October 11th, 2022

5 questions you may have as a renter in Australia

Tips & How to's

Market Insights

Here’s everything you need to know about the rental market right now if you’re renting in Sydney, Melbourne, or Brisbane.

We all know Australia is in the midst of a rental crisis — but just how limited is the supply of properties?

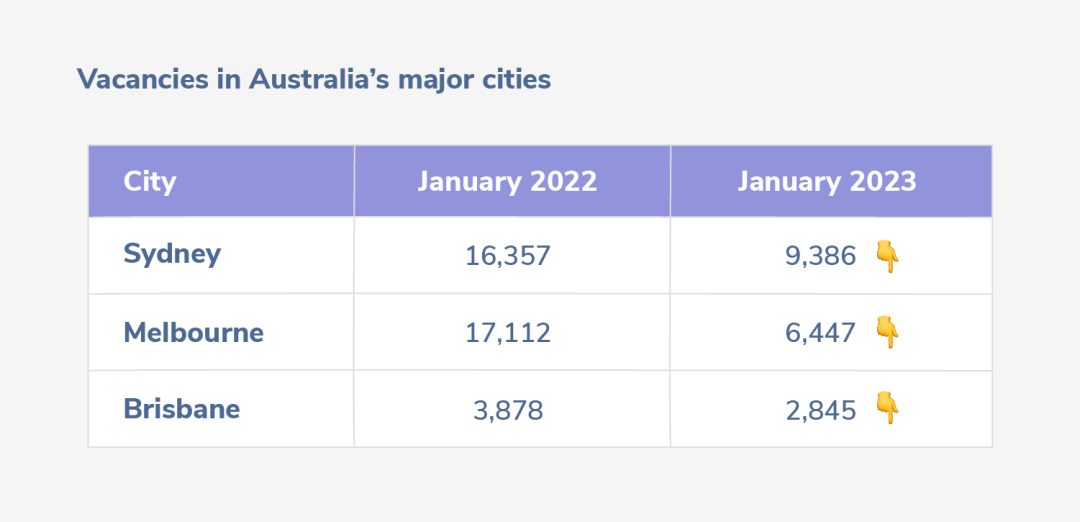

To get a better idea, we can compare the number of properties available for rent today versus one year ago. Specifically, there are now approximately 17,000 fewer properties for rent compared to 12 months ago, according to SQM Research.

Unsurprisingly, vacancy rates have dropped back to record lows, sitting at just 1%. The slight rise in vacancy rates over December 2022 did not last long.

In terms of vacancy rates, every city in Australia except Hobart recorded a drop. SQM Research suggested this fall was likely due to the increased demand from international students early in 2023.

The median weekly cost for a dwelling in Sydney was recorded at $757 — a whopping 32% increase over the past year.

This sharp increase in rental prices is reflected in the 1.3% vacancy rate.

With such low vacancy rates, it’s no surprise there’s a drastic rise in demand and prices.

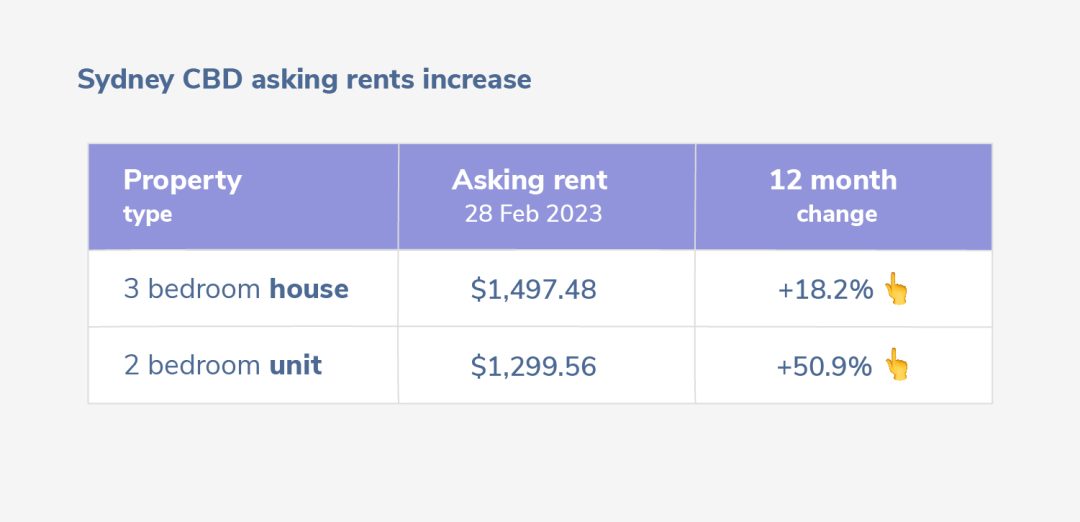

But just how much are asking rents rising?

Some areas are noticing an increase of over 50% compared to the same period 12 months ago.

For example, the average weekly asking rent for a 2-bedroom unit in Sydney CBD sat at $1,103 in December 2022. If you were looking to rent the same property today, this now sits at $1,299 – a giant increase of over 50.9% from one year ago (as of 28 Feb 2023).

