It’s no wonder many Australian homeowners are feeling the pinch of increasing interest rates and cost of living. After ten consecutive interest rate rises leading to skyrocketing mortgage repayments, many homeowners are in ‘mortgage stress’.

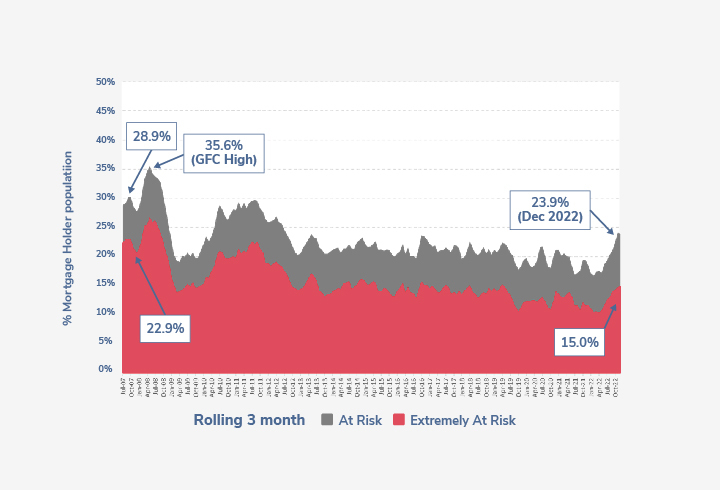

According to research by Roy Morgan, 1.1 million homeowners were reported to be in ‘mortgage stress’ during the final three months of 2022.

37% of Australian homeowners have a mortgage, and with another rate rise tipped in March, Roy Morgan believes households in ‘mortgage stress’ will jump to 1.2 million homes.

This would lead to 1-in-4 families in ‘mortgage stress’ by March.

When will interest rates stop rising?

Economists with the major banks’ have mixed outlooks. But most agree when the RBA stops raising rates, they will remain high until early 2024.

Westpac has come out strongly, predicting the cash rate to hit 4.10% by May 2023 before seven rate cuts during 2024 – 2025. Announcing its change, Westpac sighted the RBA meeting minutes that further increases are likely. CommBank and ANZ have predicted two further increases between March and May before pausing at 3.85%. NAB has followed Westpac’s forecast tipping a rise to 4.10% in May before the RBA pauses. Westpac and NAB’s prediction of 4.10% would see a $227 increase in monthly repayments over the next three months on a $500,000 home loan since last May.

CommBank remains the most optimistic forecast for the RBA’s first cut, predicting November 2023. Westpac and NAB are holding firm for February and March 2024, and ANZ is forecasting no cuts until Melbourne Cup Day in November 2024.

What can you do if your increasing mortgage repayments make you nervous?

To get started, here is what you need to know as a homeowner or investor to get help with your home loan.

Speak to your bank or lender

If you need to catch up on your repayments or cannot make them, your first call should be to your bank, broker, or financial institution.

It’s easier to be upfront and honest with them, as they want to help you get back on track and discuss options to support you.

Usually, your bank or lender will have a dedicated specialist team to assist and guide you.

For example, you may be able to:

- Renegotiate your interest rate,

- Access additional funds in your redraw or mortgage offset account,

- Restructure your home loan by extending the loan term,

- Switch from principal and interest to interest only.

Sometimes, your bank or lender can merge other debts you may have. For example, if you have a car loan or credit card, you could refinance them into your mortgage, reducing your monthly payments. Another way you can reduce your expenses is to review your household budget. Then, as inflation continues to bite, consider where you can make savings. You could consider cutting back on streaming services, ditching your daily coffee, or getting a better deal on your home insurance.

For many households, being realistic about your expenses while maintaining your lifestyle can be challenging, so take time to discuss this with your family.

What happens if you stop making your repayments?

There isn’t a set period when you can let your mortgage repayments fall behind.

Your bank can issue you a default notice the day after your last payment fell due. It’s a letter advising you have an overdue repayment and requesting payment, typically allowing you 30 days to make up your missed payments. However, they may wait until you’re 90 days overdue.

If you do nothing, the bank can issue a summons or Statement of Claim, which is the start of legal action against you. During this time, you can defend yourself or lodge a dispute. If the bank can get a court order to start foreclosing on the property, you will receive a “Notice to Vacate” from the sheriff’s office.

This process varies from state to state in Australia. As mentioned, speaking to your bank or lender is essential to resolving the situation. However, if discussing your circumstances with your bank is overwhelming, contact a financial counsellor to help you.

Are you able to pause your mortgage?

A hardship variation is one way your bank can help you. For example, the bank can pause your repayments, change loan terms, or restructure your loan.

To get started, let the bank know you are having difficulties making repayments as you are in hardship. The bank has 21 days to access your hardship application. You may need to write a letter outlining your situation and why you are in hardship. If you need help with your letter, the Financial Rights Legal Centre has a sample you can use.

When the bank agrees to your application, they may offer you a range of solutions, such as, changing your loan term, or pausing or lowering your repayments. A word of caution, though, if your bank reduces or pauses your repayments, you will still add interest on your loan’s principal. Should your bank or lender decline your hardship request, they must give you a reason in writing.

Contact their internal dispute resolution team if you’re unhappy with the outcome. And if you can’t reach an agreement, you could contact the Australian Financial Complaints Authority (AFCA) to make a complaint.

What if you’re not in hardship but want to freeze the repayments?

Many lenders and banks offer a repayment holiday allowing you to redirect cash elsewhere. For example, if your partner is on parental leave, and you have only one income, you can use the extra funds to help with other bills during this time. A repayment holiday is for an agreed fixed period, between three and twelve months. It is usually only available when you have made extra repayments. To see if you qualify, please contact your bank or lender.

Does skipping repayments affect my credit rating?

Your credit report will highlight if you have made your mortgage repayments on time over the loan term. If you miss or make a late payment, this may reduce your credit score and impact your ability to receive future finance.

How does Centrelink help me?

Centrelink does not offer support in making your mortgage repayments. However, Centrelink can help with rent assistance if you rent a property.

Should you sell your property?

As a homeowner, you may consider selling your property if your situation hasn’t improved. And as difficult a decision it would be, you are likely to have a better outcome than the bank foreclosing.

In most cases, you will achieve a better price and avoid costly legal fees incurred by the bank during foreclosure.

Sources:

- Roy Morgan (https://www.roymorgan.com/findings/9148-mortgage-stress-risk-early-2023)

- ABS (https://www.abs.gov.au/statistics/people/housing/housing-occupancy-and-costs/2019-20)

- RateCity (https://www.ratecity.com.au/home-loans/mortgage-news/high-will-rates-go-here-experts-think-rba-cash-rate)

Disclaimer:

This content relates to the MePay payment product and has been prepared by MePay Holdings Pty Ltd (ABN 55 638 819 575 / AFSL no 528836) (MePay Holdings). Any financial services provided in relation to MePay (including the issue of MePay) are provided by MePay Holdings. To the extent any information provided to you in this content constitutes financial product advice, such advice is general advice only and has been prepared without taking into consideration your objectives, financial situation or needs. You should consider your needs prior to acting on any advice or making any financial decisions and seek independent financial advice regarding your own personal circumstances. Cooling-off rights do not apply to MePay.

A product disclosure statement (PDS) has been issued by MePay Holdings for MePay and is available at https://propertyme.com.au/mepay/pds. The PDS explains the features, risks and benefits of the service and you should consider it in deciding whether to use the product.