May 29th, 2024

10 ways to attract new property owners in 2024

Property Management

Industry News

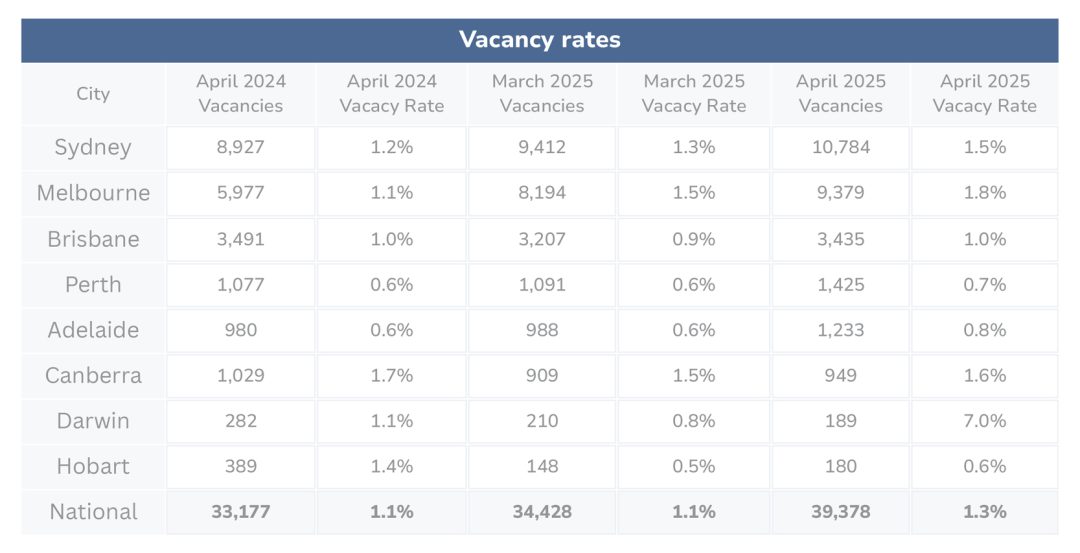

The total number of vacant residential properties nationwide rose to 39,378 in April 2025, up 18.7% from 33,177 in April 2024, according to SQM Research’s monitoring of unique online rental listings.

Melbourne recorded the highest vacancy rate at 1.8%, up significantly from 1.1% in April 2024, with vacancies surging 56.9% to 9,379 properties.

This suggests an oversupply or reduced demand in Victoria’s capital, potentially easing rental pressure for tenants.

Sydney saw its vacancy rate rise to 1.5% (from 1.2% in April 2024), with vacancies increasing 20.8% to 10,784 properties, reflecting a loosening rental market.

Brisbane maintained a relatively tight market, with a vacancy rate of 1.0% (up slightly from 0.9% in March 2025), and vacancies stable at 3,435, a 1.6% decrease from 3,491 in April 2024.

Perth and Adelaide reported low vacancy rates of 0.7% and 0.8%, respectively, though both saw increased vacancies (Perth: +32.3% to 1,425; Adelaide: +25.8% to 1,233), indicating slight softening in these tight markets.

Canberra, Darwin and Hobart recorded declines in vacancies, with Hobart’s vacancy rate dropping to 0.7% (from 1.4% in April 2024) and vacancies falling 53.7% to 180, signalling a return to a landlord-favoured market.

“The rise in national vacancy rates to 1.3% reflects a shift toward a slightly eased rental market, particularly in Melbourne and Sydney, where increased supply is providing tenants with more options,” said Louis Christopher, Managing Director of SQM Research.

“It is typical that over the winter period, the rental market goes into somewhat of a lull with rental vacancy rates rising a notch. This winter might prove to be a good time for tenants looking for rental properties, keeping in mind we don’t expect this lull to last any more than a few months.”

The national vacancy rate of 1.3% in April 2025, combined with a national average weekly rent of $650 (down 0.7% over the past month), suggests a slight easing of rental market pressure.

Over the past 12 months, national rents have risen by 3.9%, a slowdown from previous years, indicating tenants may have somewhat increased negotiating power compared to recent years.

City-specific insights:

Brisbane, Perth and Adelaide continue their strong growth, driven by affordability and migration trends.

Sydney and Melbourne remain stable but show signs of cooling in the unit market. The national market appears robust, with 7.2% annual growth in houses and 5.3% in units.

“As expected, we saw a large lift in listings following the Federal Election,” said Louis.

“The bounce in new listings indicates renewed confidence, and yet older stock continues to accumulate in cities like Sydney and Melbourne, suggesting that many vendor pricing expectations may still be out of step with the market.”

The RBA Board decided to lower the cash rate target by 25 basis points to 3.85% in May 2025. This highlights a continuation to the end to one of the longest periods of increases in rates since before 2020.

Disclaimer: The information enclosed has been sourced from SQM Research and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.