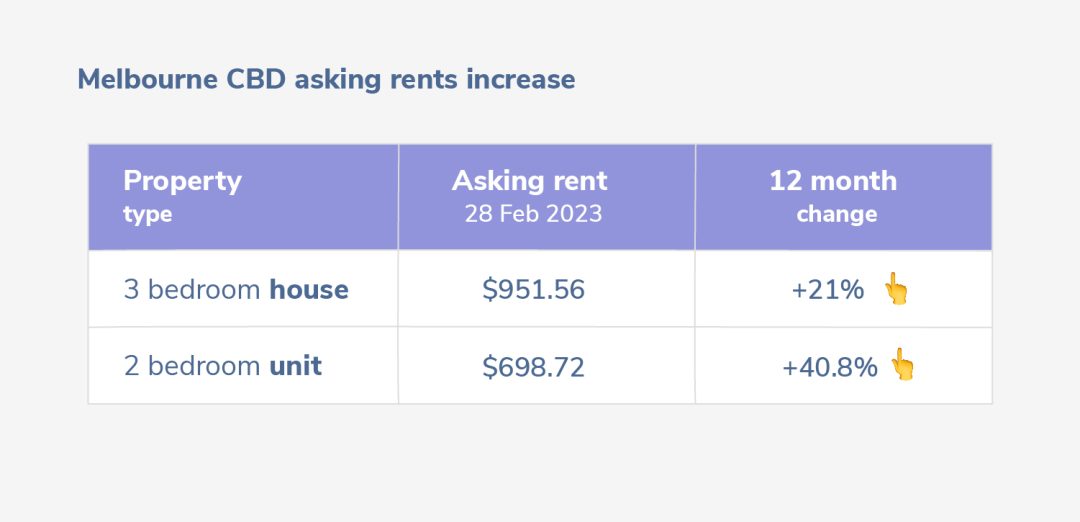

The median weekly cost to rent a house in Melbourne is $638, while the average unit cost is $493.

Overall, the cost to rent across units and houses combined has risen by 26% in Melbourne over the past year.

Over January, the vacancy rate was recorded as being slightly lower than Sydney’s – sitting at 1.2% in Melbourne.

The number of available vacancies in Melbourne has dropped substantially. There are currently just over a third of properties available now compared to a year ago – specifically, there are now 10,665 fewer properties.

Each of the major cities saw a decline in the number of available vacancies compared to the same period a year ago.

One of the biggest increases in rental prices can be seen in Melbourne CBD where the median weekly price of renting an apartment hit $642 – a 44% increase compared to one year ago, according to SQM Research.

In other news, Melbourne also saw a drop in its “liveability” rating. According to the Economist Intelligence Unit’s (EIU) annual survey of the world’s most liveable cities — Melbourne isn’t what it used to be.

From 2002 – 2019, Melbourne was ranked as one of the top three places to live in the world. However, over the COVID-19 period, Melbourne has lost its spot. Dropping to tenth place.

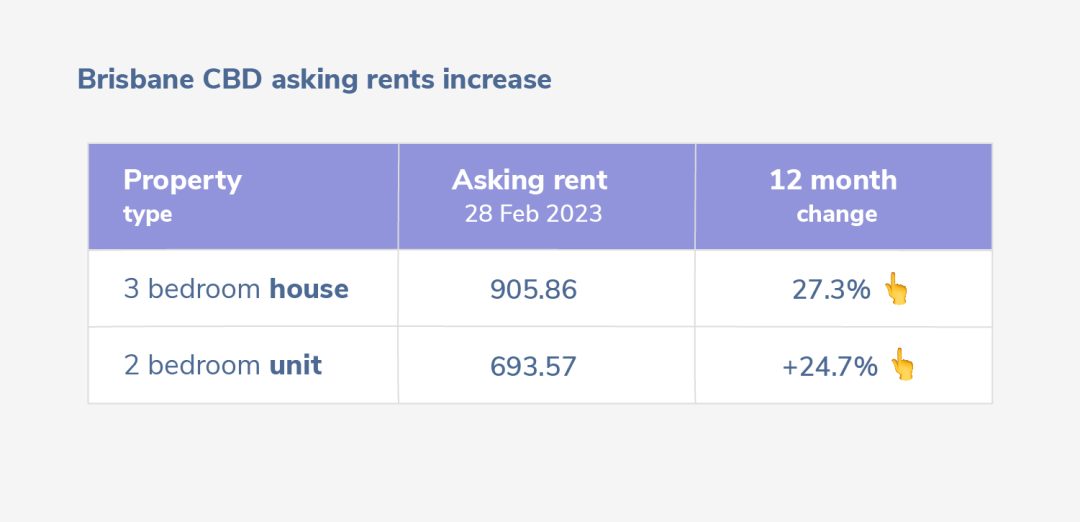

The median weekly cost for a dwelling in Brisbane was recorded at $604 – a 26% increase compared to one year ago.

The lowest rate out of the three major capital cities was recorded in Brisbane, sitting at 0.8% in January 2023.

The table below shows the difference in asking rents for houses and units in Brisbane’s CBD.

Louis Christopher, Managing Director of SQM Research highlighted, “We are expecting a further tightening in rental vacancy rates over… February”. He continued, “the months of February and March will be the most difficult time for tenants in the national rental market in many years.”

On the other hand, however, Louis Christopher noted, “Thereafter we are hoping for some relief given the expected increases in dwelling completions and an overall reduction in housing formation.”

Like us to include anything specific in our update? We’re always open to hearing your ideas! Email us at [email protected].

About the data:

The findings in this report are based on the latest insights from SQM Research as of 2 March 2023. SQM Research is an independent investment research institute that specialises in providing accurate property market data. It is operated by one of the country’s leading property analysts, Louis Christopher.