September 28th, 2022

4 ways to make your rental property feel like your home

Tips & How to's

PropertyMe

With the recent rise in hacking and scams, it’s no surprise that Australian renters are more concerned about sharing data now than they were 12 months ago. Specifically, a recent survey of over 1,000 Australian tenants revealed that 75% of renters are more concerned than they were a year ago.

As a tenant in Australia, it’s a good idea to be mindful of the potential risks that come with sharing personal data when renting a property.

It’s important to be aware of how your personal data is collected, used, and stored as a renter.

Did you know when renting in Australia, your personal data, like your contact information and rental history, can be retained by your agent indefinitely? 78% of those surveyed were not aware of the fact that their agent can hold their data, even after they are no longer a tenant.

With the rise in hacking, scams, and data leaks, 75% of renters are more concerned about sharing data now than they were 12 months ago. Unsurprisingly, 90% of these respondents noted they’re more worried now because of the recent high-profile data breaches in Australia.

In terms of what data they are most uneasy about sharing, 41% of those surveyed noted they are most concerned with sharing their bank account details. This concern is understandable as scammers and hackers have been known to use this information to access bank accounts. Therefore, it’s a good idea to be sure that the payment methods used by your landlord or Property Manager are secure and legitimate.

With so much on your plate already, it can be frustrating to now also have to worry about ensuring your data, finances, and bank details are kept secure.

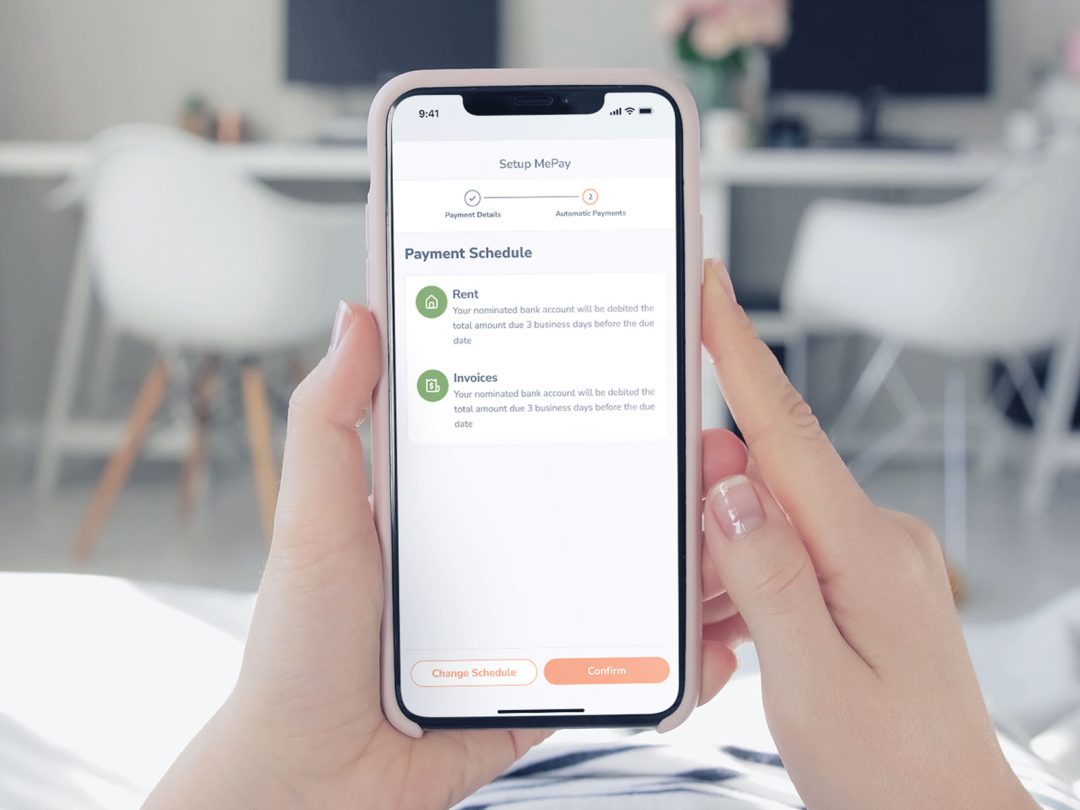

We created MePay to help Australian renters enjoy more security around their rental payments and finances, without having to undertake a vast amount of admin, nor add yet another 100 things to their to-do list.

Accordingly, our top tip to ensure your data is secure is to check if your property management agency has activated MePay inside the PropertyMe app.

In the aforementioned survey, when respondents were asked “if you could pay your rent using a secure platform, with no associated fee, would you prefer to use this method than bank transfer/cash/cheque?” 61% of renters noted they would prefer a secure platform to pay rent.

MePay is currently the only rental payments system in Australia that does not charge tenants (nor owners or Property Managers) any fees on direct debit while ensuring payments are made securely. Additionally, MePay offers:

Overall, MePay streamlines the rent payment process for both tenants and Property Managers, while also increasing security and providing greater transparency.

To get started with MePay, simply contact your Property Manager to check if MePay is available on your PropertyMe mobile app. Once you’re set up, you can choose between automatic recurring payments or one-time payments, whatever suits you best.

Some other steps you can take to ensure the security of your data include:

Please note: MePay is currently only available to Australian Real Estate Agents and tenants.

Disclaimer:

This content relates to the MePay payment product and has been prepared by MePay Holdings Pty Ltd (ABN 55 638 819 575 / AFSL no 528836) (MePay Holdings). Any financial services provided in relation to MePay (including the issue of MePay) are provided by MePay Holdings. To the extent any information provided to you in this content constitutes financial product advice, such advice is general advice only and has been prepared without taking into consideration your objectives, financial situation or needs. You should consider your needs prior to acting on any advice or making any financial decisions and seek independent financial advice regarding your own personal circumstances. Cooling-off rights do not apply to MePay. A product disclosure statement (PDS) has been issued by MePay Holdings for MePay and is available at https://propertyme.com.au/mepay/pds. The PDS explains the features, risks and benefits of the service and you should consider it in deciding whether to use the product.