June 25th, 2025

Automation vs AI in property management: what’s the real difference?

Property Management

Industry News

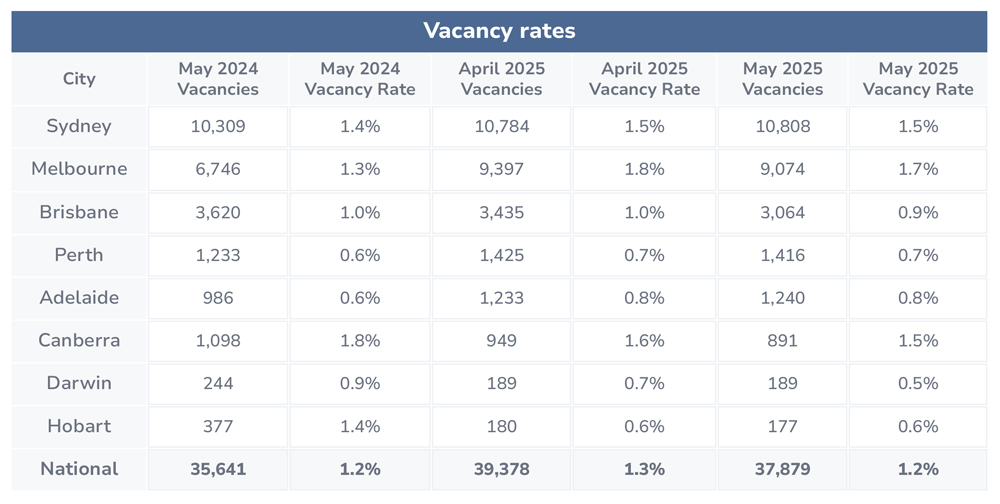

Australia’s rental market has shown dynamic shifts over the past year, with vacancy rates stabilising across most capital cities while reflecting notable changes compared to May 2024.

The national vacancy rate held steady at 1.2% in May 2025, after 1.3% in April 2025, marking a slight monthly decline.

“Overall rental vacancies remained steady from April to May. Rental growth also remained steady but continued to be elevated given the ongoing shortage in the rental market,” said Louis Christopher, Managing Director of SQM Research.

“We are likely to have ongoing elevated rents for a long period of time, until we have equilibrium between tenancy demand and rental supply.

“That’s not likely to happen until such time as we a slow down in population rate and a meaningful increase in new dwelling completions.”

Key city vacancy rates in May 2025:

Based on SQM Research’s monitoring of unique online rental listings, the total number of vacant residential properties nationwide rose to 37,879 in May 2025, from 35,641 in May 2024.

• Sydney: 1.5%, up 0.1% year-on-year, stable since April 2025.

• Melbourne: 1.7%, up 0.4% from May 2024, slightly lower than April’s 1.8%.

• Brisbane: 0.9%, down 0.1% compared to last year and 0.1 % from April, indicating tightening of availability.

• Perth: 0.7%, up 0.1% year-on-year, unchanged since April 2025. • Adelaide: 0.8%, up 0.2% from May 2024, stable month-on-month.

• Canberra: 1.5%, down 0.3% year-on-year and 0.1 % month-on-month, pointing to a gradual decline in rental vacancies.

• Darwin: 0.5%, down 0.4% from last year and 0.2 % from April, reflecting a tightening market.

• Hobart: 0.6%, down 0.8% from May 2024, stable since April 2025.

Advertised rents analysis

Nationally, combined rents average $649.18, with a 0.1% monthly decline but a 4.2% annual increase, highlighting varied conditions across states.

City-specific insights:

• Sydney: Advertised weekly rents are $854.69, reflecting a 0.2% decline over the past month but a 1.7% increase compared to last year. The 1.5% vacancy rate suggests rental conditions remain steady, tempering rent growth.

• Melbourne: Rents sit at $651.62, up 0.5% over the past month and 2.4% over the year. The 1.7% vacancy rate indicates ongoing market fluctuations.

• Brisbane: Weekly rents average $684.41, with a 0.2% monthly decline but a 3.8% annual rise, as vacancy rates tighten to 0.9%.

• Perth: Advertised rents stand at $756.93, increasing 0.4% monthly and 6.2% annually, reflecting steady demand amid 0.7% vacancy rates.

• Adelaide: Rents are $611.21, declining 0.3% over the month but up 3.1% year-on-year, with vacancy rates holding at 0.8%.

• Canberra: Weekly rents average $675.82, down 2.3% monthly but up 4.2% annually, with vacancy rates easing to 1.5%, supporting rental availability.

• Darwin: Rents are $633.37, up 2.7% over the past month and 13.1% year-on-year, with vacancy rates dropping to 0.5%, reflecting tightening supply.

• Hobart: Advertised rents reach $543.69, growing 3.6% monthly and 7.6% annually, as the 0.6% vacancy rate underscores ongoing market constraints.

Asking prices national

Asking prices rose modestly in the four weeks to 1 July 2025, with combined house and unit prices lifting 0.5% over the month and 9.0% annually.

Houses outpaced units in growth, with standout gains across several mid-sized capitals. City highlights:

• Adelaide led the national upswing with a 1.9% rise in combined dwelling prices over the month, now sitting 17.4% higher than a year ago.

• Brisbane (+1.3% monthly) and Perth (+0.8%) also posted robust gains, with both cities showing double-digit annual growth—12.5% and 13.7% respectively.

• Canberra prices jumped 2.9% in June, rebounding from recent softness, though still tracking 1.4% below last year.

• Sydney and Melbourne remained steady, with Sydney rising 0.3% over the month and 5.5% annually, while Melbourne added 0.7% monthly and 3.3% over the year.

• Hobart and Darwin were the only capitals to record combined price declines in June, down 0.5% and 0.6% respectively.

The Reserve Bank of Australia (RBA) announced the cash rate for has once again been reduced by –0.25%, with a cash rate target of 3.85%. This represents an ongoing trend in dropping the cash rate since December 2023.

“Inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance,” the RBA said in a statement.

“Data on inflation for the March quarter provided further evidence that inflation continues to ease.”