In August vacancy rates held steady nationally at 1.3% with a marginal decrease in the number of rental vacancies with an additional 36 properties available in August than in July. Compared to this time last year, vacancy rates increased by 0.1%.

Vacancy Rates

In August vacancy rates held steady nationally at 1.3% with a marginal decrease in the number of rental vacancies with an additional 36 properties available in August than in July. Compared to this time last year, vacancy rates increased by 0.1%, up from the 35,425 vacancies in August 2024.

Most capital cities have recorded an increase in vacancy rates compared to this time last year, with just Darwin and Hobart experiencing decreases in vacancies.

Across the past 30 days in capital cities marginal (0.1%) decreases in vacancy rates were seen in Sydney, Perth, Adelaide, Canberra and Hobart. Melbourne was the only capital city to experience an increase of 0.1% to 1.6%, bringing it to the same index as Sydney, While Brisbane and Darwin remained unchanged.

Louis Christopher, Managing Director of SQM Research said, “National rental vacancy rates fell slightly in August, and we are now expecting further falls in vacancies through spring, however, this will be just a seasonal change and so we are not anticipating a reacceleration of rents, which have eased in recent months.

“Overall, the national rental market remains in severe shortage and barring some exceptions, is not expected to materially soften out of the rental crisis for some years. However, much of the structural rental shortage has now been priced into the rental market and so I do believe the days of 10-20% plus annual rental increases have come to an end.”

Rental values

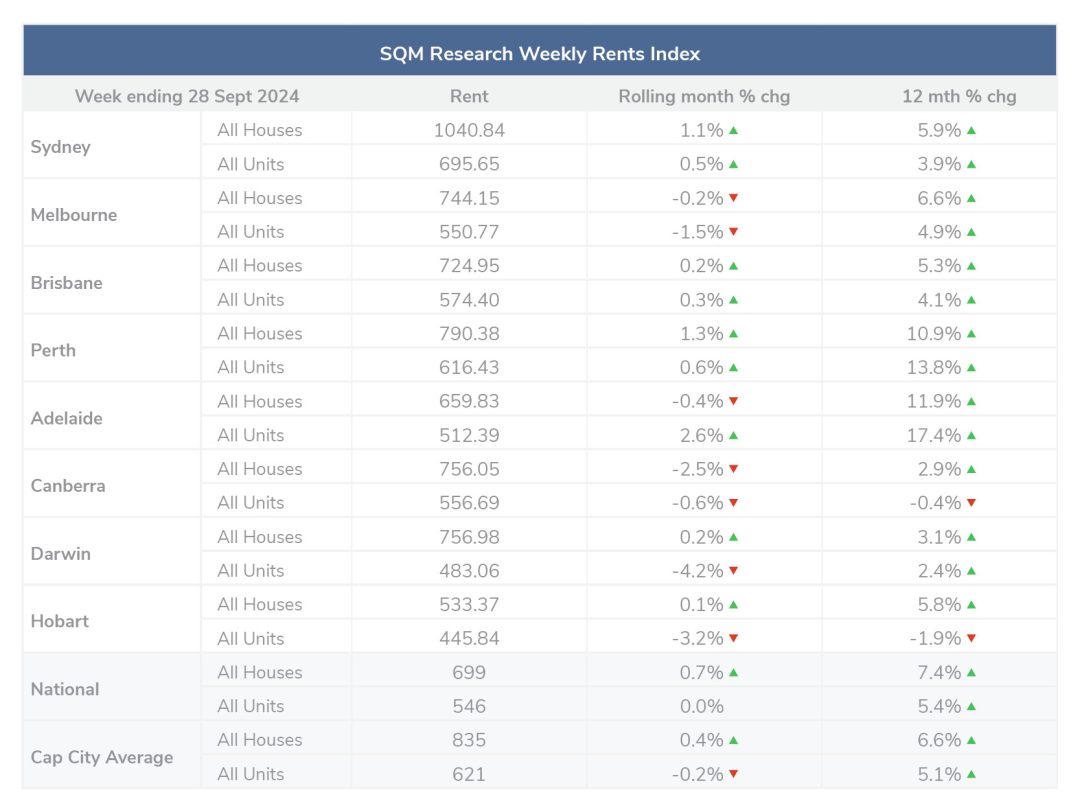

Over the past 30 days to 28 September 2024, the national median asking rents for houses increased by 0.7% and remained steady for units. Across capital cities averages, the median asking rent increased by 0.4% and units decreased by -0.2%, with varied changes seen across the capitals.

- Sydney, Brisbane and Perth experienced increases in both houses and units;

- Adelaide, Darwin and Hobart experienced mixed results across houses and units

- Canberra and Melbourne experienced decreases across both houses and units

The largest variation in results was seen in Darwin, with houses increasing by 0.2% and units decreasing by -4.2%.

The average national rental asking price at 28 September 2024 was $699 for houses and $546 for units. Compared to last year, the national rental asking prices increased by 7.4% for houses and 5.4% for units.

The capital city average rental asking price at 28 September 2024 was $835 for houses and $621 for units. Compared to last year capital city asking prices increased by 6.6% for houses and 5.1% for units.

Property prices

Across the past 30 days to 1 September 2024 national residential property listings decreased by 2.3%, comprising of a 5.4% increase in new property listings, 2.2% decrease in old listings and 1.1% increase in distressed listings. Melbourne recorded the largest monthly decrease in total listings, falling by 3.5%, driven by the AFL Grand final weekend.

Nationally, asking prices have increased slightly across the past 30 days, with a 0.5% increase in median asking prices for houses to $940,235 and a 1.6% increase in median asking prices for units to $565,497. Compared to this time last year, median asking prices have increased by 7.8% for houses and 10% for units.

Across capital cities, median asking prices increased by 0.8% for houses to $1,401,839 and 1.3% for units to $699,510. Compared to this time last year capital city average asking prices increased by 8.3% for houses and 9.1% for units.

Decreases were seen in Canberra and Hobart house prices by -0.5% and -0.4% respectively.

Louis Christopher, Managing Director of SQM Research said, “Overall, listings activity was mixed in September due in part to a decline in Melbourne listings, driven by the AFL Grand final weekend, just past. Overall counts of properties listed in the national market are very similar to levels recorded this time, last year.

Cash rate and predictions

On 28 September 2024, the RBA held the cash rate target at 4.35% stating, “Inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance. But inflation is still some way above the midpoint of the 2–3 per cent target range… While headline inflation will decline for a time, underlying inflation is more indicative of inflation momentum, and it remains too high. The most recent projections in the August SMP show that it will be some time yet before inflation is sustainably in the target range.”

Disclaimer: The information enclosed has been sourced from SQM Research and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.