September 2nd, 2024

10 signs you’re a top tier Property Manager

Property Management

Industry News

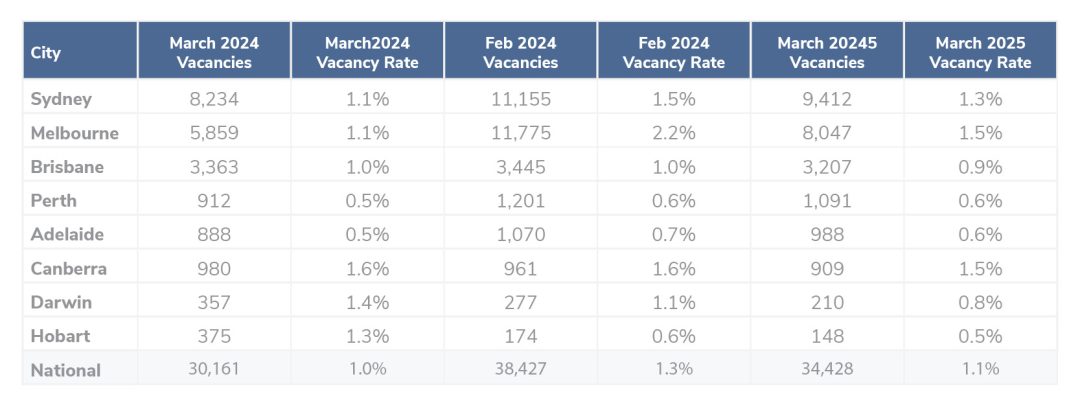

According to SQM Research, Australia’s residential dwelling vacancy rate decreased back to 1.1% in March 2025, down from 1.5% in January 2025. The total number of rental vacancies fell to 34,428 dwellings.

Sydney’s rental vacancy rate decreased to 1.3%, with 9,412 rental dwellings now vacant, compared to 11,155 in February.

Melbourne also recorded vacancy falls with its vacancy rate falling to 1.5%, representing 8,194 vacant dwellings. Similarly, Brisbane also recorded a falling vacancy rate of 0.9%, with 3,207 rental properties now vacant and available for rent.

The city that recorded the largest declines for the month was Darwin with vacancy rates falling sharply to just 0.8%. Perth and Adelaide have the tightest rental markets with both cities recording a vacancy rate of just 0.6%.

“March is typically one of the peak months for rental demand, so the falls in rental vacancy rates recorded last month should not be a surprise,” said Louis Christopher, Managing Director of SQM Research.

