October 6th, 2022

5 questions first-time Property Investors should ask

First time investors

Market insights

Here’s what you need to know about the rental market right now if you’re looking to invest in the Australian property market.

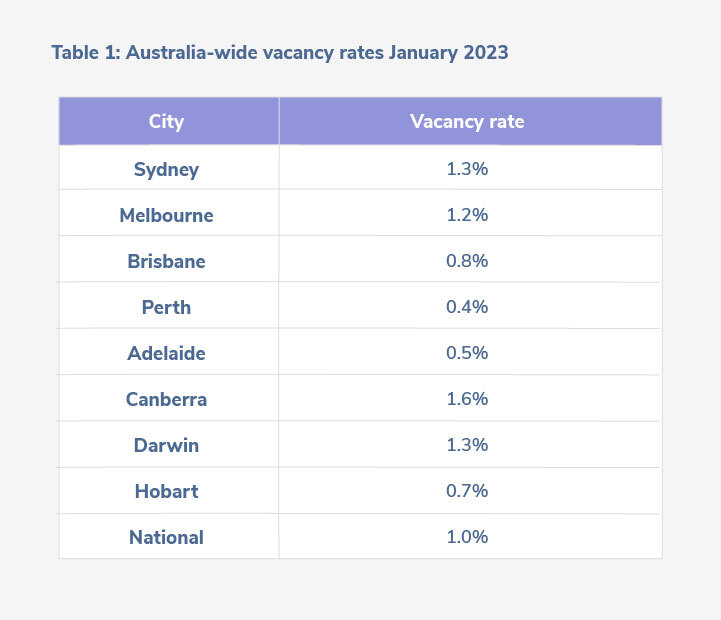

With limited rental supply, vacancy rates have dropped back to record lows of 1%.

Rental vacancies briefly rose in December due to seasonal factors. However, the national rental market has rapidly returned to its highly competitive state, and it is anticipated that it will remain tight or potentially worsen in February and March.

The influx of net overseas arrivals on a long-term or permanent basis, compared to the limited supply of new residential properties, is contributing to the ongoing tight rental conditions for the foreseeable future.

How does your city stack up?

Major cities

Sydney, Melbourne, Perth, Brisbane, and Canberra experienced a decline in their vacancy rates, returning to previous record lows or slightly above them. In contrast, Hobart was the only city to see an increase in its vacancy rate, rising from 0.6% to 0.7%.

Regional areas

In January, many regional areas saw decreased rental vacancy rates, including Sydney’s Blue Mountains, Melbourne’s Mornington Peninsula, and Queensland’s Toowoomba.

The median weekly asking rent for a dwelling across the country stands at $562. Sydney has the highest weekly rent for a house, which is recorded at $913. On the other hand, Adelaide’s units provide the most affordable rental options among all the capital cities, with a weekly rent of $401.

Louis Christopher, “The ongoing surge in rents is pushing up rental yields, especially with falling prices.”

Your opportunity to invest?

Louise Christopher noted if the cash rate were to peak below 4% there could be a potential opportunity for investors in the latter part of 2023.

“I believe ‘would-be’ investors will be attracted to higher rental yields in later 2023, provided the cash rate peaks at below 4%,” Louis Christopher outlined.

“However, if the cash rate rises above 4% it is likely home buyers including investors will largely stay away from the housing market for another year, and so investment dwelling approvals will remain in the doldrums, setting us up for another super tight rental market in later 2024 and 2025.”

Over February, asking prices for combined dwellings increased slightly by 0.2% nationally. Meanwhile, asking prices in capital cities fell by 0.4%.

Despite the ongoing downturn, asking prices have remained relatively stable compared to actual prices, which could explain the significant decline in property volumes and clearance rates due to a lack of agreement between buyers and sellers.

Louis Christopher, Managing Director of SQM Research highlighted that despite the housing downturn, many sellers are not willing to “meet the market.” He continued, this can be seen in “the lower-than-average counts of new stock entering the market for February and what sellers are there, continue to hold the line on their asking price.”

He warns, “sellers do need to understand the market is unlikely to catch up to their asking price at this present point in time. Only a minority of sellers recognise this, hence why there has been a rather large rise in older listings.”

How much does the average property cost in Australia?

The average asking price for a house in Australian capital cities was $1.21 million at the end of February, according to SQM Research. The average asking price for a unit in capital cities was $626,601.

These figures provide a snapshot of the current property market in Australia, but prices can vary widely depending on factors like location, property type, and demand.

The number of property listings that have been available for more than 180 days increased by 5.2% in February 2023 and by 30.3% over the course of the year.

According to the latest report by SQM Research, as of March 1st, 2023, there were 5,917 residential properties being sold under distressed conditions across the country. This represents a decrease of 1.7% from the 6,018 distressed listings that were recorded in January 2023. The decline in distressed selling was primarily driven by decreases in Queensland and the ACT, but NSW saw a significant increase of 6.2%.

Despite this recent increase, distressed listings activity has still surged in NSW by 59.5% when compared to the same time period from the previous year.

Overall, distressed listings have stabilised slightly.

New listings (Less than 30 days) rose by 67.3% over January 2023 to 70,948 properties on the market. However, compared to one year ago, new listings have dropped by 11%.

It’s important to acknowledge that the increase in new property listings was anticipated due to the start of the new property season after a pause in the market during the January school holiday period. In fact, the average number of new listings in the month of February has been 75,460 homes since 2017.

How does your city stack up?

In terms of total listings, every city in Australia recorded a rise in total listings for the month compared to the previous month.

Louis Christopher, Managing Director of SQM Research highlighted “Going forward, I remain cautious on the housing market despite some recent signs prices might be stabilising. Much depends at what point and when the RBA will pause cash rate increases.”

About the data:

The findings in this report are based on the latest insights from SQM Research as of 2 March 2023. SQM Research is an independent investment research institute that specialises in providing accurate property market data. It is operated by one of the country’s leading property analysts, Louis Christopher.

Disclaimer:

Buyers and investors should consider conducting their own research and seeking professional advice before making any property purchases.