30 days to 12 January 2026 and are now 5.8% higher than a year ago.

The national average rent sits at $684 per week, while capital city rents average $766 per week. Houses continue to lead rental growth, up by 3.4% over the past month and 7.0% annually, while unit rents rose by 1.0% monthly and 4.1% over the year.

“Importantly, the latest rent data shows renewed upward momentum entering January, suggesting the late-2025 softening in rental growth is likely to be temporary,” Tate said.

“Without a sustained increase in new rental supply, affordability pressures are expected to persist into 2026.”

While no capital city saw vacancy tighten, the pressure is still high across the country with Melbourne the only capital not below the 2% vacancy mark. Every capital city, except Canberra, saw rents increase compared to 12 months ago.

Vacancy rates remain extremely low in these capital cities, signalling ongoing supply shortages.

Here, conditions remain tight, but vacancy rates are still above 1.0%.

Tightness in these two capitals eased in December, but this is largely seasonal due to year-end turnover.

The latest findings should come as no surprise for most agencies. Tenant demand remains strong, supply is tight and rental growth is gearing back up in many markets. The end-of-year easing offers a bit of short-term relief, but it hasn’t changed the bigger picture.

As 2026 begins, tenants are still feeling the pressure, while low vacancies continue to support rents. Managing expectations through clear conversations will be key. Setting expectations early and pricing realistically will matter just as much as efficient leasing.

————

Disclaimer: The information enclosed has been sourced from SQM Research and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy and disclaimer notices on those websites.