September 28th, 2022

4 ways to make your rental property feel like your home

Tips & How to's

Market Insights

Here’s everything you need to know about the rental market right now if you’re a tenant in Australia.

Over the past month, the number of rents available in Australia has risen by 448 dwellings reaching 32,040 residential properties.

The median weekly cost for a dwelling in Sydney was recorded at $777 — a 2.8% increase over the past month.

Vacancy rate

This sharp increase in rental prices is reflected in Sydney’s 1.3% vacancy rate.

Sydney vacancy rate: 1.3%

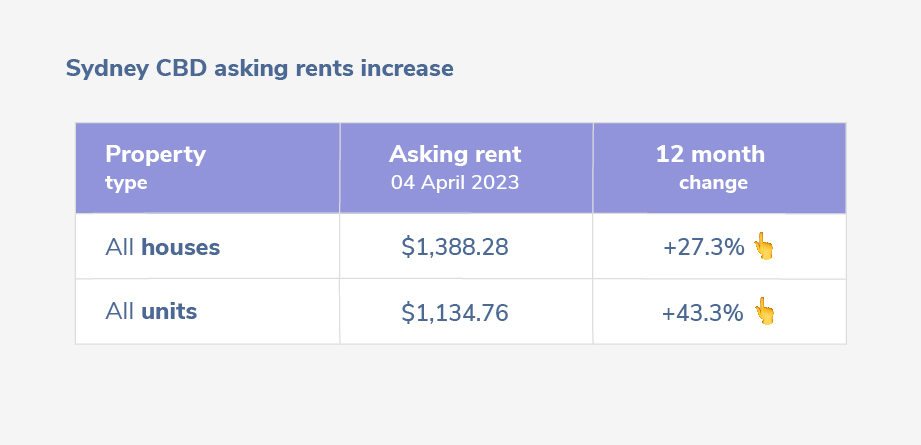

Compared to the same period 12 months ago, the average weekly asking rent for a house in Sydney has increased by 27% over the past year. While the asking rent for a unit has increased by 43% across Australia during the same period.

Table 1: Sydney CBD asking rents increase

Source: https://sqmresearch.com.au/weekly-rents.php?postcode=2000&t=1

Melbourne was the only city to record a fall in rental vacancies over the month.

The median weekly cost to rent a house in Melbourne is $659, while the average unit cost is $512.

Overall, the cost to rent across units and houses combined has risen by 23% in Melbourne over the past year.

Vacancy rate

Over February, the vacancy rate was recorded as being slightly lower than Sydney’s — sitting at 1.1% in Melbourne.

Melbourne vacancy rate February 2023: 1.1%

Number of available properties

The number of available properties in Melbourne has dropped substantially. Over the past month, only 5,545 properties were recorded as vacant. During the same time last year, the number of vacant residential properties sat at 14,777.

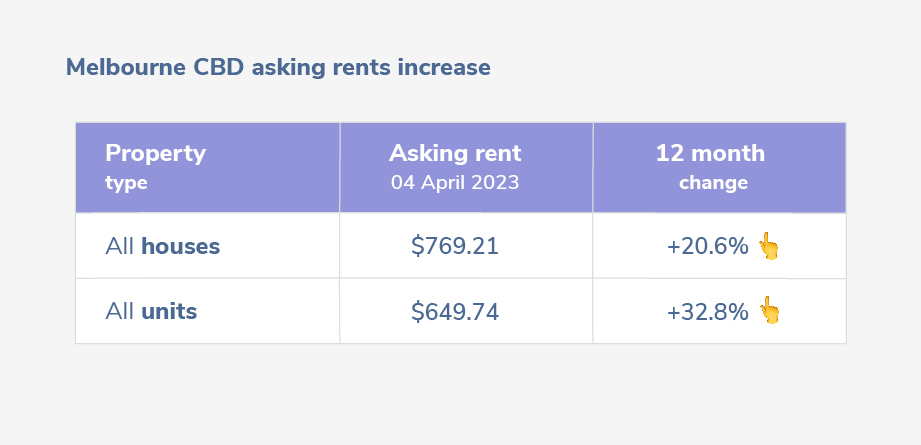

The cost of rentals

One of the biggest increases in rental prices can be seen in Melbourne CBD where the median weekly price of renting an apartment hit $649 — a 33% increase compared to one year ago, according to SQM Research.

