October 29th, 2025

Australian residential property market now worth $12 trillion

Industry News

Industry News

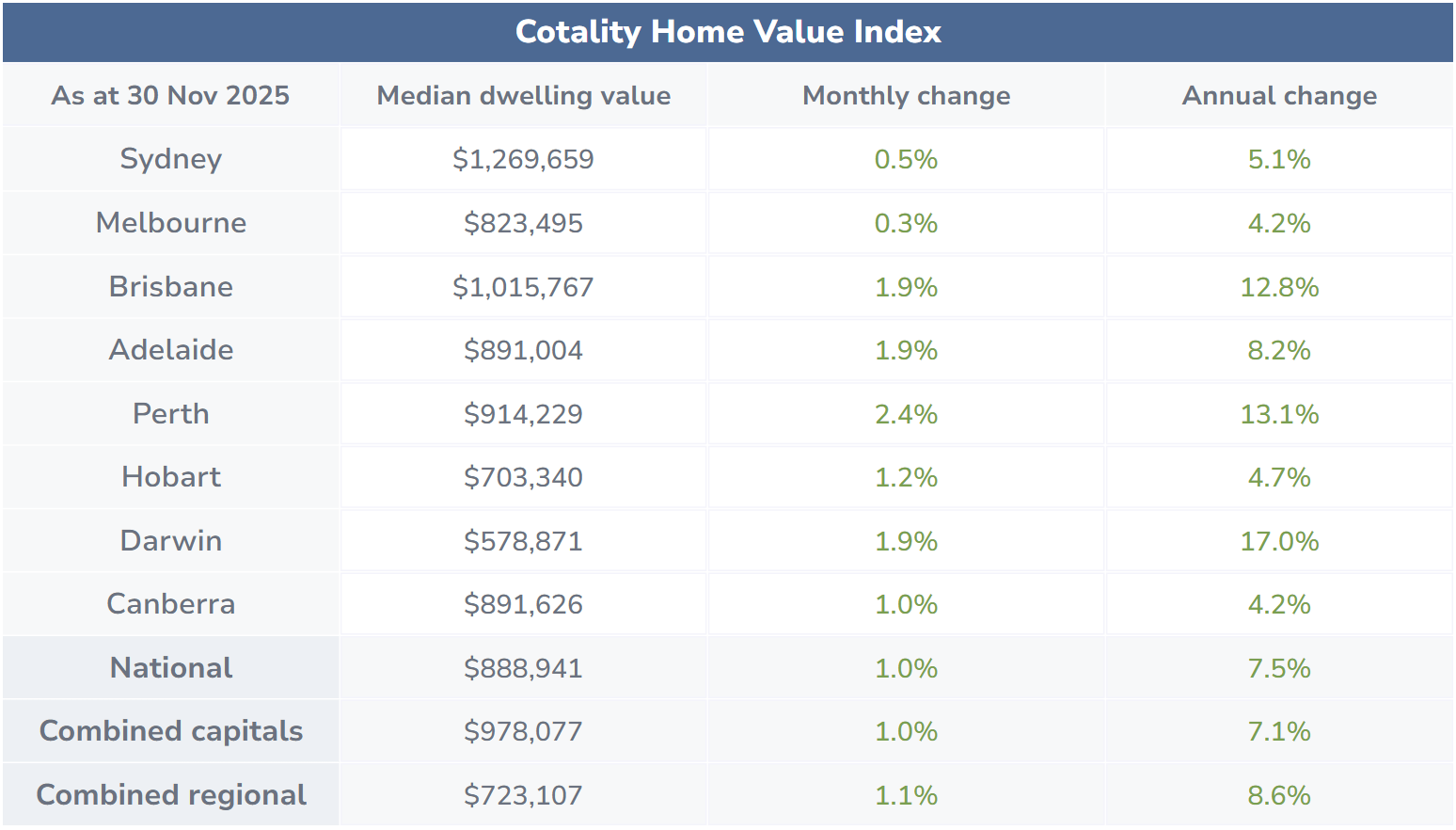

Australian housing values rose by 1.0% in November 2025, according to the latest data from Cotality. Prices are now up 7.5% over the year, reaching a median dwelling value of $888,941. This marks the third month in a row where home values have jumped by one per cent or more. Still, the pace has eased slightly from October’s 1.1% rise.

Every capital city except Sydney and Melbourne recorded at least 1.0% growth in November. Sydney values lifted 0.5% to $1,269,659, while Melbourne edged up 0.3% to $823,495, the smallest gain of all capitals. This flips the long-running story of the two powerhouse property markets leading the pack.

Across the capitals, both house and unit markets showed growth, with the exception of Canberra units, which slipped by 0.1%. National house prices rose by 1.1% and unit prices increased by 0.9%.

Perth was the top capital city for houses in November 2025, rising by 2.4% and reaching a median house price of $955,832. Meanwhile, Hobart led the unit market, with values increasing by 2.6% to a median price of $567,828.

Perth led the country with 2.4% growth in November, pushing its median dwelling value to $914,229. It was the only capital city to record more than 2% growth for the month.

Buyer demand remains strong, with listings more than 40% below average. The 2.4% monthly rise added just over $21,000 to the median price, which works out to about $5,000 each week.

The last time a capital hit more than 2% growth in a single month was Darwin in July 2025.

Over the past 12 months, Darwin still holds the top spot with 17% annual growth, followed by Perth at 13.1%. These results highlight how mid-sized capitals continue to perform better than the larger cities, reshaping the usual east-coast-led housing narrative.

The RBA kept the cash rate at 3.60% at its final meeting of 2025, as widely expected. The tone of the RBA Governor’s comments at the post-meeting press conference was widely interpreted as tilting the chances towards a rate hike in 2026.

“It does look like additional cuts are not needed,” RBA Governor Michele Bullock said.

“I don’t think there are interest rate cuts on the horizon for the foreseeable future. The question is, is it just an extended hold from here or is it the possibility of a rate rise?”

Tim Lawless, Cotality’s Research Director, said a cash rate pause could impact the heat in the market.

“With inflation once again above the RBA’s target range and rates potentially on hold for the foreseeable future, it’s likely housing sentiment will suffer,” he said.

At 3.6%, the cash rate is still more than a percentage point above the pre-COVID decade average of 2.55%. Even so, property prices have surged by 7.2% since the first 2025 rate cut was handed down in February.

Looking ahead, the potential long pause on the cash rate, along with stretched affordability, is expected to ease home-buying demand and price growth as we enter 2026. On the flip side, low supply levels and government incentives for first-home buyers are likely to prop up momentum in the market.

—————–

Disclaimer: The information enclosed has been sourced from Cotality and the Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.