July 12th, 2022

10 tips to deal with challenges and conflict as a Property Manager

Property Management

Industry News

The national residential property rental vacancy rates remained unchanged over the month at 1%. Over the month to 6 September 2022, asking prices across Australia rose by 0.3% for houses and remained unchanged for units. The RBA has raised the cash rate by 0.5% for the fourth month in a row bringing the cash rate to 2.35%.

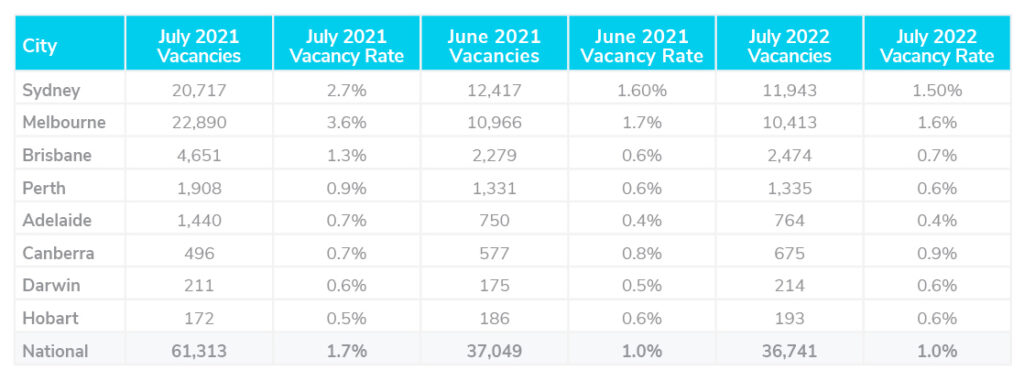

The national residential property rental vacancy rates remained unchanged over the month at 1%. Nationwide there were 36,741 rental vacancies reported on August 15th. A slight drop from June.

In Sydney and Melbourne, rates dropped to 1.5% and 1.6% from 1.6% and 1.7%. The CBDs across Brisbane, Sydney and Melbourne all sank to below-average levels at 2.2%, 3.4% and 2% respectively. SQM Research suggests this may be due to the increase in international arrivals seeking inner city properties. Brisbane, The Gold Coast and the Sunshine Coast all recorded increased vacancies. However, this is a slight jump from the previously tight rates.

Louis Christopher, Managing Director of SQM Research said, “We appear to be recording more evidence of a small easing in rental conditions… That said, the rental market by and large remains very tight. And now, with the falls in CBD rental vacancy rates to well below average, we have evidence that the rise in overseas arrivals is starting to put some additional demand pressure in certain pockets of the rental market.”

Over the past month to the 4th of September, national rental values increased by 2.2% for houses and 0.7% for units. The greatest increase in house rents was seen in Hobart at 2.3%, followed by Melbourne (1.2%), and Adelaide (1.1%). Canberra saw a drop of 0.6% for houses over the month while all other states saw a slight increase.

In Sydney, house rents rose by 0.9% while units rose by 2.8%. Similarly, Brisbane saw an increase in unit rents at 2.7%. Melbourne units saw an increase of 0.9%. The greatest rise was seen in Darwin growing by 5% for units over the month.

Louis Christopher, Managing Director of SQM Research highlighted, “Rents continue to sharply rise in most locations, albeit SQM is now recording falls in rents for Canberra, Hobart and Darwin, which will at least provide some relief to local tenants.”

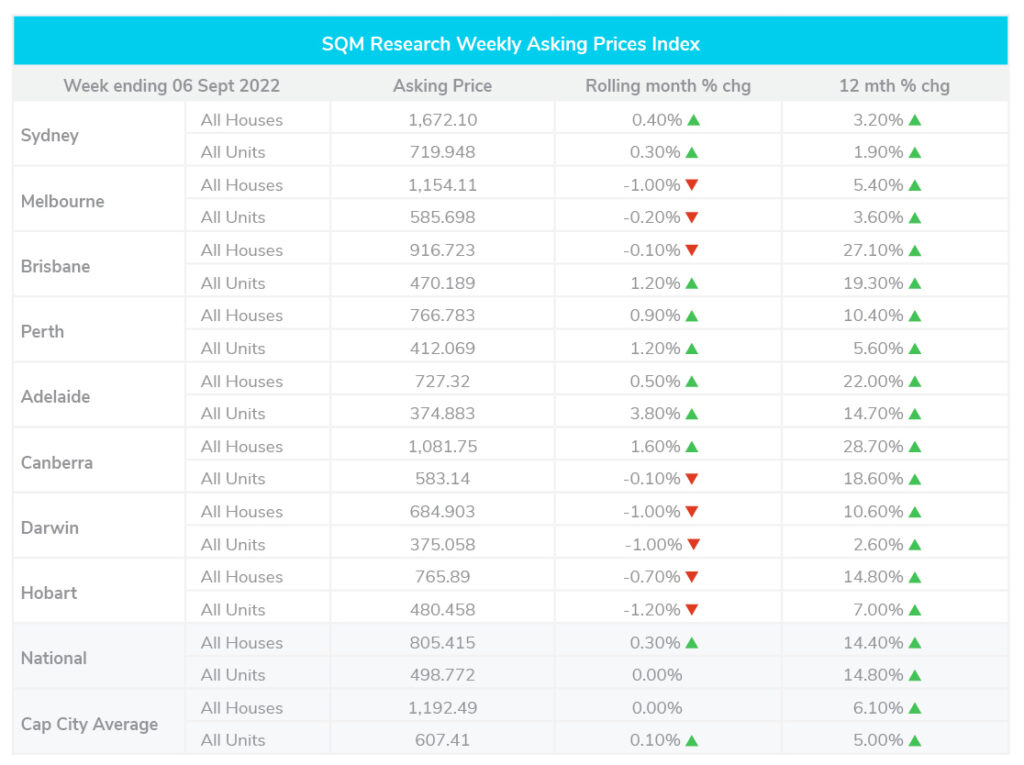

Over the month to 6 September 2022, asking prices across Australia rose by 0.3% for houses and remained unchanged for units.

Canberra saw the greatest increase in prices over the month at 1.6%, followed by Perth (0.9%), Adelaide (0.5%), and Sydney (0.4%). Meanwhile, Darwin and Melbourne saw a drop of 1% in house prices over the month. Hobart also saw a drop of 0.7% followed by Brisbane at 0.1%.

Compared to the same time last year, house prices have grown by 14.4% while units have risen by 14.8%. Canberra and Brisbane saw the greatest house prices increase over the year at 28.7% and 27.1% respectively. In contrast, Sydney and Melbourne saw an increase of just 3.2% and 5.4% over the same period.

Louis Christopher, Managing Director of SQM Research said, “Property listings surprisingly fell over the month of August right across the country. Normally August is a month when listings start to rise ahead of the spring selling season. It would suggest to me spring is going to be weaker on the activity front. Vendors are clearly cautious to sell in this environment and there is no panic selling at this stage.”

The RBA has raised the cash rate by 0.5% for the fourth month in a row bringing the cash rate to 2.35%. This is the highest it has been since early 2015. RBA governor Philip Lowe stated the board “expects to increase interest rates further over the months ahead“.