Table 3: Melbourne CBD asking rents increase

Source: https://sqmresearch.com.au/weekly-rents.php?postcode=3000&t=1

The median weekly cost for a dwelling in Brisbane was recorded at $604 – a 26 per cent increase compared to one year ago.

Vacancy rate

The lowest rate out of the three major capital cities was recorded in Brisbane, sitting at 0.8% in January 2023.

Brisbane vacancy rate: 0.8%

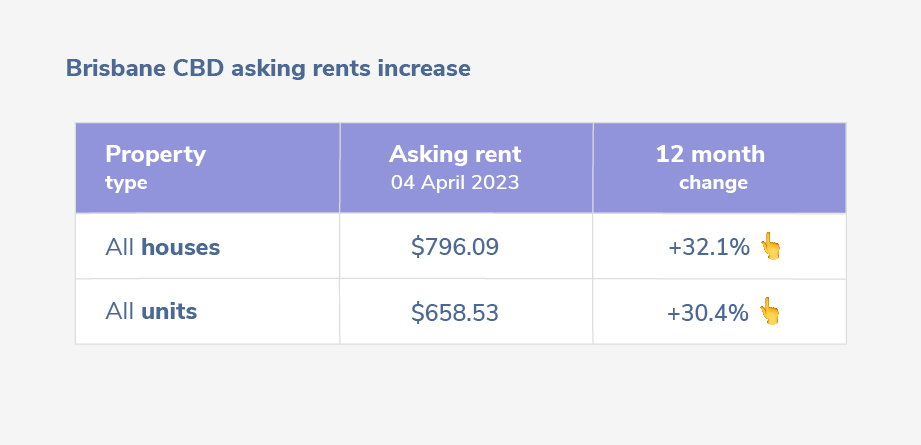

Asking rents

The table below shows the difference in asking rents for houses and units in Brisbane’s CBD.

Table 4: Brisbane CBD asking rents increase

Source: https://sqmresearch.com.au/weekly-rents.php?mode=p&postcode=4000&t=1

The rental crisis is due to a vast number of reasons. Here we explore a few of the many factors influencing the market right now.

The housing shortage: failing to keep pace with a growing population and household formation

Household formation refers to the rate at which new households are formed. For example, when Sam and Johnny broke up, they decided to go their separate ways and live alone for a while, splitting the house up into two separate households rather than the one when they were still together.

There are many factors that lead to growth in new households. One theory posed by the Australian Housing and Urban Research Institute is that there was an increase in single-person households due to the breakdown of relationships and sharehouse situations over COVID-19.

Specifically, between the 2016 and 2021 Censuses, there was a large 17.1% surge in single-person households, which has been partly attributed to relationship breakdowns due to COVID-19 lockdowns. This is a stark contrast to the 7.1% increase recorded between the 2011 and 2016 Censuses.

The increase in the number of new residential homes failed to keep pace with the growth in new households. Only a 10.6% rise (equivalent to around 198,000 new dwellings per year) was recorded, which means that the demand for housing outstripped supply.

The impact of international borders reopening on rental housing in Australia

During the COVID-19 pandemic, international restrictions provided temporary relief to the lack of rental housing in Australia, resulting in high vacancy rates in Sydney and Melbourne.

The impact of short-term rental on rental housing in Australia

Short-term rental services like Airbnb are a contributing factor to the current housing market challenges in Australia. While these platforms are not significantly affecting rental affordability across major cities, they are impacting the availability of rental properties in high-demand inner-city areas with significant tourism appeal.

Louis Christopher, Managing Director of SQM Research stated, “Could we be seeing some light at the end of the tunnel for our national rental crisis? Perhaps for some cities and regions, yes. However, we still remain very concerned for the situation in Melbourne, Sydney and Brisbane where most international arrivals first land.”

Louis Christopher also noted, “I was expecting a decline in rental vacancy rates over February. However, the result came in steady and indeed we recorded sharp rises for some regions. Further, I think we now have hard evidence that the rental crisis is now easing in Canberra, Darwin and Hobart. It isn’t just February we have recorded rises in these cities; they are also up compared to this time in 2022.”

About the data:

The findings in this report are based on the latest insights from SQM Research as of 14 March 2023. SQM Research is an independent investment research institute that specialises in providing accurate property market data. It is operated by one of the country’s leading property analysts, Louis Christopher.