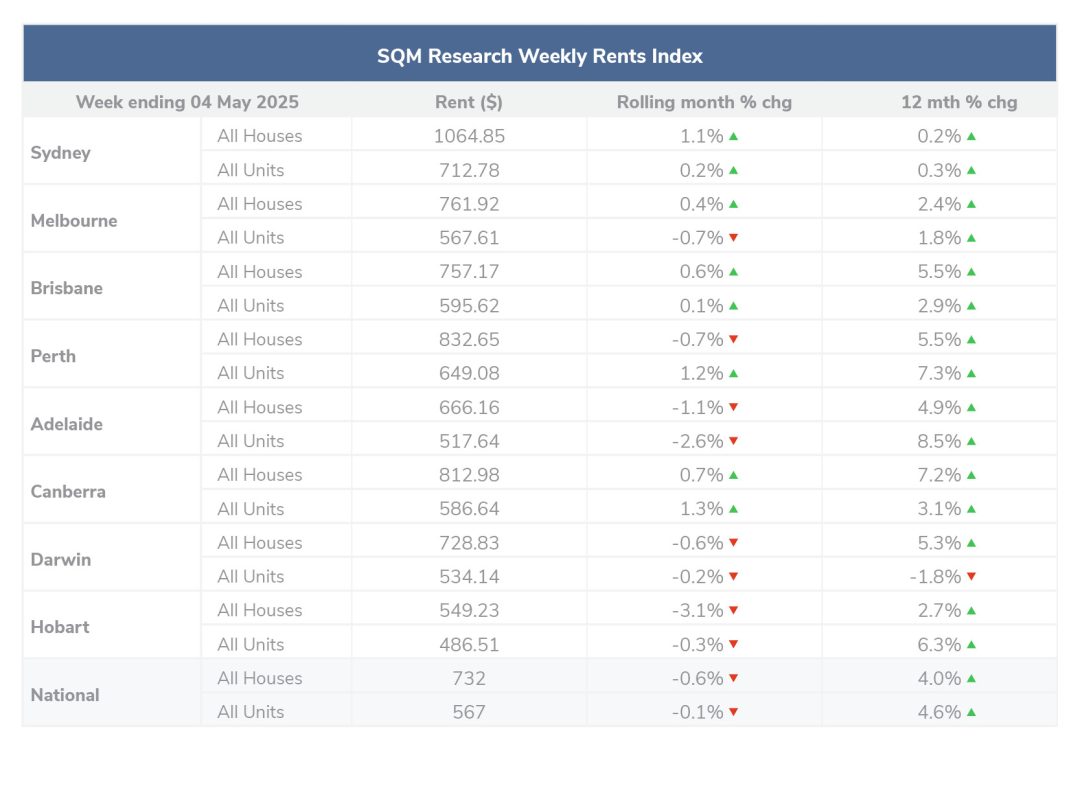

Over the past month leading up to 12 April 2025, rental prices across Australia’s capital city asking rents rose marginally, up by 0.2%.

This slight rise continues the trend of a national slowdown in rental growth, which has been a phenomenon since the start of 2024.

In Sydney, dwelling rents rose faster than the capital city average, rising by 1.0% for the past 30 days.

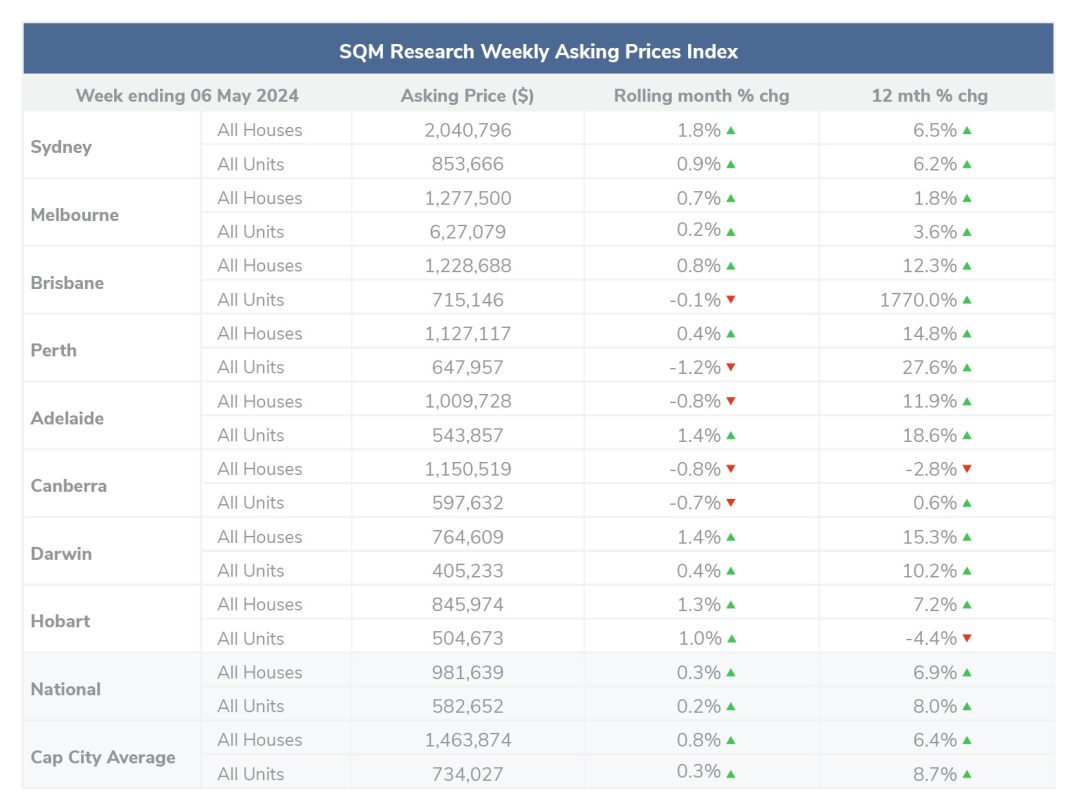

Nationally, house asking prices increased by 0.3%, while unit asking prices increased by 0.2%. Among capital cities, the average asking price rose by 0.7%, with houses increasing by 0.8% and units by 0.3%.

“Going forward, with the election behind us and a majority government in place, I expect a large uplift in new listings for May as well as a pick-up in auction clearance rates,” said Louis.

“As for prices, we are expecting participant confidence to lift now that we past the election period and coming up to another interest rate cut.”

The RBA cash rate has remained steady at 4.1% after decreasing in February for the first time since November 2020. This highlights a continuation to the end to one of the longest periods of increases in rates since before 2020.

Disclaimer: The information enclosed has been sourced from SQM Research and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.