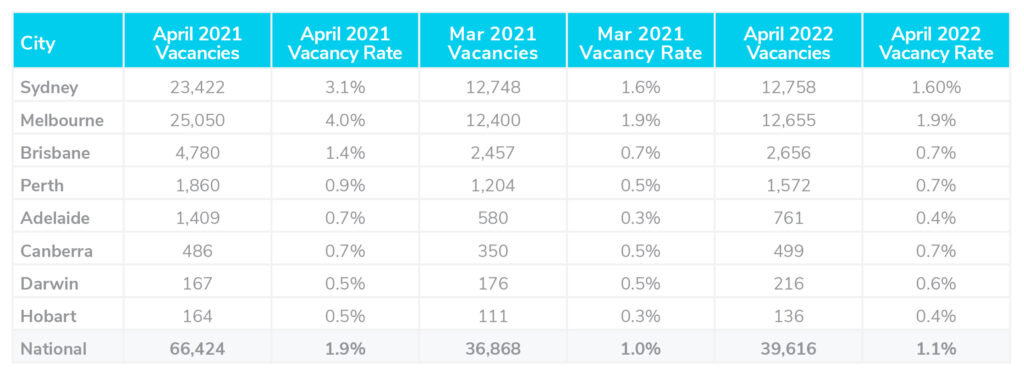

The latest research reveals the national residential property rental vacancy rates increased to 1.1% in April 2022, up from 1% in March. Across Australia’s regional areas, vacancy rates remained tight with the average rate sitting well below 1%. The RBA is expected to raise interest rates further from 0.35% once again in June.

Vacancy rates

The latest research reveals the national residential property rental vacancy rates increased to 1.1% in April 2022, up from 1% in March.

Over April, vacancy rates remained steady in Sydney, Melbourne and Brisbane at 1.6%, 1.9% and 0.7%. There was a slight increase in vacancy rates across Perth, Adelaide, Canberra, Darwin and Hobart sitting at 0.7%, 0.4%, 0.7%, 0.6%, and 0.4%. In Melbourne CBD, vacancy rates increased from 2.4% to 2.9% while in Sydney CBD rates rose from 3.4% to 3.5%.

Across Australia’s regional areas, vacancy rates remained tight with the average rate sitting well below 1%.

Louis Christopher, Managing Director of SQM Research said, “Rental conditions slightly improved for tenants over April and our weekly rental listings for May suggest another slight easing. Potentially more property owners are responding to the tight rental market and are looking to lease their properties once again after taking their investment property off the market during the bleakest periods of Covid.”

Rental values

Over the month till the 28th of May, rental values dropped for houses by 0.3% and remained unchanged for units at 0%. Sydney, Brisbane, Melbourne, Darwin and Hobart all saw an increase in vacancy rates for houses and units. While Perth, Adelaide and Canberra each saw a decrease in values over the month for units at 0.4%, 0.2% and 0.1% respectively.

Compared to the same time last year, rents have increased by 14% and 11.7% for houses and units. During this period, the greatest increases have been seen in Brisbane, where the house rents have increased by 21.7%, Sydney, which saw an increase of 21.3% and Adelaide, which has seen an increase of 19.9% for house rents.

Louis Christopher, Managing Director of SQM Research said, “while it’s way too early to state the worst is over for the national rental market, we may be close to that point. Clearly, landlords remain confident as they lifted their asking rents by another 1.4% over the past 30 days.”

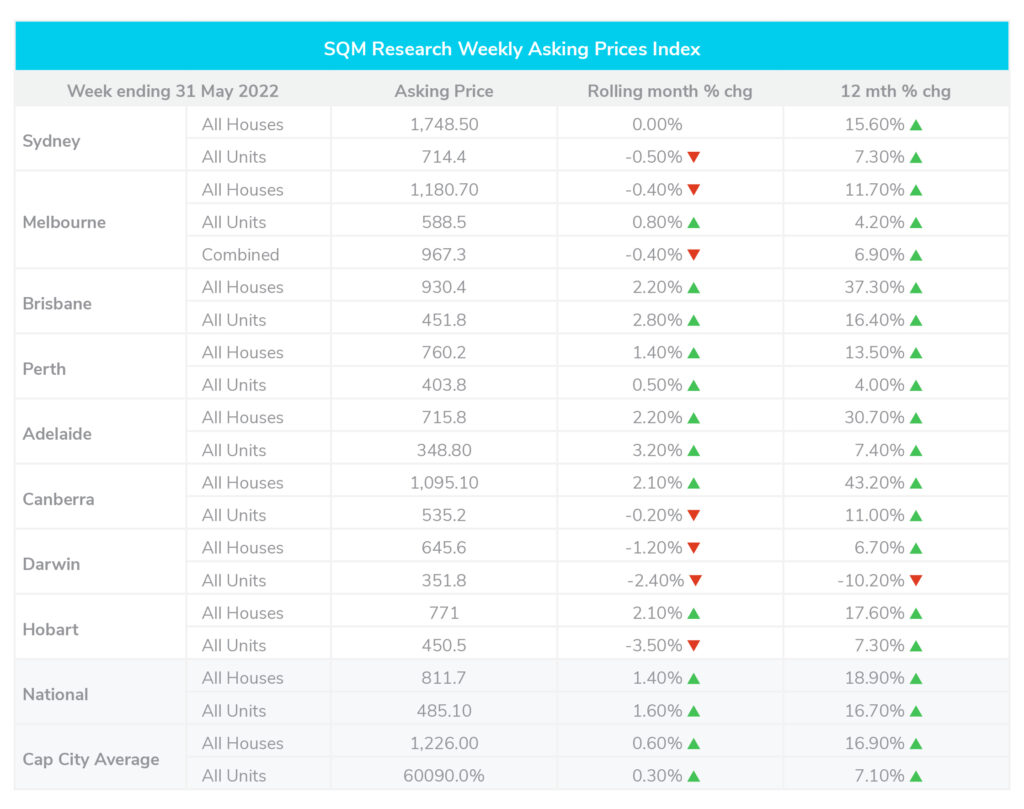

Property prices

Over the month till the 31st of May, property prices rose by 1.4% for houses and 1.6% for units. The greatest increases over the month were seen in Brisbane, where prices rose by 2.2% for houses and 2.8% for units, as well as Adelaide, where prices increased by 2.2% for houses and 3.2% for units.

Compared to the same time last year, prices increased by 18.9% for houses and 16.7% for units Australia-wide. In capital cities specifically, prices have risen by 16.9% for houses and 7.10% for units over the year.

Cash rate and predictions

The RBA is expected to raise interest rates further from 0.35% once again during their meeting in the second week of June. Accordingly, economists are warning Australians to begin restricting their spending to keep up with the increasing rates.