The national residential vacancy rate has fallen to the lowest rate since 2006, sitting at 0.9%. Over the past month to the 4th of October, weekly asking rents have increased by 1% for houses and 1.1% for units. Compared to the same time last year, Sydney home asking prices have decreased by 0.8%. Whereas in Brisbane, prices have increased by a substantial amount at 23%. The cash rate has increased further, while the Australian dollar dipped slightly.

Vacancy rates

The national residential vacancy rate has fallen to the lowest rate since 2006, sitting at 0.9%. This rate has been consistently low over the past six months and has been present throughout the majority of Australia. Accordingly, it sits at unprecedented levels.

Australia-wide, the number of rental vacancies has fallen to 32,948 residential properties over August. This is a significant drop from 36,741 in July. Rates in Sydney and Melbourne dropped from 1.5% and 1.6% in July to 1.3% and 1.4% in August. Adelaide, Perth, and Canberra saw rates sitting well below 1%.

Louis Christopher, Managing Director of SQM Research said, “The national housing rental crisis has further deteriorated to unprecedented levels. And rental listings thus far recorded in September would suggest another fall in rental vacancy rates for the current month. I note the recent alerts and warnings issued by the various housing bodies as to what is happening on the ground and our data would concur with such concerning reports.”

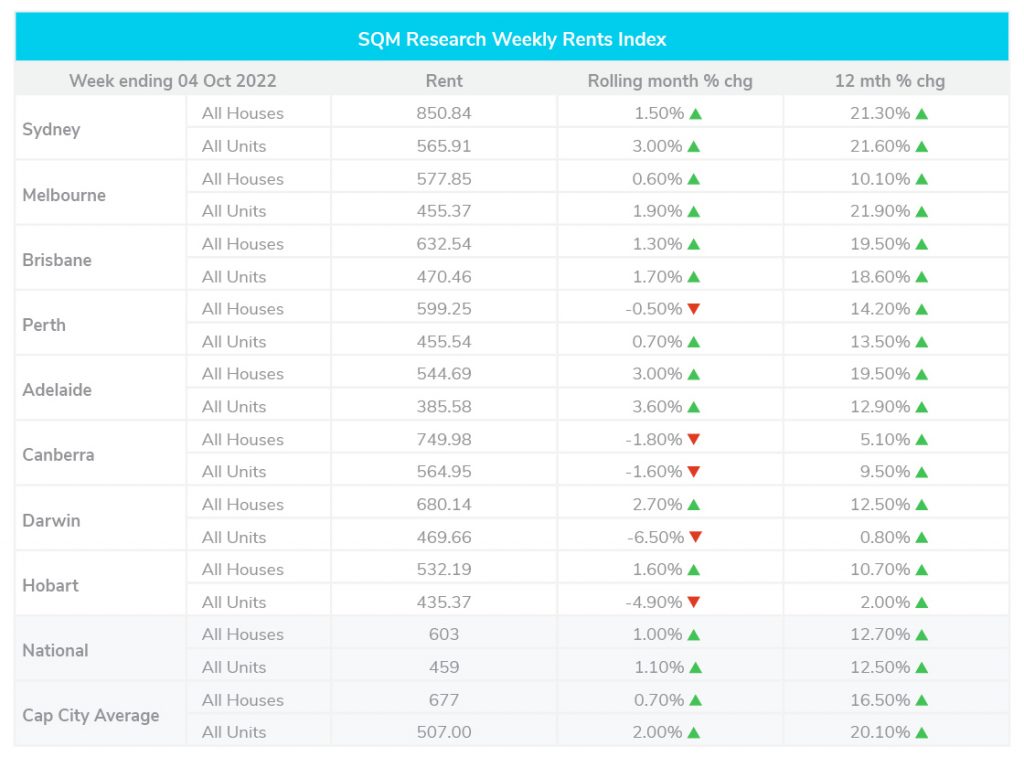

Rental values

Over the past month to the 4th of October, weekly asking rents have increased by 1% for houses and 1.1% for units. Compared to the same time last year, rents have increased by 12.7% for homes and 12.5% for units.

