October 11th, 2021

Everything you need to know about the regional rental boom

Industry News

Industry News

Over August, national asking rents grew for both units and homes nationwide. This rise has been driven primarily by growth in regional rents. SQM Research suggests that this could be due to the lockdowns, which may have encouraged more people to move to regional areas in a bid to escape the latest restrictions.

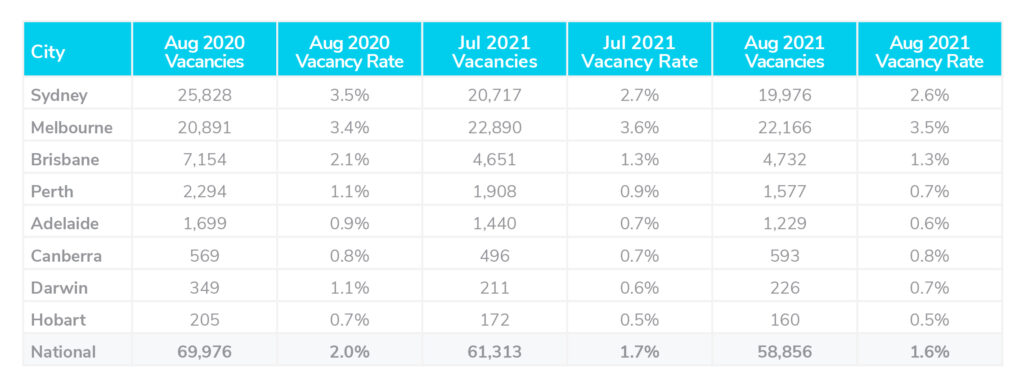

Over the month of July, the residential vacancy rate sat at 1.7% Australia-wide with 61,313 residential properties recorded as vacant across the nation. This is a jump up from 60,468 recorded in June.

In Sydney, vacancy rates dropped from 2.8% in June to 2.7% in July. However, in the Sydney CBD, rates rose to 6.1%, most likely a reflection of the new lockdown rules. While in Melbourne, the vacancy rate grew from 3.5% to 3.6% overall and fell to 5.7% in the CBD. The vacancy rate sat below 1.0% in Adelaide, Darwin and Hobart, singing good news for owners in these states. Perth, Brisbane and Canberra saw no changes in their vacancy rates over July.

Louis Christopher, Managing Director of SQM Research said, “Current tight rental vacancy rates are driving up rents across Australia. It is somewhat perplexing to see both regional Australia and the Capital cities record surges. Given the ongoing international border closures and still relatively high completions.”

Over the month to 4th September, national asking rents rose by 0.9% for houses and 0.8% for units. Units grew to $401 per week, while houses rose to $532 per week. Compared to the previous year, house rents grew by 15.7% while units rose by 8.1% nationally.

The national rise over the past month has been propelled by increases in regional areas, more so than the elevation in capital cities. SQM Research attributes this growth in regional areas to the lockdowns, which may have encouraged more people to move to regional areas in a bid to escape the latest restrictions. This can be seen in the fact that the capital city average for units remained the same over the month, seeing no increase in asking rents. However, houses still rose by 0.7% in asking prices over the 30 days up until the 4th of September.

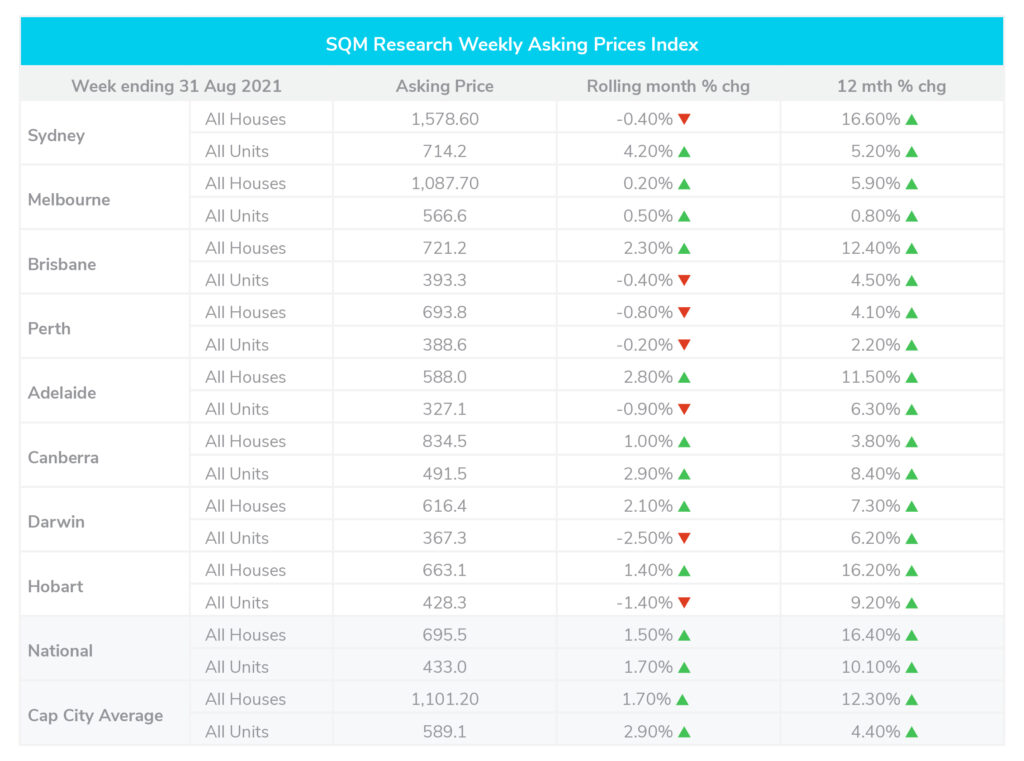

The largest increase was seen in units in Hobart, which saw an increase of 2.9% over August.

Over August, asking prices in Sydney dropped by 0.4% for houses compared to the previous month. However, prices in Sydney rose by 4.2% for units. Meanwhile, house prices grew by 2.8% in Adelaide, 0.2% in Melbourne, 2.3% in Brisbane and 2.1% in Darwin. Property listings across Australia dropped by 9.6% during August. In comparison to the same time last year, listings have decreased by 26.3%. The number of new listings on the market (less than 30 days) decreased by 7.8% over August compared to July.

Louis Christopher, Managing Director of SQM Research said, “Listing counts over August were predominantly impacted by lockdowns, particularly for Sydney whereby there was a 19.7% decline in new listings.”

The cash rate was held unchanged at 0.1%. The board has signalled that the cash rate is likely to remain on hold until 2024 at the earliest.