Negative gearing is always a hot topic in the news, especially whenever election time rolls around (thankfully, negative gearing looks to be safe for a little while longer). Despite the near-constant press coverage, there still remains a huge number of property owners who aren’t taking advantage of negative gearing.

As a property manager, it’s your role to make your client’s property as valuable to them as possible. If you’re not currently advising them of the huge potential of negative gearing, and the significant financial benefits to be gained by claiming against the depreciation of their property, then you’d best keep reading.

Below, we’ll explain how you can help your clients to make the most of the many options available to them.

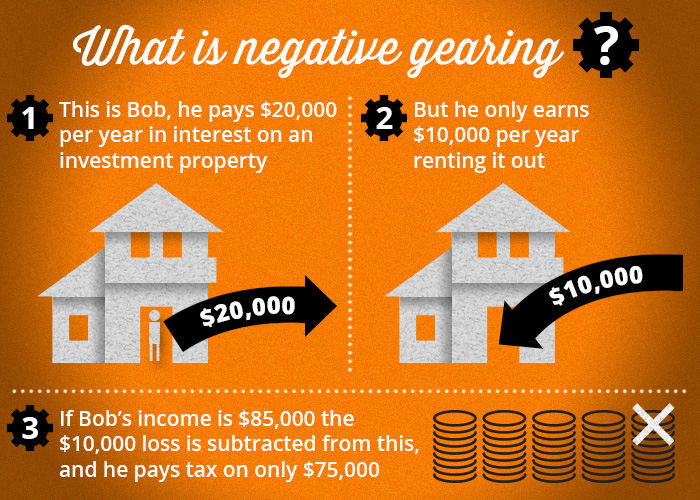

What is negative gearing?

Negative gearing occurs when the interest you’re paying on a property is more than the income you’re earning from the property. This means, technically, that you are making a loss on your investment. The benefits of this negative gearing materialise at tax time when this loss is claimable as a deduction from your salary.

Reducing your taxable income decreases the amount of tax you owe, meaning you’ll receive a larger tax return. Say, for example, you have a property that generates $25,000 a year in rental income. The outgoings associated with the property, including mortgage instalments, totals at $30,000.

This means you make a loss of $5,000. You can then mark this loss on your tax return and make the most of having a lower taxable income.

Image credit: realestateview.com.au

Image credit: realestateview.com.au

Making a loss doesn’t sound good, so why is negative gearing so popular? The benefit in negative gearing is that you’re using the money you borrowed, so while you naturally have to repay the loan you took to buy the property, you’re able to make money back each year through tax breaks.

However, it’s important to note that this is not the ultimate goal of a property investment strategy; you should be aiming to have a profitable investment property, meaning that your rental income (or income earned through your property) is higher than your outgoings.

Ideally, this comes from the value of your property appreciating over time. So if there’s negative gearing, there must be positive gearing right? Exactly. Positive gearing is turning a profit from the rental property by having its income exceed the outgoings.

In other words, aiming to negatively gear your investment property initially is a great strategy, but ultimately, you want your investment to be positively geared, so you go from making a loss to making a profit. Negative gearing is the art of reducing your losses while you’re on the way to a positively geared property.

What’s the downside?

The risks associated with negative gearing can, of course, be very detrimental to your investment strategy. Understanding and minimising the risks involved with this strategy are paramount. Firstly let’s look at the things that are within your control.

The importance of having tenants in your investment property

Unsurprisingly, keeping an investment property full of tenants is critical to success with a negatively geared property that you wish to turn into a positively geared one for your client. In order to keep it inhabited by quality tenants, here are the things you should look at;

Condition of the property

Keeping your property in excellent condition with regular property maintenance is a great start. While of course ensuring that no major repairs are due, it’s important to treat the needs of the tenant seriously and assess any issues or tenant complaints that arise from the perspective of them and the property.

If there is something that needs attention, ensure that it’s not only actioned quickly but rectified fully. Of course, if tenants are damaging the property, necessitating costly repairs, it may be time to look at evicting your tenants and replacing them with better ones.

Regularly monitor rent

Should the interest rates rise when the tenants have locked in a 12-month lease, your owner will be out of pocket, meaning that they could potentially take advantage of higher tax breaks. Ensure you keep updated with the market value in the area by conducting regular rental market analyses, and keep an eye on latest interest rate changes and predictions.

Keep an eye on property trends in the area

Remember to keep up to date with local developments and changes that may adversely affect the property. A dramatic decrease in property value could spell disaster.

Depreciation schedules

One of the ways you can help your client maximise their negative gearing potential is to suggest they have a depreciation schedule done for their property. A depreciation schedule is essentially a report which estimates how much a building and its appliances and equipment will lose value over a specified period of time.

The purpose is to allow the property owner to claim this depreciation as a tax deduction, so suggesting that the property owner gets one done if they haven’t already is a great way to show you’re looking out for their financial interests.

What other tax benefits are there with investment properties?

Owning an investment property allows you to claim many expenses back on tax. As a property manager, ensure that these are well known to your client. Here’s what you can claim, according to Paul Drum, the Head of Policy at CPA Australia;

- Real estate management fees

- Council and water rates

- Advertising for tenants

- Insurance

- Interest on your investment loan

- Reasonable travel expenses to inspect your property

- Depreciation on assets like whitegoods and air conditioners

Remember that proof of all the above is, of course, a necessity. Ensure you are logging all expenses related to the property and that the owner is doing the same for the components you’re not in control of.

What can’t they claim?

Paul Drum elaborates on this in the same article;

- Those relating to your personal use of the rental property

- Utility bills paid by the tenant

- Borrowing costs where you have borrowed against the equity in the investment property for private use

- Costs relating to the purchase or sale of the investment property.

Managing these costs is critical to a successful investment, particularly if the property is negatively geared as they all make up the outgoing costs of the investment.

Understanding how these work for your client

Knowing how to leverage tax benefits could be the critical difference when prospective clients are looking to hire a property manager. Caretaking and maintaining a working knowledge of the surrounding area will ensure you keep the property inhabited by good quality tenants that are providing the best return for the investment.

Understanding and researching trends in the greater market and interest rate fluctuations will help you stay ahead of the curve and reduce the number of additional costs incurred for the property.

Finally, understanding the significant tax benefits afforded to property owners will not only guarantee your advice to your client will yield stronger results but could encourage them to further invest in other properties, which in turn will favour your business.

Keeping all the details in one place with a good property management software is critical to staying on top of all the properties under your management, get in touch with PropertyMe and discover the brilliance of having all the information in one place.