Over the month, Sydney saw a jump of 1.5% for houses and a significant 3% increase for units. Melbourne saw a slight increase for houses at 0.6% and 1.9% for units. Perth and Canberra both saw a drop in house rents at -0.5% and -1.80% respectively. Hobart, Darwin and Canberra also saw a drop in unit rents over the month at -4.9%, -6.5% and -1.6%.

Louis Christopher, Managing Director of SQM Research highlighted, “Asking rents continue to rise across the country at a red-hot pace… All capital cities are recording double-digit percentage rental increases over the past 12 months.”

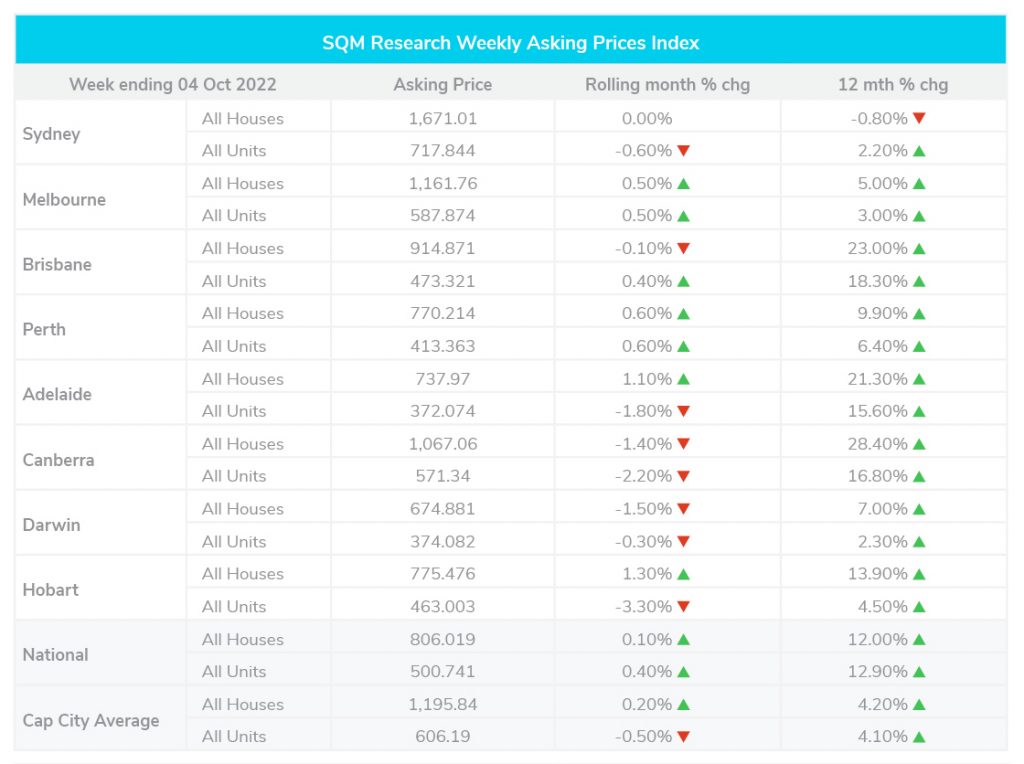

Property prices

Over the past month, property prices have risen by 0.1% for homes and 0.4% for units nationally. During this period, Sydney saw no change in house prices, and a 0.6% decrease in unit prices. Melbourne saw a 0.5% increase in both units and homes. While Brisbane saw a slight 0.1% decrease for homes and a 0.4% increase for units.

Compared to the same time last year, Sydney home asking prices have decreased by 0.8%. Whereas in Brisbane, prices have increased by a substantial amount at 23%. Melbourne has seen a slight increase over the year at 5%.

Louis Christopher, Managing Director of SQM Research said, “there are currently more sellers than buyers in the national housing market… New listing numbers are actually down on the long-term average activity recorded for a typical spring selling season.”

Cash rate and predictions

On Tuesday, the RBA raised its cash rate to 2.6%. An increase of 25 basis points. This is half the amount predicted by forecasters. Accordingly, the Australian dollar has dipped by about half a cent to approximately 64.6 US cents.